How Best To Insure A Learner Driver

How Best To Insure A Learner Driver

Introduction

Getting a driver's license and beginning to drive can be an exciting milestone in life, but it also comes with a lot of responsibilities. One of the most important is making sure that you're properly insured while you are driving as a learner driver. Fortunately, there are a number of ways to insure a learner driver and make sure that they, and other drivers around them, are protected while they are learning to drive.

Using Family Policies

One of the simplest ways to insure a learner driver is to add them to an existing family policy. Most car insurance policies will allow you to add a learner driver to the policy, but it's important to be aware that some insurers may require the learner to have been in possession of a provisional license for a certain time period before they can be added. You should also be aware that adding a learner driver to an existing policy may increase the premiums, so it's important to speak to your insurer to find out exactly how much your policy will be affected before adding the driver.

Getting A Learner Policy

Another option for those looking to insure a learner driver is to get a separate learner driver policy. These policies are designed specifically for those who are learning to drive and can provide some additional benefits over a traditional car insurance policy. For example, some learner driver policies will allow a parent or guardian to be insured on the policy alongside the learner driver, which can help to reduce the cost of the policy. It's also important to remember that learner driver policies are typically short-term policies, so you will need to look for a more permanent insurance solution once the learner has passed their test.

Using A Provisional Licence

Once you have a provisional licence, there are a number of ways that you can insure yourself while you are still learning to drive. One option is to take out a pay-as-you-go policy, which can be used to cover you for a certain period of time, such as a month or a quarter. This type of policy can be a good option for those who don't want to be tied into a long-term policy, as you can simply renew the policy as and when you need to. Another option is to take out a temporary car insurance policy, which can be used to cover you while you are learning to drive.

Finding The Right Insurance

When it comes to insuring a learner driver, it's important to make sure that you are getting the right type of insurance for your needs. It's also important to shop around and compare different policies to make sure that you are getting the best deal. Finally, it's also important to remember that the cost of insurance is only one factor to consider when choosing a policy - you should also make sure that you are getting the right level of cover for your needs.

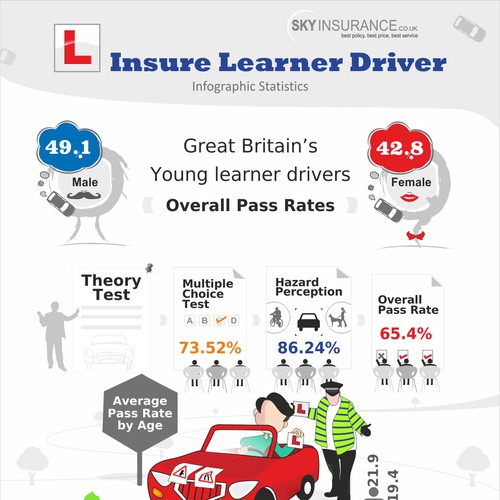

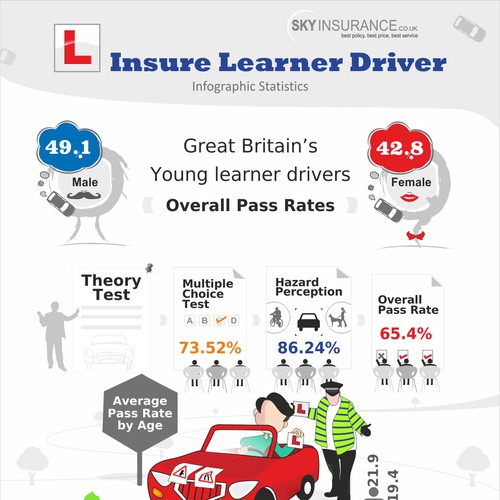

Create the next infographic for Sky Insurance - Insure Learner Driver

Best Learner Driver Insurance - Cheap Car Insurance For Young And

Learner Drivers of the UK Prepare for Driving Test Changes

Provisional Insurance Could Save You £670!

Brilliant Driving Schools In Dorset