Cheap Full Coverage Car Insurance Nc

Cheap Full Coverage Car Insurance in North Carolina

Introduction

Are you a North Carolina resident who is looking for affordable full coverage car insurance? If so, you are not alone. Many drivers in the state are looking for the best coverage at the lowest price. Fortunately, there are many ways to get cheap full coverage car insurance in North Carolina. Whether you’re a new driver or an experienced one, there are ways to save money on car insurance without sacrificing the coverage you need. Read on to learn more about how to get cheap full coverage car insurance in North Carolina.

What is Full Coverage Car Insurance?

Full coverage car insurance is a type of insurance that provides coverage for both liability and physical damage coverage. Liability coverage pays for any damages that you may cause to other people or property while physical damage coverage pays for damages to your own car. Full coverage car insurance is a great way to ensure that you are protected in the event of an accident or other unforeseen events. It is important to understand what is included in full coverage car insurance, so you can make sure that you are getting the coverage you need at the best price.

How to Get Cheap Full Coverage Car Insurance in North Carolina

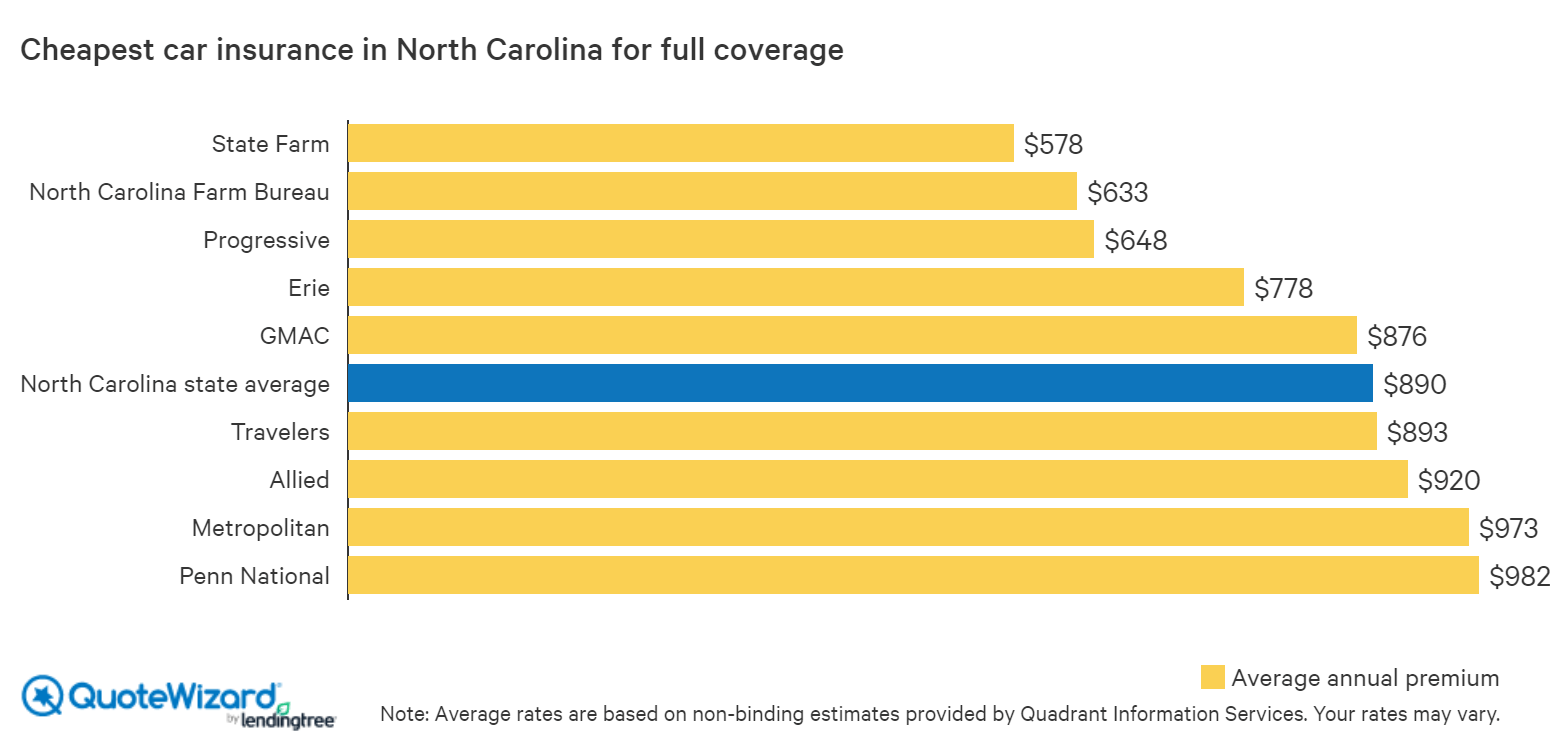

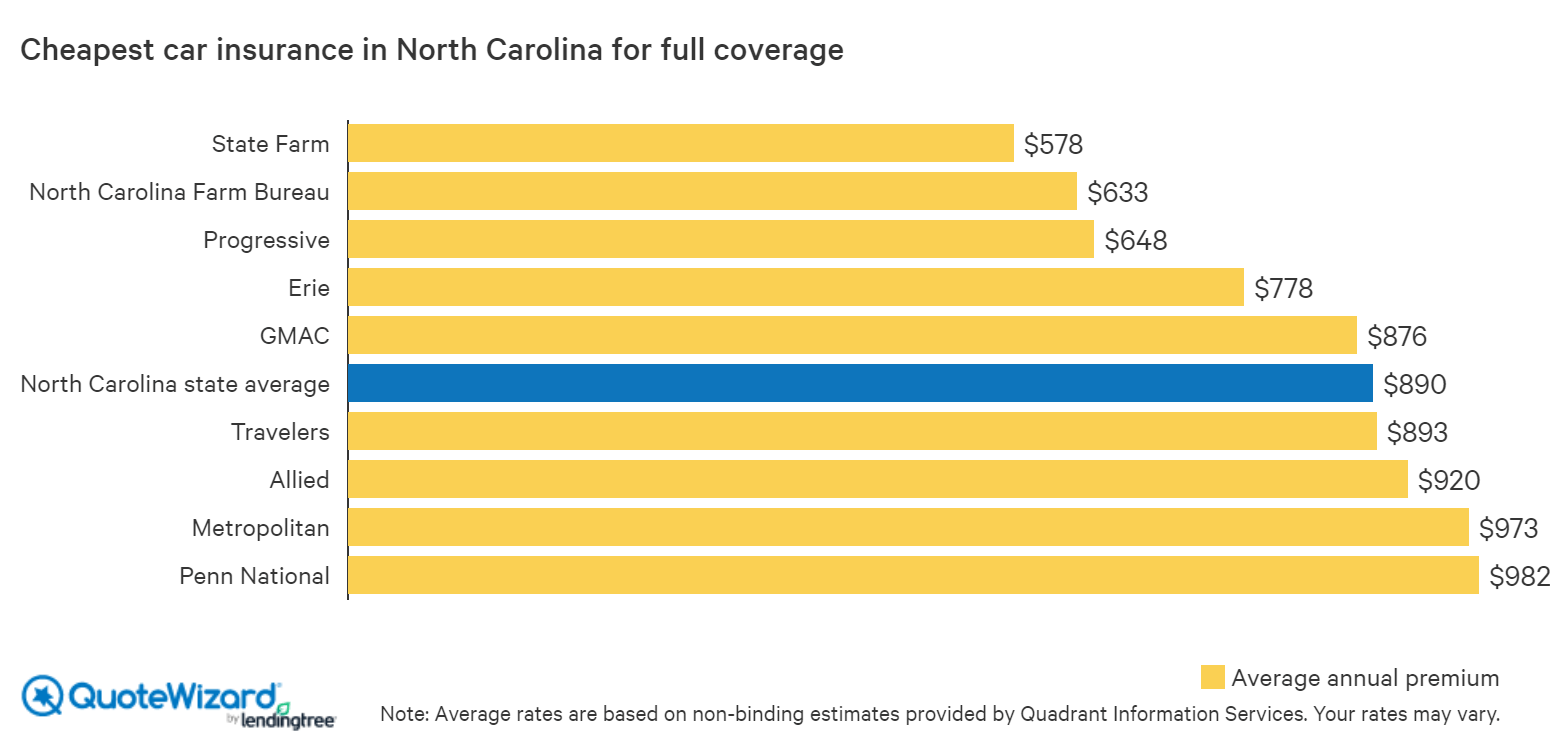

The first step to getting cheap full coverage car insurance in North Carolina is to shop around. Compare different insurance companies and rates to find the best deal. Also, make sure to take advantage of any discounts that may be available. Some insurance companies may offer discounts for good drivers, for having multiple policies with the same company, or for being a safe driver. Make sure to ask about any discounts that may be available to you.

What Affects Your Car Insurance Rates?

When you are looking for cheap full coverage car insurance in North Carolina, there are several factors that can affect your rates. These include your age, driving record, credit score, and the type of car you drive. The type of car you drive can have a big impact on your rates. If you drive a car that is considered to be “high risk”, such as a sports car or luxury vehicle, you may find that your rates are higher than others. Additionally, your age and driving record can also impact your rates. If you are a young driver or have an accident on your record, you may find that your rates are higher than someone who is older and has a clean driving record.

Conclusion

Getting cheap full coverage car insurance in North Carolina is possible. Take the time to compare different insurance companies and rates, and take advantage of any discounts that may be available. Additionally, be aware of the factors that can affect your rates, such as your age, driving record, credit score, and the type of car you drive. By following these tips, you can find the best coverage at the lowest price. With the right insurance coverage, you can have peace of mind knowing that you are protected in the event of an accident or other unforeseen events.

Cheap Car Insurance in North Carolina | QuoteWizard

9 Best Cheap Car Insurance In North Carolina (With Quotes)

Who Has the Cheapest Auto Insurance Quotes in North Carolina

Cheap full coverage auto insurance quotes top 3 things

Cheap full coverage auto insurance