1st 2nd And 3rd Party Insurance

Everything You Need to Know About 1st, 2nd, and 3rd Party Insurance

What is Insurance?

Insurance is a form of risk management that is used to protect against the risk of a financial loss. It is a type of contract between two parties, the insured and the insurer, in which the insurer agrees to provide financial protection in the event of an unforeseen event or accident. Insurance is designed to protect both parties from the financial consequences of a loss, while also providing a way to spread the cost of losses over time. Insurance can be used to cover a variety of risks, including health, life, property, liability, and more. Insurance is one of the most important ways to protect yourself, your family, and your business from potential losses.

What is 1st, 2nd and 3rd Party Insurance?

1st, 2nd and 3rd party insurance are all types of insurance that are used to protect against potential losses. 1st party insurance is used to protect the insured from a financial loss that may be caused by an accident or other unforeseen event. This type of insurance is often used to cover medical bills or property damages that may occur due to an accident. 2nd party insurance is used to protect the insurer from a financial loss that may occur due to the actions of the insured. This type of insurance is often used to cover a company’s legal liability in the event that the insured causes damage to another person or property. Finally, 3rd party insurance is used to protect a third party from a financial loss that may occur due to the actions of the insured. This type of insurance is often used to cover legal fees, damages, or medical bills that may be incurred when the insured causes damage to another person or property.

What is the Difference Between 1st, 2nd and 3rd Party Insurance?

The main difference between 1st, 2nd and 3rd party insurance is who is covered by the policy. 1st party insurance covers the insured, 2nd party insurance covers the insurer, and 3rd party insurance covers a third party. Additionally, 1st party insurance covers the insured from a financial loss due to an accident or other unforeseen event, while 2nd party insurance covers the insurer from a financial loss due to the actions of the insured. Finally, 3rd party insurance covers a third party from a financial loss due to the actions of the insured. Each type of insurance has its own specific requirements and coverage limits, so it is important to read the policy carefully before signing up.

What Does 1st, 2nd and 3rd Party Insurance Cover?

1st party insurance typically covers medical bills, property damage, legal fees, and other expenses that may occur due to an accident or other unforeseen event. 2nd party insurance typically covers legal liability, damages, and medical bills that may occur due to the actions of the insured. Finally, 3rd party insurance typically covers legal fees, damages, and medical bills that may occur due to the actions of the insured. Each type of insurance has its own limits and specific coverage, so it is important to read the policy carefully before signing up.

How to Choose the Right Insurance

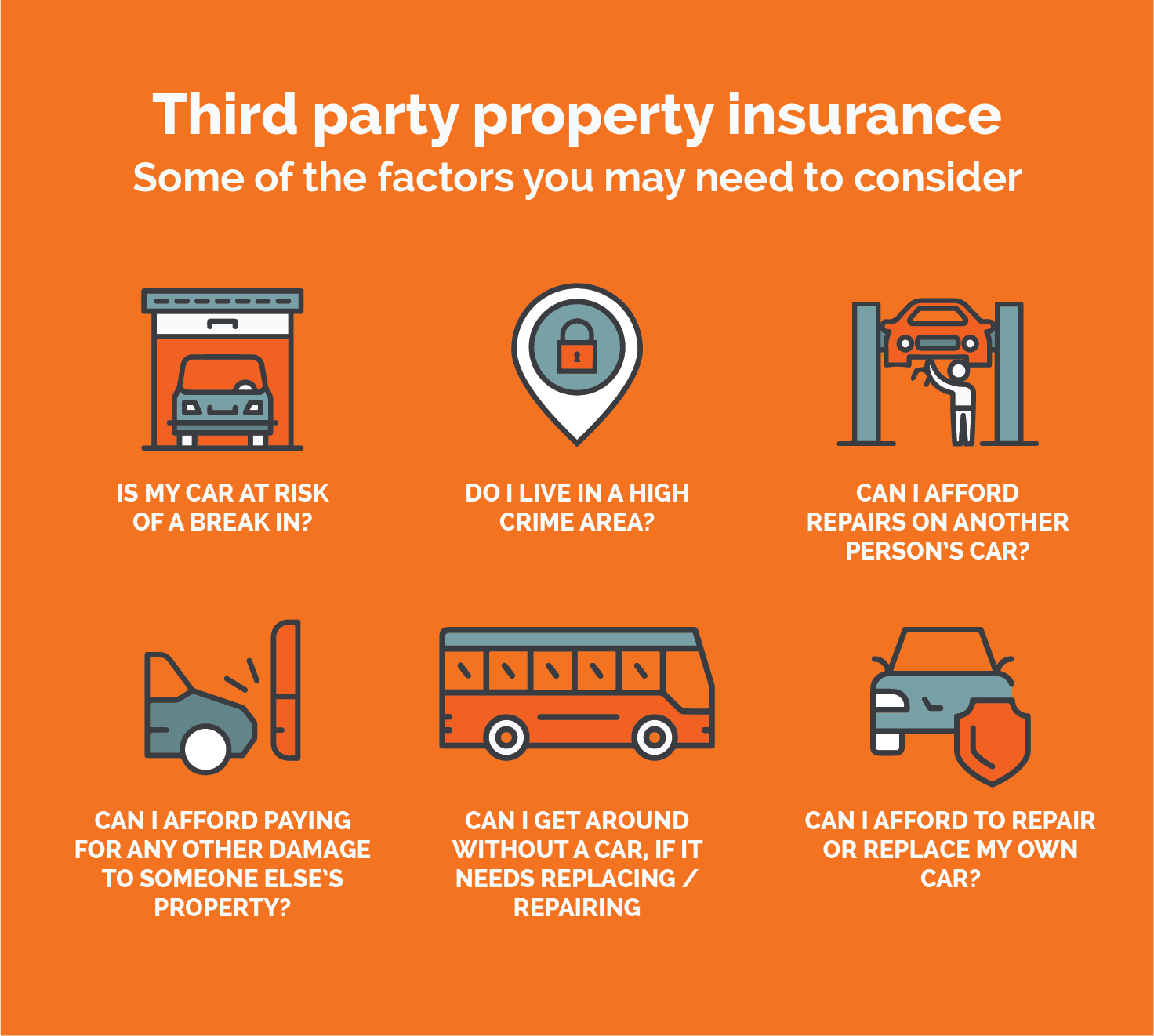

Choosing the right insurance policy is an important decision that should not be taken lightly. It is important to understand the different types of insurance and the coverage that each type provides. Additionally, it is important to consider what type of coverage is best suited to your individual needs and budget. Finally, it is important to research the different policies available and to compare the different coverage and cost options before making a decision.

Conclusion

1st, 2nd and 3rd party insurance are all types of insurance that are used to protect against potential losses. 1st party insurance is used to protect the insured from a financial loss that may be caused by an accident or other unforeseen event. 2nd party insurance is used to protect the insurer from a financial loss that may occur due to the actions of the insured. Finally, 3rd party insurance is used to protect a third party from a financial loss that may occur due to the actions of the insured. Understanding the different types of insurance and their coverage limits is an important step to making sure that you are adequately protected against potential losses.

Which Is Better Comprehensive Or Third Party Insurance - noclutter.cloud

The loss your car incurs is not covered by your insurance provider but

What Is Third Party Insurance And First Party Insurance

3rd Party Insurance Quora - insurance

Third Party Insurance | क्या है थर्ड पार्टी INSURANCE - YouTube