Average Cost Of Car Insurance In California

Sunday, January 11, 2026

Edit

Average Cost Of Car Insurance In California

What is the Average Cost Of Car Insurance in California?

Living in California and needing car insurance is no surprise. In the state of California, drivers need to have liability insurance in order to legally operate a motor vehicle. California drivers pay an average of $1,817 for car insurance each year, according to WalletHub’s 2020 rankings. For drivers in California, these rates are slightly higher than the national average.

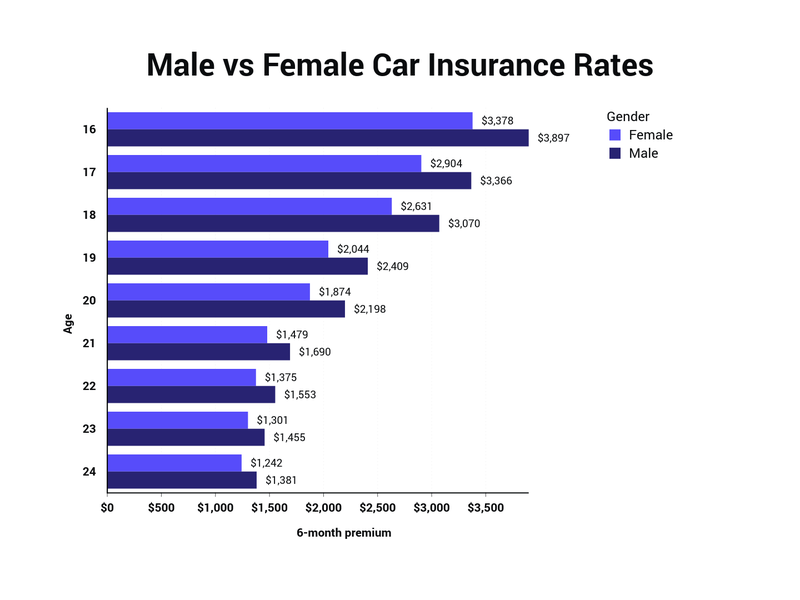

The cost of car insurance in California may vary significantly depending on the type of coverage, the vehicle, and the age and driving record of the driver. Drivers aged 25 and under typically pay more for auto insurance in the state of California.

How Much Does Car Insurance Cost in California?

Car insurance costs in California can range from $500 to $2,500, depending on several factors. The cost of car insurance in California may be affected by the type of vehicle, the age and driving history of the driver, and the amount of coverage purchased.

In California, drivers are required to carry minimum liability insurance. This type of coverage will help to cover the cost of damages and injuries caused by the driver in an accident. The minimum liability insurance required in California is $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage.

For additional coverage, drivers can purchase comprehensive and collision coverage, as well as uninsured motorist coverage. These types of coverage will help to cover the cost of repairs to the vehicle, as well as medical expenses for the driver and passengers. Drivers can also purchase additional insurance options such as gap insurance, roadside assistance, and rental car reimbursement.

What Factors Affect the Cost Of Car Insurance in California?

The cost of car insurance in California is affected by a variety of factors, including the type of vehicle, the age and driving record of the driver, and the amount of coverage purchased.

The type of vehicle can have a major impact on the cost of car insurance in California. Some vehicles are more expensive to insure than others due to their size, age, performance, or safety features. Drivers of luxury vehicles or sports cars may pay more for car insurance in California than drivers of more economical vehicles.

The age and driving record of the driver can also affect the cost of car insurance in California. Drivers aged 25 and under typically pay more for car insurance in the state of California. Additionally, drivers with a history of accidents or traffic violations may pay higher premiums.

Finally, the amount of coverage purchased will have an impact on the cost of car insurance in California. The minimum required liability coverage is typically the least expensive option, while additional coverage such as comprehensive and collision coverage can increase the cost of car insurance in California.

How Can Drivers Save Money On Car Insurance in California?

There are several ways for drivers to save money on car insurance in California. Drivers can shop around for the best rates and compare different car insurance companies. Additionally, drivers can take advantage of discounts for good driving records, multi-car policies, and low mileage. Drivers can also lower the cost of their car insurance by increasing the deductible or opting for a higher deductible.

Drivers should also consider purchasing liability coverage only if their vehicle is older or of low value. Drivers should also consider raising their deductible in order to reduce their premiums. Finally, drivers should consider bundling their auto insurance with other policies such as home or renter’s insurance in order to save money.

Conclusion

California drivers pay an average of $1,817 for car insurance each year, according to WalletHub’s 2020 rankings. The cost of car insurance in California may vary significantly depending on the type of coverage, the vehicle, and the age and driving record of the driver. Drivers can save money on car insurance in California by shopping around for the best rates, taking advantage of discounts, increasing the deductible, and bundling policies.

Who Has The Cheapest Auto Insurance Quotes in California? (2019

How Much Does Car Insurance Cost in California? (2019 Average

Average Car Insurance California - What Car Insurance Companies Don't

What is the best car insurance company in California? (2020