Hired And Non Owned Auto Coverage Definition

What is Hired and Non Owned Auto Coverage?

Hired and Non Owned Auto coverage are two types of insurance coverage that protect businesses from liabilities arising from the use of rented or borrowed vehicles. Hired Auto Coverage pays for losses resulting from accidents involving vehicles that are rented and used for business purposes, while Non Owned Auto Coverage pays for losses incurred when employees use their own cars for work-related activities. Both types of coverage can prove invaluable for businesses that regularly rely on rented or borrowed vehicles for their operations.

Hired Auto Coverage

Hired Auto Coverage is a type of commercial auto insurance that provides protection when a business rents a vehicle and uses it for business-related activities. It pays for damage to the rented vehicle, as well as medical expenses and other costs resulting from an accident involving the rented vehicle. This coverage is typically provided by the rental company itself and is included in the rental agreement. It may also be provided by the business’s commercial auto insurance provider, depending on the type of policy.

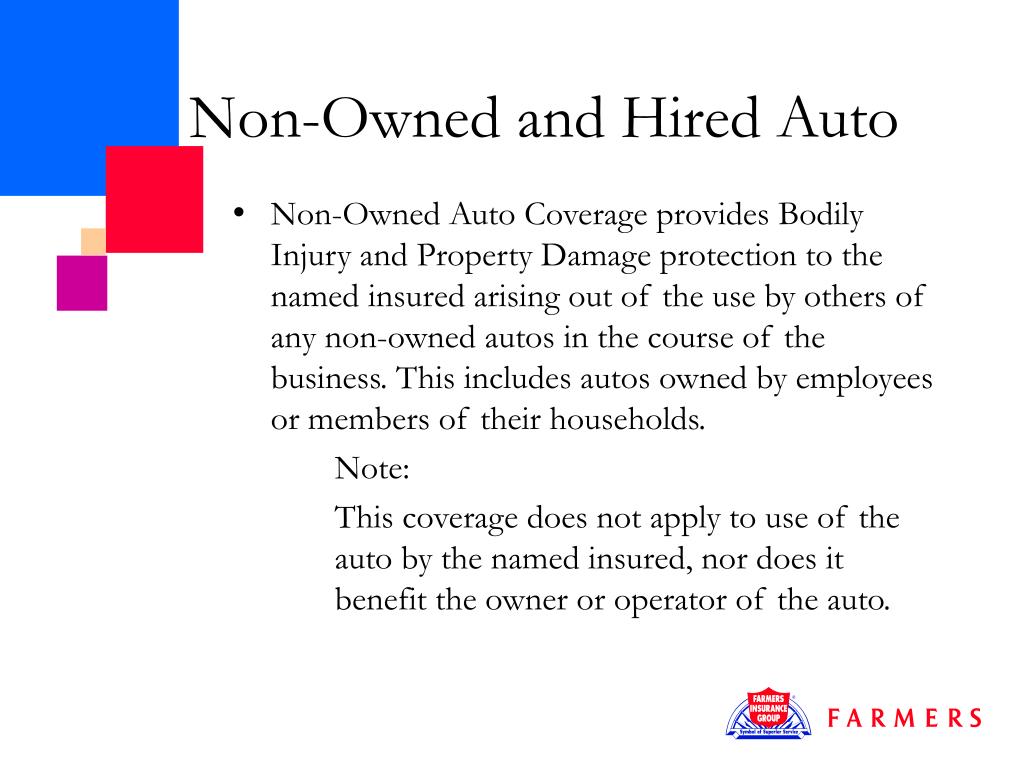

Non Owned Auto Coverage

Non Owned Auto Coverage, also known as Hired Non-Owned Auto Coverage, is a type of commercial auto insurance that provides protection when an employee uses their own vehicle for business purposes. This coverage pays for damage to the employee’s car, as well as medical expenses and other costs resulting from an accident involving the employee’s vehicle. It is important to note that Non Owned Auto Coverage does not provide coverage for the employee’s car if it is being rented or borrowed. For that, the business would need to purchase Hired Auto Coverage.

When is Hired and Non Owned Auto Coverage Necessary?

Hired and Non Owned Auto Coverage are important types of coverage for businesses that regularly rely on rented or borrowed vehicles. If a business rents cars for its employees to use for business-related activities, then it should have Hired Auto Coverage to protect the business from any losses resulting from an accident involving the rented car. Similarly, if employees are using their own vehicles for business-related activities, then the business should have Non Owned Auto Coverage to protect the business from any losses resulting from an accident involving the employee’s car.

Conclusion

Hired and Non Owned Auto Coverage are two important types of coverage for businesses that regularly rely on rented or borrowed vehicles for their operations. Hired Auto Coverage pays for losses resulting from accidents involving vehicles that are rented and used for business purposes, while Non Owned Auto Coverage pays for losses incurred when employees use their own cars for work-related activities. Both types of coverage can prove invaluable for businesses that regularly rely on rented or borrowed vehicles for their operations.

Commercial Auto vs. Hired and Non-Owned Auto Insurance | Insureon

PPT - COMMERCIAL REAL ESTATE PowerPoint Presentation, free download

Hired/Non-Owned Auto Coverage | BIG Insurance Solutions

Hired and Non-Owned Auto Liability - JenCap Holdings

The Impacts of Employees Driving Personal Vehicles on Company Time