Agreement To Provide Auto Insurance

Thursday, January 1, 2026

Edit

Agreement To Provide Auto Insurance

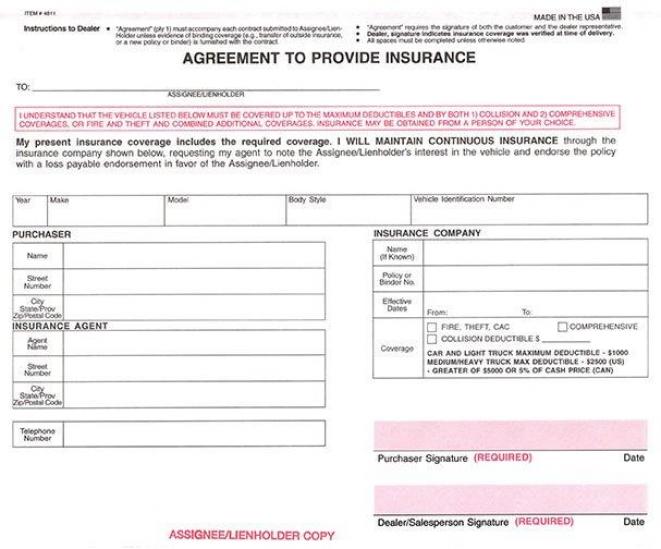

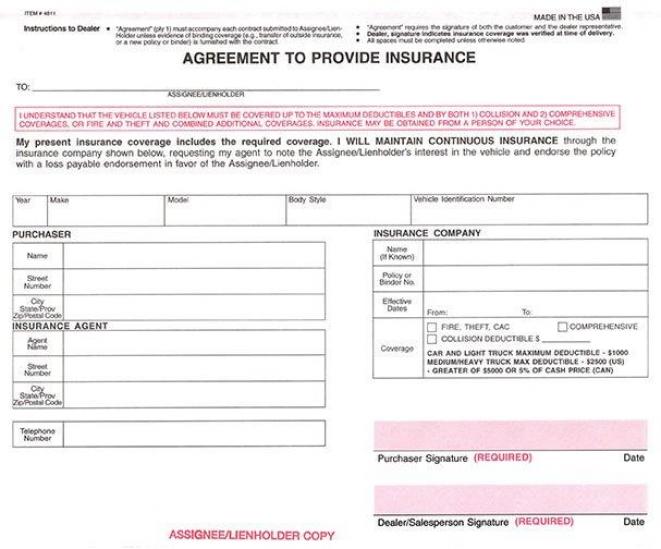

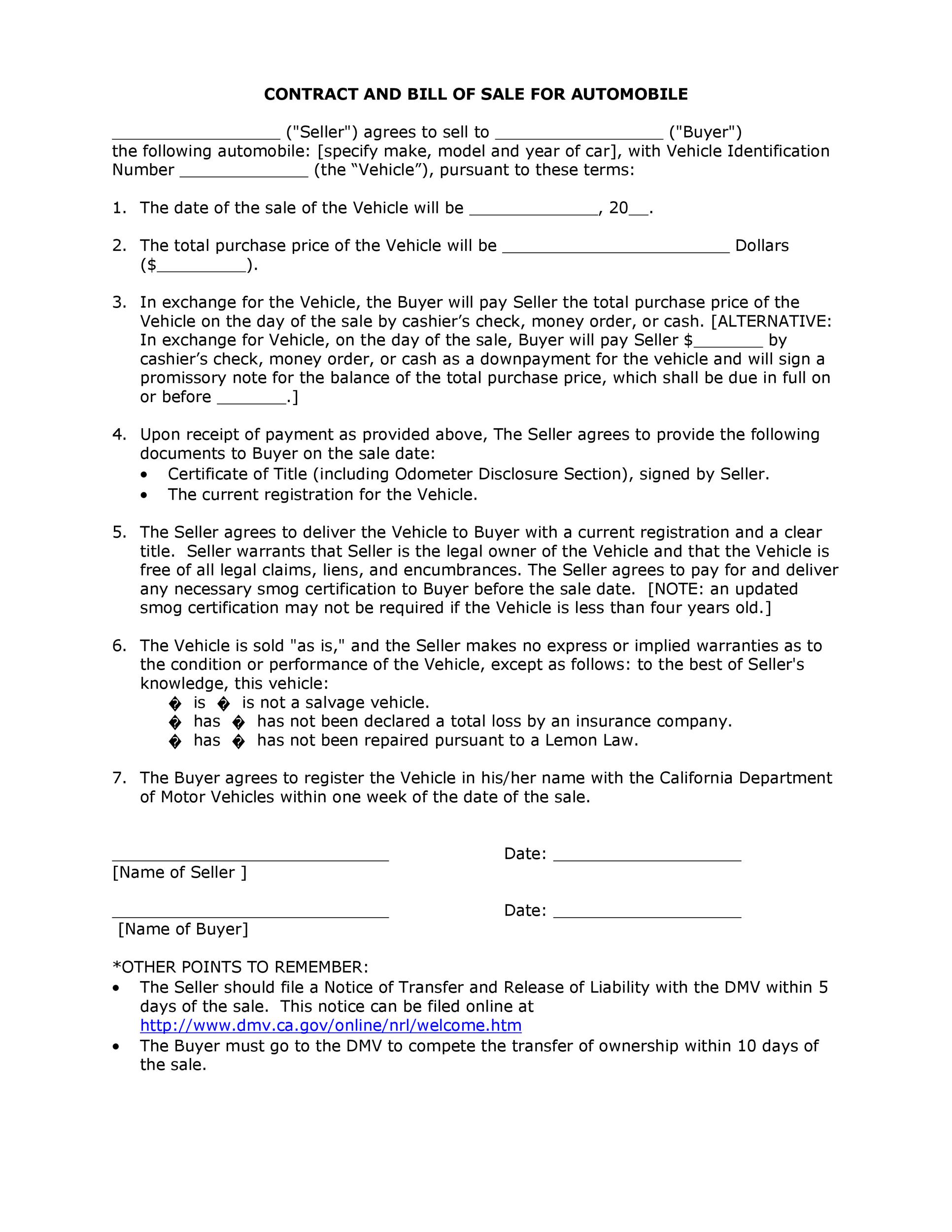

What is an Auto Insurance Agreement?

An auto insurance agreement is a contract between a policyholder and an insurance company that outlines the terms of the policyholder’s coverage. This agreement typically covers the type of vehicle, the amount of coverage, and the policyholder’s deductible. It also outlines the policyholder’s payment and renewal terms. Auto insurance agreements are typically offered for both personal and commercial vehicles.

What is Covered in an Auto Insurance Agreement?

Auto insurance agreements typically cover damage or loss of the vehicle, liability protection, and medical coverage. It may also include coverage for rental vehicles, towing and roadside assistance, and other services. The coverage and services included in the agreement will depend on the type of policy the policyholder chooses.

In addition to the coverage, the agreement may also include the policyholder’s deductible, the amount they must pay upfront before the insurance company pays for any damages or losses. The deductible may vary depending on the type of coverage the policyholder has chosen.

What are the Benefits of an Auto Insurance Agreement?

The primary benefit of an auto insurance agreement is that it provides peace of mind and financial protection in the event of an accident. It also provides coverage for any medical expenses that may arise due to an accident. Having the right auto insurance agreement can give policyholders the confidence to drive knowing that they are covered in the event of an accident.

In addition to providing financial protection, auto insurance agreements can also help policyholders save money. Many insurance companies offer discounts for policyholders who have a clean driving record, are insuring multiple vehicles, or have taken a defensive driving course.

How to Find the Right Auto Insurance Agreement?

When looking for the right auto insurance agreement, policyholders should shop around and compare different policies. It’s important to compare the types of coverage offered, the coverage limits, and the cost of the policy. It’s also important to consider any discounts that may be available.

Policyholders should also read the fine print of the agreement and understand the coverage limits and any exclusions or restrictions that may apply. It’s important to choose a policy that meets the policyholder’s needs and is within their budget.

What Happens if the Policyholder Breaks the Agreement?

If the policyholder fails to make payments as outlined in the agreement or breaks the terms of the agreement, the policy may be canceled. The policyholder may also be subject to a penalty or fines. It’s important to make sure that the policyholder understands the terms of the agreement before signing it.

Conclusion

An auto insurance agreement is an important document that outlines the terms of coverage for a policyholder. It’s important to shop around and compare different policies to make sure that the policyholder is getting the right coverage at the right price. It’s also important to understand the terms of the agreement and any restrictions or exclusions that may apply. By following these tips, policyholders can make sure that they have the right auto insurance agreement in place.

agreement to provide insurance form #4811 | AutoDealerSupplies.com is

Proof Of Car Insurance Template Collection

Template Used Car Sale Agreement | HQ Printable Documents

FREE 5+ Sample Car Lease Agreement Templates in MS Word | PDF | Pages

Car Insurance Contract Example ~ designdsight