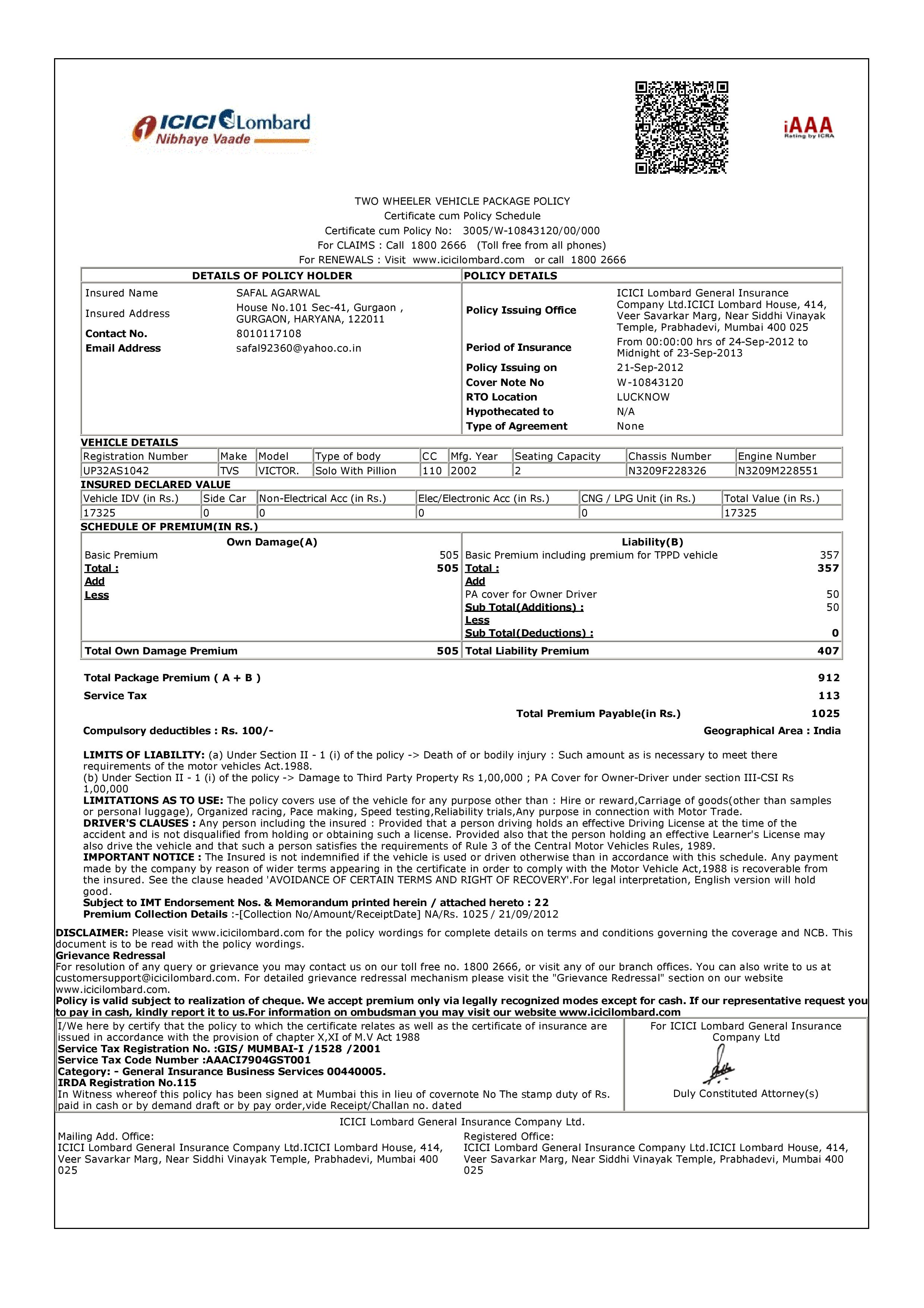

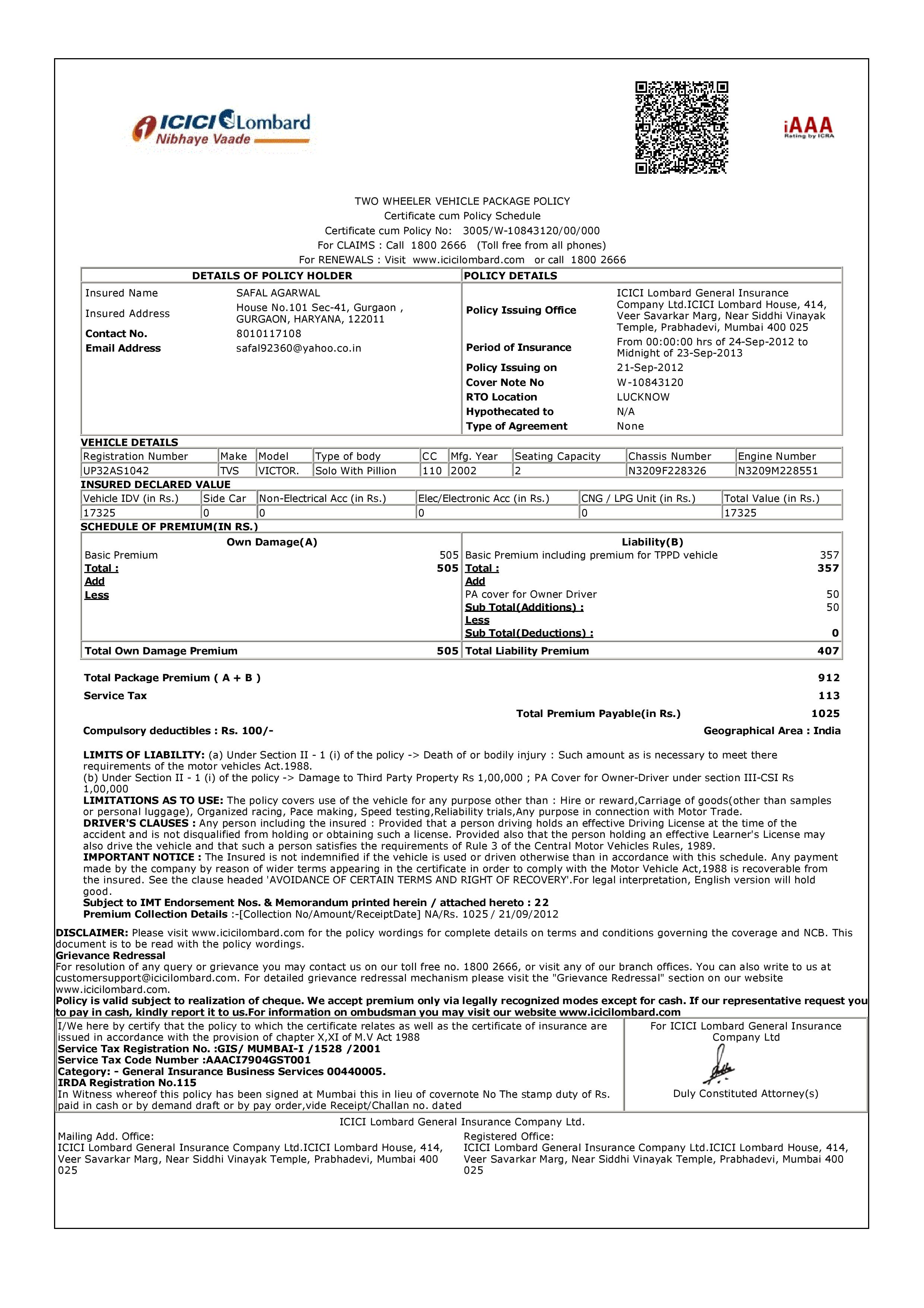

Icici Lombard Car Insurance Policy

ICICI Lombard Car Insurance – Get The Best Policy to Protect Your Car

What is ICICI Lombard Car Insurance?

ICICI Lombard Car Insurance is a comprehensive car insurance policy offered by ICICI Lombard General Insurance, one of India’s leading general insurance companies. The policy provides coverage for all kinds of damages caused to your car due to an accident, theft, natural disaster, fire and more. The policy also provides coverage for third-party liabilities arising out of damages caused to other persons or properties due to an accident involving your car. With ICICI Lombard Car Insurance, you can get a customized policy that meets your needs and offers you the best protection against any kind of damage to your car.

Features & Benefits of ICICI Lombard Car Insurance

ICICI Lombard Car Insurance offers several features and benefits to the policyholder. Some of the important features and benefits are listed below:

- Coverage for damages caused to your car due to an accident, theft, natural disaster, fire and more.

- Coverage for third-party liability.

- Cashless repair facility at network garages.

- No Claim Bonus (NCB) up to 50% on renewal.

- Personal accident cover up to Rs. 15 lakhs.

- 24x7 roadside assistance.

- Additional coverage options available.

Inclusions and Exclusions of ICICI Lombard Car Insurance

The ICICI Lombard Car Insurance policy covers all kinds of damages caused to your car due to an accident, theft, natural disaster, fire and more. However, the policy does not cover any damages caused due to the following:

- Normal wear and tear of the car.

- Damages caused due to mechanical or electrical breakdown.

- Damages caused due to terrorism or war.

- Damages caused due to driving under the influence of alcohol or drugs.

- Damages caused due to participating in racing or speed testing.

Documents Required for ICICI Lombard Car Insurance

The following documents are required to purchase the ICICI Lombard Car Insurance policy:

- Registration Certificate (RC) of the car.

- Driving License of the car owner.

- No Claim Bonus (NCB) certificate (if applicable).

- Address proof of the car owner.

- Age proof of the car owner.

- Passport size photos of the car owner.

- Previous policy details (if any).

Conclusion

ICICI Lombard Car Insurance is a comprehensive car insurance policy that offers coverage for all kinds of damages caused to your car due to an accident, theft, natural disaster, fire and more. The policy also provides coverage for third-party liabilities arising out of damages caused to other persons or properties due to an accident involving your car. With ICICI Lombard Car Insurance, you can get a customized policy that meets your needs and offers you the best protection against any kind of damage to your car.

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO

Car Insurance Renewal Icici Lombard » Daily Blog Networks

[Resolved] ICICI Lombard General Insurance — 'ICICILom=[protected

Icici Lombard Motor Claim Form