Does Personal Car Insurance Cover Rental

Tuesday, January 20, 2026

Edit

Does Personal Car Insurance Cover Rental?

Understanding Your Personal Car Insurance Policy

When it comes to understanding whether or not your personal car insurance policy will cover rental vehicles, the most important thing you need to do is read your policy and understand the details. All car insurance policies are different, and it is up to you to know what is and isn't covered. In general, most personal car insurance policies will not cover a rental vehicle; however, there are some exceptions. If you are planning on renting a car and want to be sure that you are covered, it is best to check with your insurance provider before you rent.

Do You Need Additional Coverage?

If you are renting a vehicle, you may need additional coverage. This is especially true if you are traveling out of state or if you are renting a luxury vehicle. Most rental car agencies will offer additional coverage for a fee. This coverage will usually include collision, theft and liability protection. It is important to understand that this coverage is separate from your personal car insurance policy and will need to be purchased separately.

What Does Personal Car Insurance Cover?

Your personal car insurance policy will usually cover the basics such as bodily injury, property damage and medical expenses if you are in an accident. If you have comprehensive coverage, you may also be covered against theft and vandalism. However, you will not be covered for any damage or theft that occurs to the rental vehicle. It is important to note that if you are involved in an accident while driving a rental vehicle, you will be responsible for the cost of repairs, not your insurance provider.

Do I Need Rental Car Insurance?

The answer to this question will depend on your personal situation. If you are renting a vehicle for an extended period of time, it may be a good idea to purchase additional coverage. This will ensure that you are protected in the event of an accident or theft. If you are renting a vehicle for a short period of time, you may be able to get away without purchasing additional coverage. However, it is important to remember that you will be responsible for any damage that occurs to the rental vehicle.

How Much Does Rental Car Insurance Cost?

The cost of rental car insurance will vary depending on the rental agency and the type of coverage you purchase. Generally speaking, rental car insurance is fairly inexpensive and can range anywhere from $10 to $30 per day. It is important to shop around and compare rates before you decide which policy is best for you.

In Conclusion

When it comes to understanding whether or not your personal car insurance policy will cover rental vehicles, it is important to read your policy and understand the details. In general, most personal car insurance policies will not cover a rental vehicle; however, there are some exceptions. If you are renting a vehicle, you may need additional coverage. This coverage will usually include collision, theft and liability protection. It is important to remember that if you are involved in an accident while driving a rental vehicle, you will be responsible for the cost of repairs, not your insurance provider.

Does my Auto Insurance cover a Rental Car? | Inside Insurance

Do rental cars get coverage under personal car insurance?

A Guide To Car Rental Insurance vs. Personal Auto Insurance Coverage

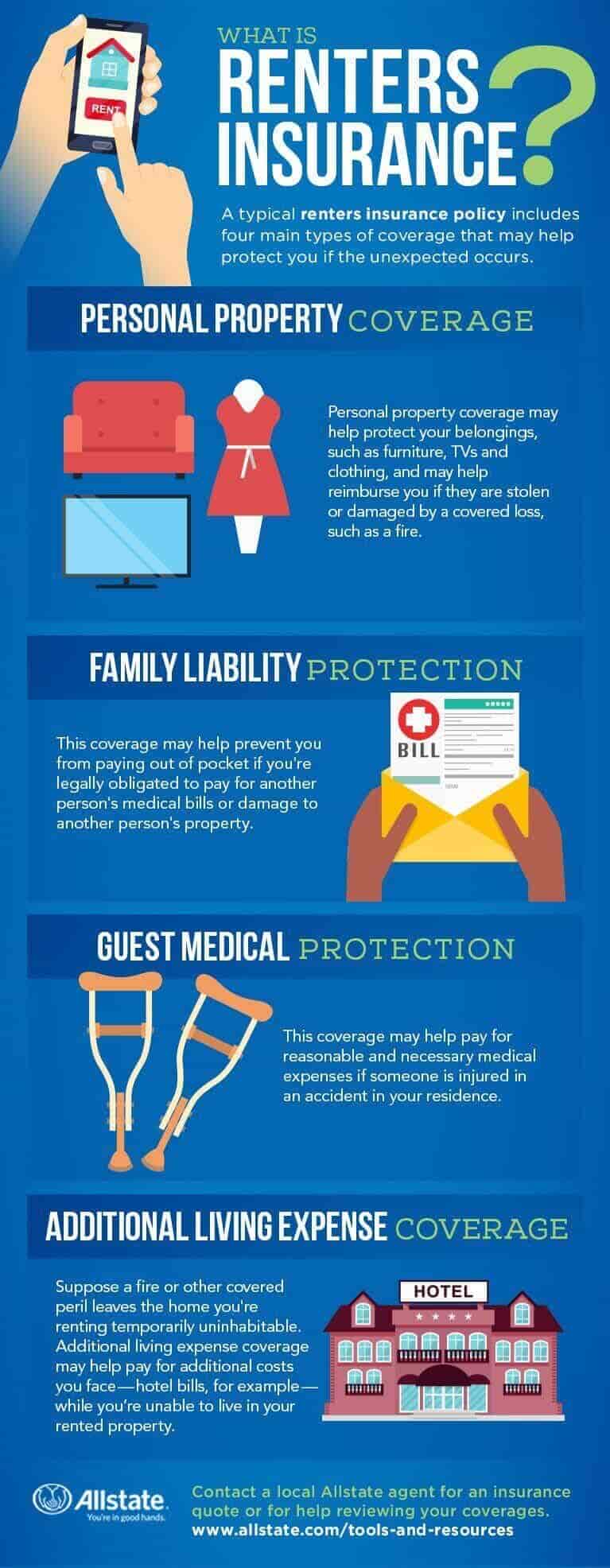

What is Renters Insurance? | Allstate

Does My Car Insurance Cover Rental Cars? | Ogletree Financial