How Many States Have No Fault Insurance

What is No Fault Insurance?

No Fault Insurance, also known as Personal Injury Protection (PIP), is a type of auto insurance that covers medical expenses and lost wages for the insured party, regardless of who is at fault in an accident. This type of coverage is designed to help reduce the number of lawsuits resulting from car accidents, as the insured party would not need to pursue legal action to receive compensation for medical bills and lost wages. No Fault Insurance is most commonly found in the United States, but some countries around the world have similar forms of coverage.

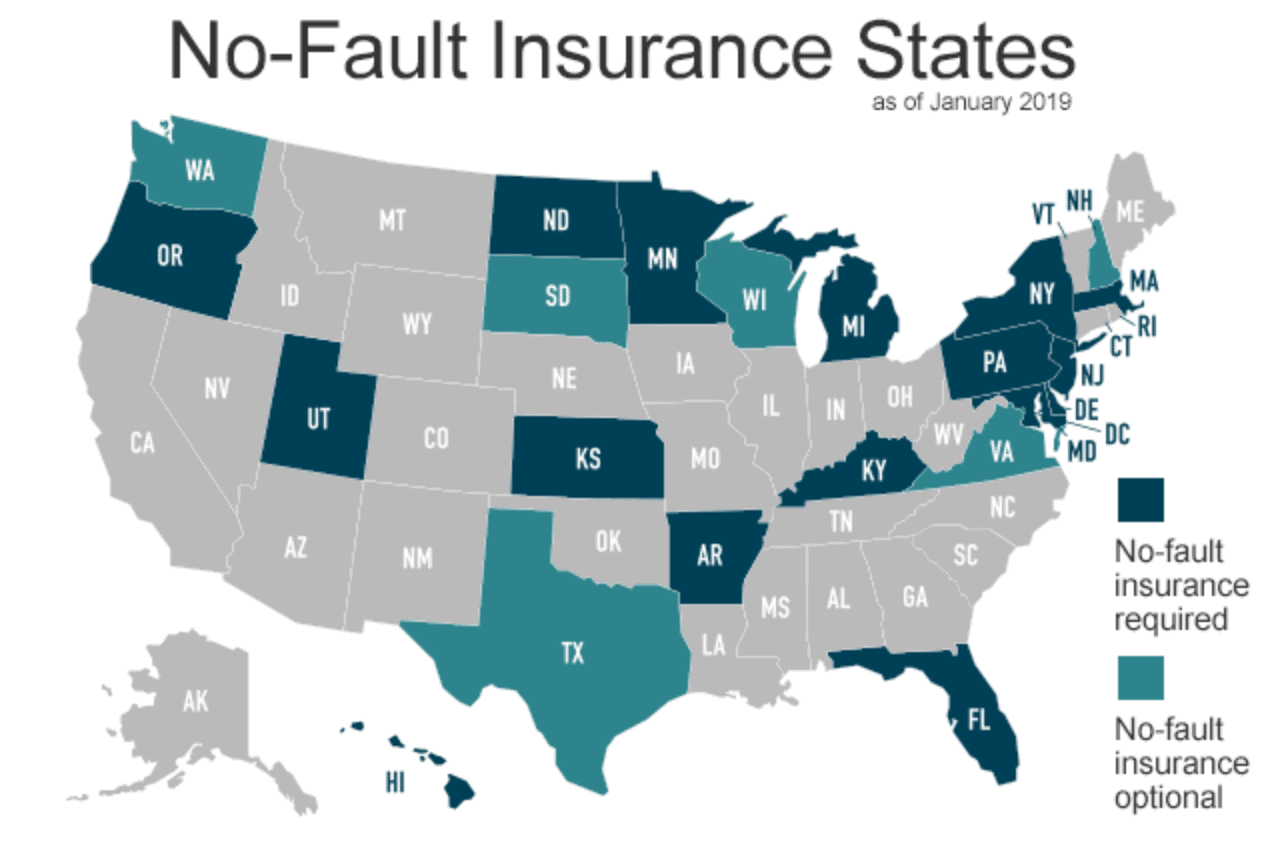

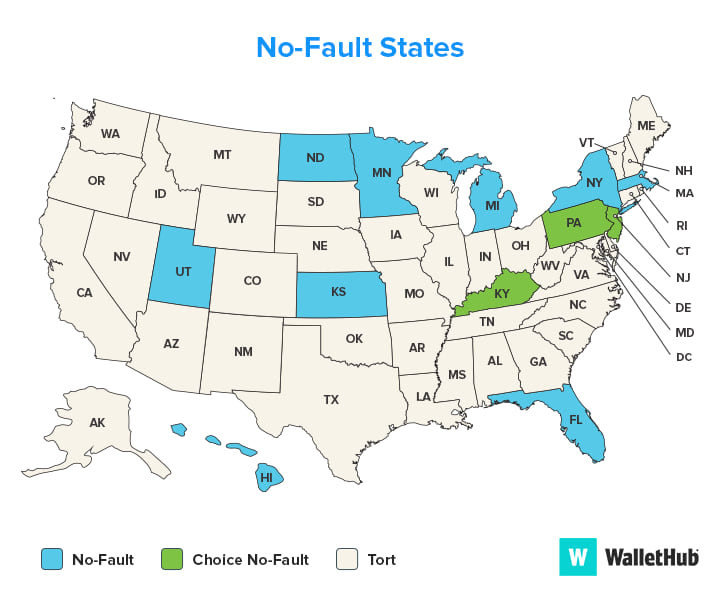

How Many States Have No Fault Insurance?

Currently, 12 states have implemented some form of No Fault Insurance. These states are Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. In these states, No Fault Insurance is generally required for all drivers, but the specifics of each state's laws may vary. For example, the coverage limits and exclusions may be different for each state.

The Benefits of No Fault Insurance

No Fault Insurance can help drivers in a number of ways. First, it eliminates the need to go to court in order to receive compensation for medical bills and lost wages. This can save time and money, as well as reduce the stress of a long and drawn-out legal battle. Second, No Fault Insurance can help reduce the cost of insurance premiums. Since the insured party is not held liable for any damages or medical expenses, the insurance company is able to offer lower premiums. Finally, No Fault Insurance is designed to ensure that all parties involved in an accident receive the medical attention they need, regardless of their financial situation.

Disadvantages of No Fault Insurance

No Fault Insurance is not without its drawbacks. First, the coverage limits are often very low, meaning that the insured party may not receive the full compensation they are entitled to. Second, the coverage does not always cover property damage, meaning that the insured party may still be liable for any damage to their vehicle. Finally, No Fault Insurance does not provide any coverage for pain and suffering, which can be a significant source of compensation for those injured in an accident.

Conclusion

No Fault Insurance can be a great way to protect yourself and your family in the event of an accident. It can provide peace of mind knowing that medical bills and lost wages will be covered, regardless of who is at fault. However, it is important to understand the limitations of No Fault Insurance and make sure that you are adequately covered. Currently, 12 states have some form of No Fault Insurance, and it is important to be familiar with the laws and regulations of your state when purchasing auto insurance.

Ultimate Guide to No-Fault Auto Insurance

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

No-Fault Insurance: Guide for 2022

Fault vs No Fault Accidents and Auto Insurance Claims - ValuePenguin