Cheapest Low Mileage Car Insurance

Saturday, January 10, 2026

Edit

Cheapest Low Mileage Car Insurance

What is Low Mileage Car Insurance?

Low mileage car insurance is a type of coverage that can be used to replace traditional car insurance. Low mileage car insurance is designed for drivers who don't drive their vehicles very often. Typically, this type of coverage is used by people who only drive their vehicles occasionally, such as to commute to work or run errands. The coverage is usually cheaper than traditional car insurance because the insurer can assume the vehicle will not be driven as much, and therefore the chances of an accident are lower.

How is Low Mileage Car Insurance Calculated?

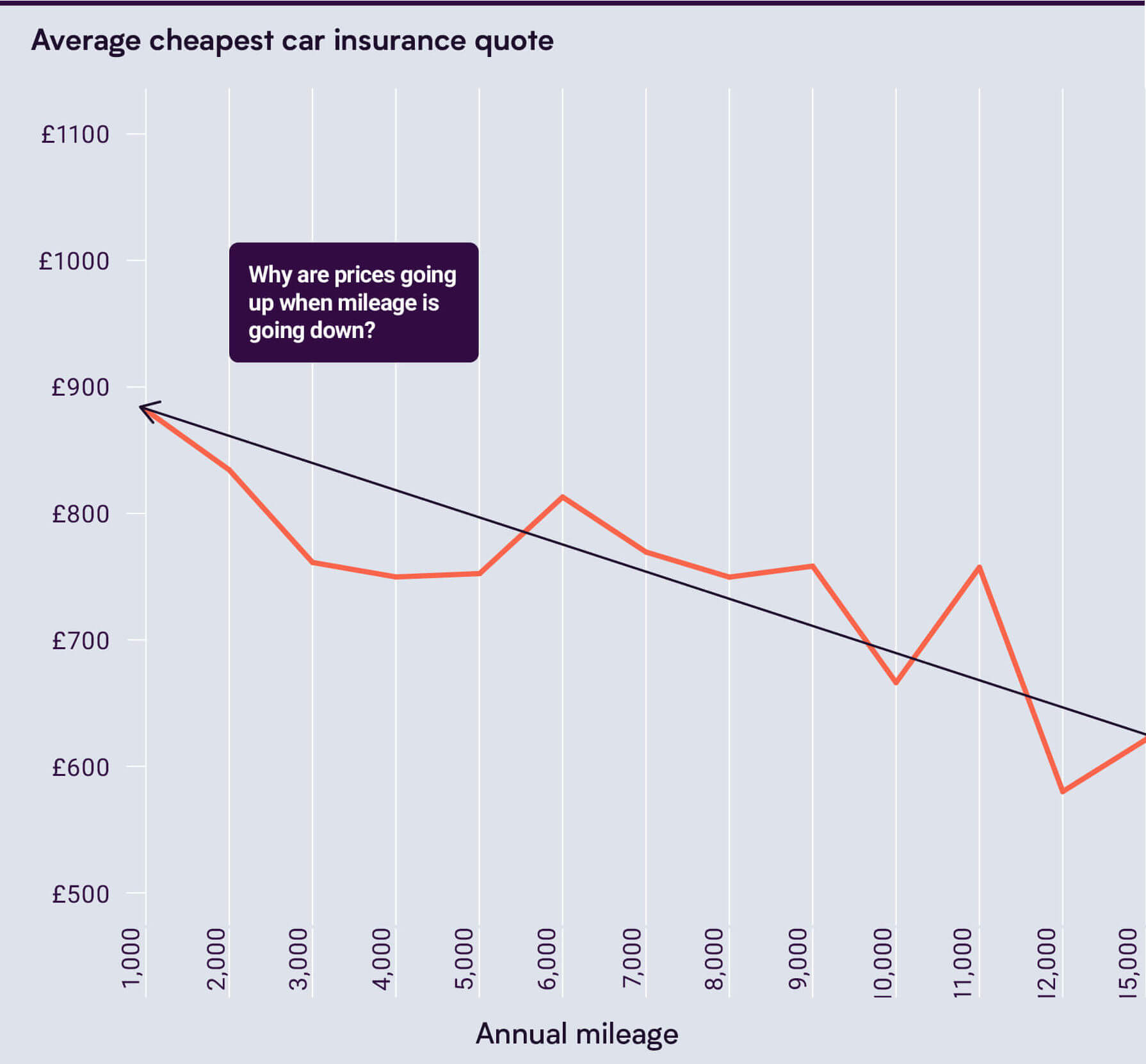

When calculating the cost of low mileage car insurance, the insurer will take into account the amount of miles you plan to drive each year. Usually, the lower the number of miles you drive, the lower the insurance premiums will be. The insurer will also consider other factors, such as your driving record, the type of vehicle you drive, and the age of the driver. The insurer may also take into account the type of area in which the vehicle will be driven, such as a rural or urban area.

What are the Benefits of Low Mileage Car Insurance?

The biggest benefit of low mileage car insurance is the cost savings. Because the insurer assumes that the vehicle will not be driven very often, they will offer lower premiums than traditional car insurance. This type of coverage is also great for people who don't drive very often, such as those who work from home or retirees. It's also beneficial for people who don't need to drive very far, such as those who live in urban areas.

What are the Disadvantages of Low Mileage Car Insurance?

The biggest disadvantage of low mileage car insurance is that it is not always available. Some insurers do not offer this type of coverage. Additionally, even if an insurer does offer this type of coverage, it may not be available in all areas. The coverage may also be limited to certain types of vehicles and drivers. Finally, the coverage may also have restrictions on the number of miles that can be driven each year.

How Can I Get the Cheapest Low Mileage Car Insurance?

The best way to find the cheapest low mileage car insurance is to shop around. Compare quotes from different insurers to find the best deal. Make sure to take into account the amount of coverage you need and the amount of miles you plan to drive each year. Additionally, make sure to check the insurer's ratings and reviews to make sure they will provide the coverage you need.

Conclusion

Low mileage car insurance can be a great option for people who don't drive their vehicles often, as it can result in big savings. However, it's important to shop around and compare quotes from different insurers to find the best deal. Additionally, make sure to read the terms and conditions of the coverage to make sure you are getting the right coverage for your needs.

canonprintermx410: 26 Awesome Inexpensive Car Insurance

Cheapest Car Insurance For Students

Best Car Insurance For Low Mileage Drivers : How To Buy Cheap Car

Why are low mileage drivers charged more?

Cheapest Auto Insurance Pay – Have Growler Will Travel