Cheap Full Coverage Car Insurance Indiana

Saturday, January 24, 2026

Edit

Cheap Full Coverage Car Insurance in Indiana

Finding the Best Rates for Car Insurance in Indiana

Finding the best rates for car insurance in Indiana is no easy task. With so many different companies offering different coverage and different rates, it can be difficult to know where to start. The best way to ensure you get the best deal is to shop around and compare quotes from multiple companies. By doing so, you can make sure you are getting the best coverage at the lowest rate possible.

Fortunately, there are a number of insurance companies in Indiana that offer competitive rates and coverage. In addition to the traditional insurers, there are also a number of smaller, independent companies that offer affordable coverage. Taking the time to research and compare these options can help you save money and get the best coverage.

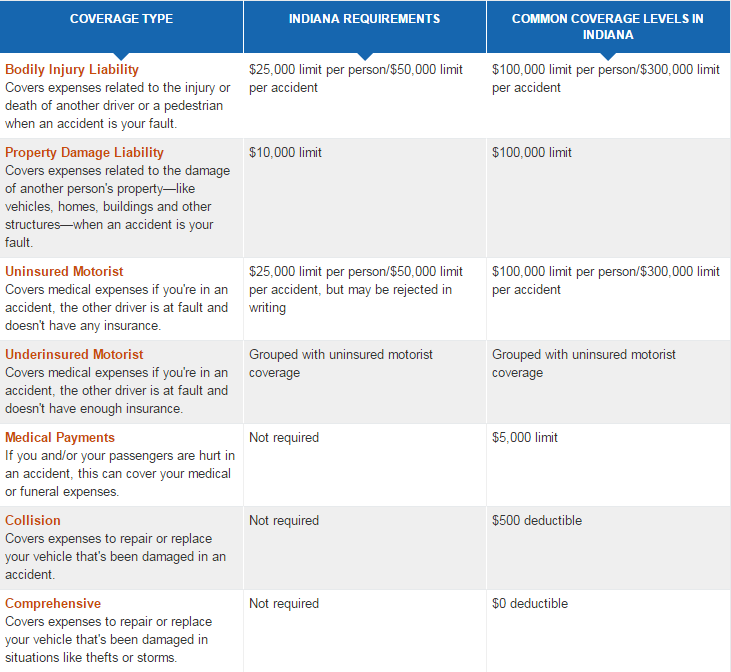

Indiana Car Insurance Requirements

Indiana has specific car insurance requirements that must be met by all drivers. The minimum coverage amounts for bodily injury and property damage are $25,000 per person, $50,000 per accident, and $25,000 for property damage. Additionally, drivers must have uninsured/underinsured motorist coverage of at least $50,000 per person, $100,000 per accident.

In addition to these requirements, drivers must have a valid driver's license, proof of financial responsibility, and auto insurance identification cards. Failure to have the required coverage can result in fines and other penalties.

Factors That Affect Your Car Insurance Rates

When shopping for car insurance, it's important to be aware of the factors that can affect your rates. These can include your driving record, the type of vehicle you drive, the age and gender of the driver, and the area in which you live. All of these factors are taken into consideration when determining your rates.

The type of coverage you choose also affects your rates. If you choose a policy with higher coverage limits, you may be able to get a lower rate. However, this also means you will have to pay more out of pocket if you are involved in an accident.

Discounts for Car Insurance in Indiana

In addition to shopping around for the best rates, there are also a number of discounts available for car insurance in Indiana. These can include discounts for good drivers, multi-car policies, and safe driving courses. Additionally, some insurance companies offer discounts for certain professions, such as teachers and military personnel. Taking advantage of these discounts can help you get the best rates possible.

Finding Cheap Full Coverage Car Insurance in Indiana

Finding cheap full coverage car insurance in Indiana can be a challenge, but it is possible. Taking the time to research and compare rates from multiple companies is the best way to ensure you are getting the best deal. Additionally, taking advantage of the discounts available can help you save money on your premiums.

By taking the time to shop around and compare rates, you can make sure you are getting the best coverage at the lowest rate possible. With the right coverage and the right rates, you can protect yourself and your vehicle from the unexpected.

Car Insurance Indiana Cheap / Who Has the Cheapest Auto Insurance

Who Has the Cheapest Auto Insurance Quotes in Indiana?

car insurance - cheap car insurance indiana - Top 10 best car insurance

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu