Icici Lombard 3rd Party Insurance Price List

Get a Comprehensive Insurance Plan from ICICI Lombard

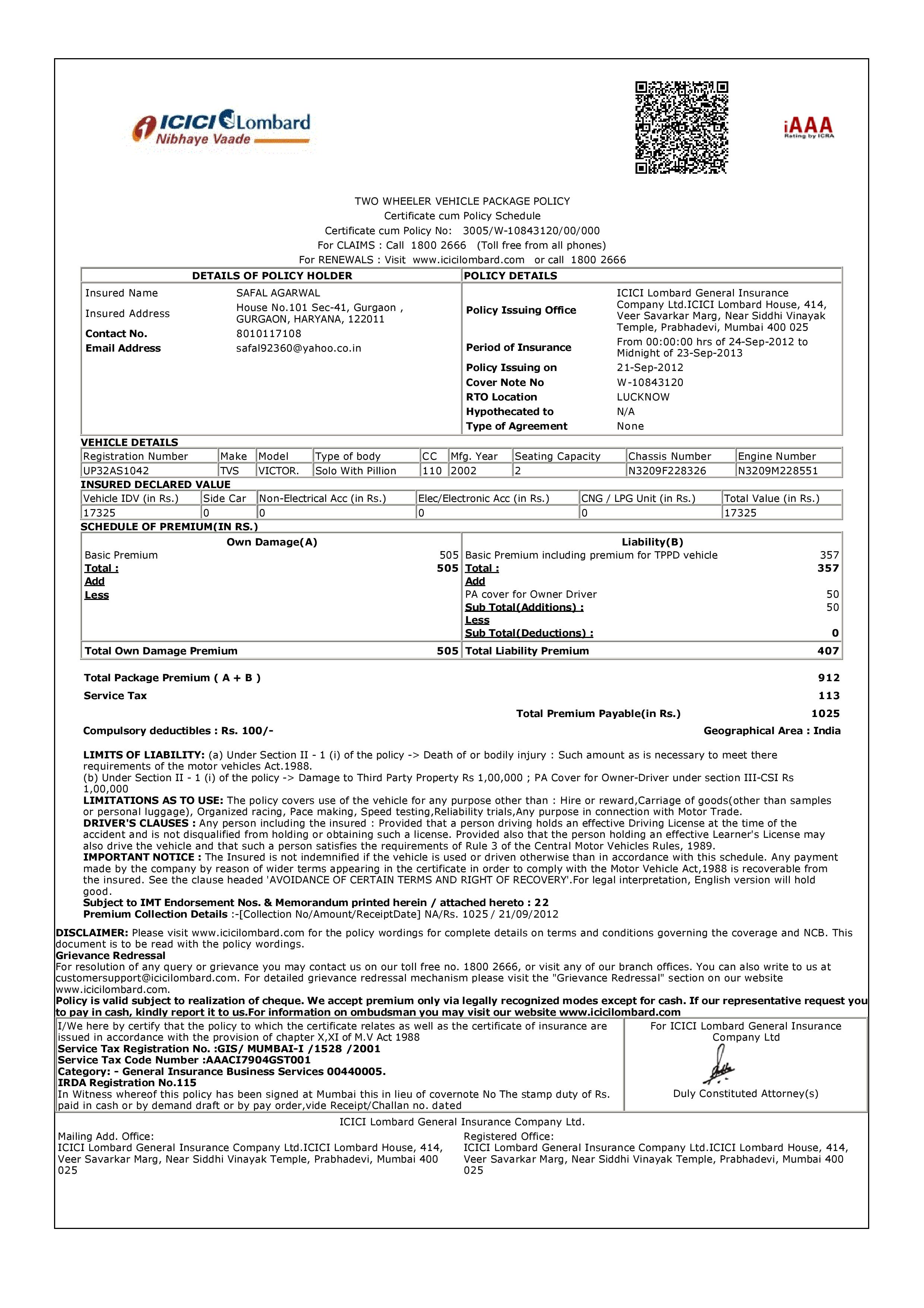

It is now possible to get a comprehensive insurance plan from ICICI Lombard that covers your car against third party liabilities. The ICICI Lombard third party insurance plan provides a much needed financial security to car owners. In case of an accident, the third party insurance plan can help you to bear the cost of any damages caused by your vehicle to the property or injuries to third parties. The cost of the ICICI Lombard third party insurance plan varies based on the type of car and the driver’s personal risk profile.

Types of Third Party Insurance Plans Offered by ICICI Lombard

The ICICI Lombard third party insurance plan offers two types of cover options. The first option is for a basic third party liability cover. This cover is for any liability arising out of death or injury to third parties, or damage to the property of third parties. The second option is for a comprehensive third party liability cover. This cover provides an additional cover for damages caused to third parties due to the use of your insured vehicle, including for damages caused by fire, theft and natural disasters. Both types of covers are available for private cars, commercial vehicles, two-wheelers and four-wheelers.

Cost of ICICI Lombard Third Party Insurance Plan

The cost of the ICICI Lombard third party insurance plan is based on the type of vehicle, its age and the risk profile of the driver. The basic third party insurance plan starts from as low as Rs. 884 and can go up to Rs. 7,000 depending on the type of vehicle and the risk profile of the driver. The comprehensive third party insurance plan is slightly more expensive and starts from Rs. 2,000 and can go up to Rs. 10,000 depending on the type of vehicle and the risk profile of the driver. ICICI Lombard also offers discounts for long term third party insurance plans.

Benefits of ICICI Lombard Third Party Insurance Plan

The ICICI Lombard third party insurance plan provides several benefits. The policyholder is protected from the financial burden of any liabilities arising due to damages to the property or injuries to third parties. The policyholder also gets a discount for a long term policy. In addition, the policyholder also gets an emergency assistance facility and a 24-hour customer service. ICICI Lombard also offers a cashless claim settlement facility in case of an accident.

Conclusion

The ICICI Lombard third party insurance plan offers the policyholder the much needed financial security against the liabilities arising due to damages to the property or injuries to third parties. The cost of the plan is based on the type of vehicle, its age and the risk profile of the driver. The policyholder also gets several benefits, including discounts for long term policies, emergency assistance facility and a 24-hour customer service. It is therefore advisable for all car owners to get a third party insurance plan from ICICI Lombard.

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO

Vehicle Insurance for 3 years in 15 minutes - ICICI LOMBARD AUTO

Icici Lombard General Insurance Company Customer Care Number - hldesigns2

Icici Lombard General Insurance Ad - Advert Gallery

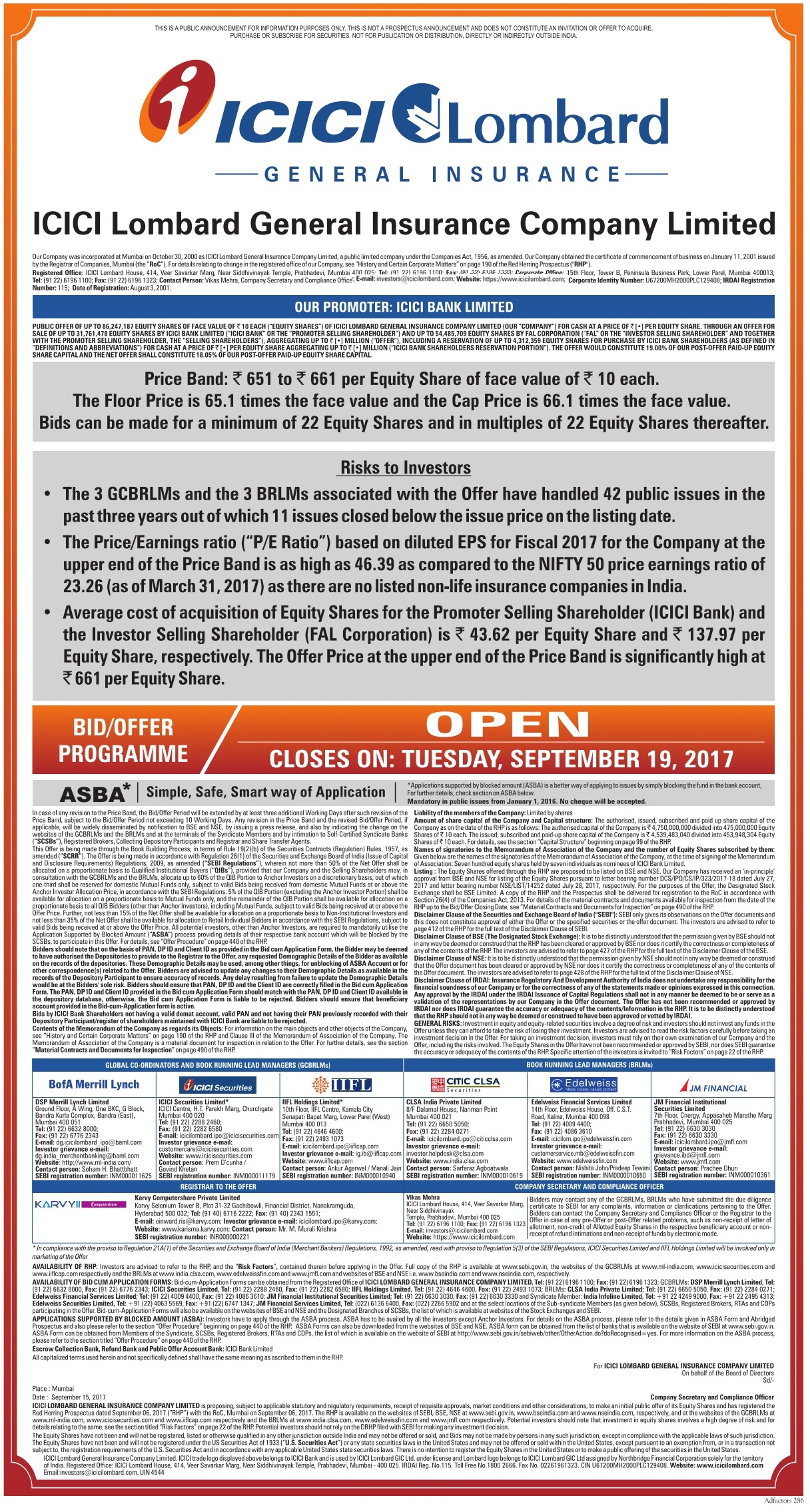

ICICI Lombard shares recover after a dull debut: all you need to know