Gap Insurance Through State Farm

Sunday, January 11, 2026

Edit

Gap Insurance Through State Farm

What is Gap Insurance?

Gap insurance is a form of coverage that helps protect drivers in the event of an accident. It covers the difference between the pre-accident value of a vehicle and the amount of money owed on the vehicle loan. It is important to know if your policy covers gap insurance, as it can help you avoid a financial burden if you are involved in an accident.

Gap insurance can be purchased from most insurance companies, but State Farm is one of the few insurers that offer gap insurance. State Farm offers both a standard gap policy and a Preferred Gap policy. The standard policy is available to all drivers and provides coverage for up to $50,000 in additional replacement costs. The Preferred Gap policy provides additional coverage for up to $100,000 in additional replacement costs.

How Does Gap Insurance Work?

Gap insurance is designed to pay the difference between the pre-accident value of a vehicle and the amount of money owed on the loan. If the vehicle is totaled in an accident, the gap insurance policy will pay the difference between the actual cash value of the vehicle and the amount of money owed on the loan. This helps the driver avoid having to pay out of pocket for the difference in value.

State Farm's gap insurance policies are designed to be simple and easy to understand. The policies provide coverage for up to $50,000 or $100,000 in additional replacement costs, depending on the policy chosen. They also provide coverage for a period of up to five years.

Benefits of Gap Insurance Through State Farm

Gap insurance through State Farm offers several benefits for drivers. The policies are easy to understand and provide coverage for up to $50,000 or $100,000 in additional replacement costs. They also provide coverage for a period of up to five years. Additionally, State Farm offers competitive rates and discounts for drivers who bundle their policies.

State Farm also offers additional coverage options that can be added to a gap insurance policy. These include rental car coverage, towing and labor coverage, and rental reimbursement coverage. These additional coverages can provide additional peace of mind and protection in the event of an accident.

Why Should You Consider Gap Insurance?

Gap insurance is an important form of coverage for drivers. It helps protect drivers in the event of an accident by providing coverage for the difference between the pre-accident value of a vehicle and the amount of money owed on the loan. Gap insurance can help protect drivers from a financial burden in the event of an accident.

State Farm offers competitive rates and discounts for drivers who bundle their policies. Additionally, they offer additional coverage options that can be added to a gap insurance policy. These additional coverages can provide additional peace of mind and protection in the event of an accident.

How to Get Started With Gap Insurance Through State Farm

Getting started with gap insurance through State Farm is easy. The first step is to contact a State Farm agent to discuss your options. They will be able to provide you with more information about the different policies available and help you choose the right one for you.

Once you have chosen a policy, you will need to fill out the necessary paperwork and pay the required premium. Once the policy is in place, you will be covered in the event of an accident. It is important to remember to keep your policy up to date so that you continue to be covered.

Gap insurance is an important form of coverage for drivers. State Farm offers competitive rates and discounts, as well as additional coverage options that can be added to a policy. If you are looking for gap insurance, contact your State Farm agent to discuss your options and get the coverage you need.

Does state farm offer gap insurance - insurance

State farm gap insurance - insurance

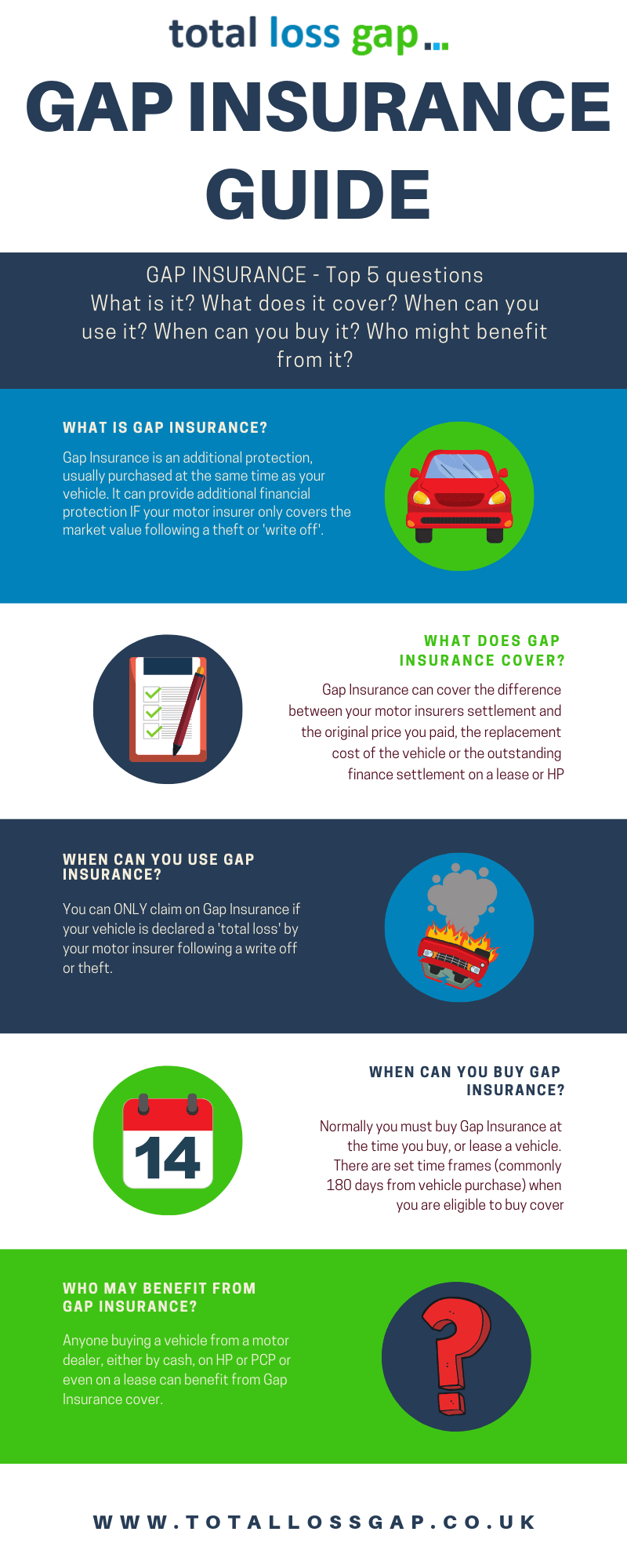

What is Gap Insurance? Infographic

Is It Worth Getting Gap Insurance On A Pcp - TRAVELVOS

How Replacement GAP insurance works | GAPinsurance.co.uk Blog