Zurich Steadfast Motor Insurance Policy Wording

Zurich Steadfast Motor Insurance Policy Wording: Understanding the Details

Zurich Steadfast is a respected motor insurance provider offering coverage for a range of vehicles, from cars and motorbikes to commercial vehicles. They understand that the motor insurance policy wording can be complex and confusing, so they have taken a proactive approach to ensure that customers understand the details of their policy. This article will explore the policy wording of Zurich Steadfast Motor Insurance and explain the key points.

What is Covered?

Zurich Steadfast Motor Insurance offers cover for a range of vehicles and situations. This includes cover for theft, malicious damage, fire, and accidental damage. The policy also includes cover for personal injury and loss of or damage to personal belongings. It is important to note that Zurich Steadfast Motor Insurance does not cover any damage or loss resulting from racing, rallies, or competitions. It is also important to understand that Zurich Steadfast Motor Insurance is a comprehensive policy and does not cover any third-party liabilities or damages.

What are the Excesses?

When taking out a Zurich Steadfast Motor Insurance policy, you will need to pay an excess. This is the amount that you will need to pay in the event of a claim. The exact amount will depend on the type of vehicle covered and the level of cover chosen. It is important to be aware that the excess for a claim caused by an uninsured driver may be higher than the excess for a claim caused by an insured driver.

What Additional Benefits are Included?

In addition to the standard cover, Zurich Steadfast Motor Insurance includes a number of additional benefits. This includes cover for legal expenses, personal accident cover, and cover for a courtesy car. It is also important to note that Zurich Steadfast Motor Insurance includes cover for windscreen repair and replacement. Customers may also be eligible for a no-claims discount, depending on their driving history.

How is the Premium Calculated?

The premium for Zurich Steadfast Motor Insurance is calculated based on a number of factors, including the type of vehicle covered, the level of cover chosen, the age and driving history of the driver, and the area in which the vehicle is kept. It is important to note that the premium may be higher for drivers with a history of accidents, convictions, or claims.

How Can I Make a Claim?

To make a claim on Zurich Steadfast Motor Insurance, customers should contact the insurer directly. It is important to provide all necessary details and supporting documents, including the police report, if applicable. Customers should also provide details of any third-party involved in the accident. Zurich Steadfast Motor Insurance will then assess the claim and determine whether it is eligible for cover.

Conclusion

Zurich Steadfast Motor Insurance provides comprehensive cover for a range of vehicles and situations. It is important to understand the policy wording and to be aware of the excesses, additional benefits, and how the premium is calculated. Customers should also understand how to make a claim and provide all necessary documentation. With this in mind, customers can enjoy peace of mind knowing that their vehicles are covered by Zurich Steadfast Motor Insurance.

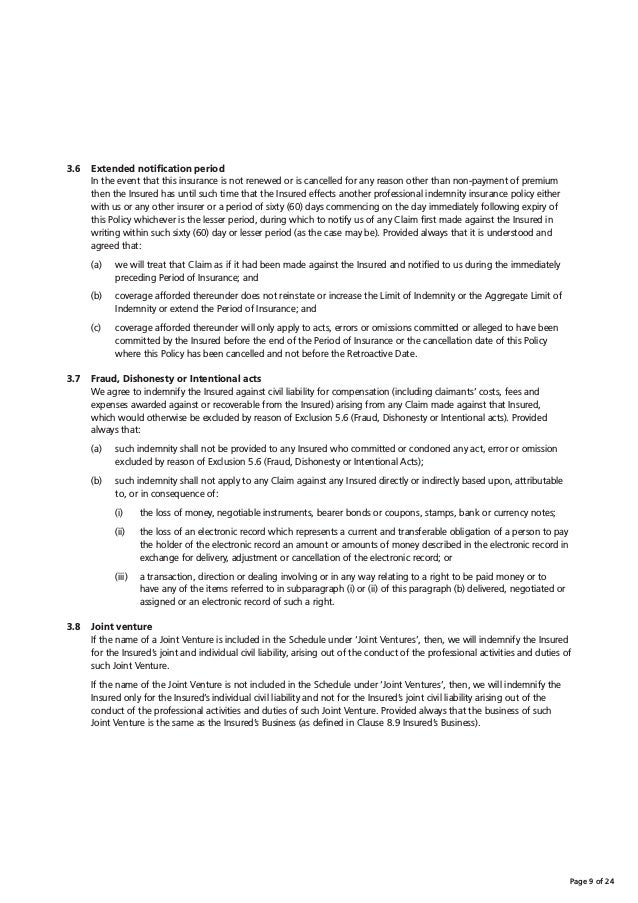

Zurich Steadfast Professional Indemnity Policy Wording

Zurich Steadfast Professional Indemnity Policy Wording

Zurich Steadfast Professional Indemnity Policy Wording

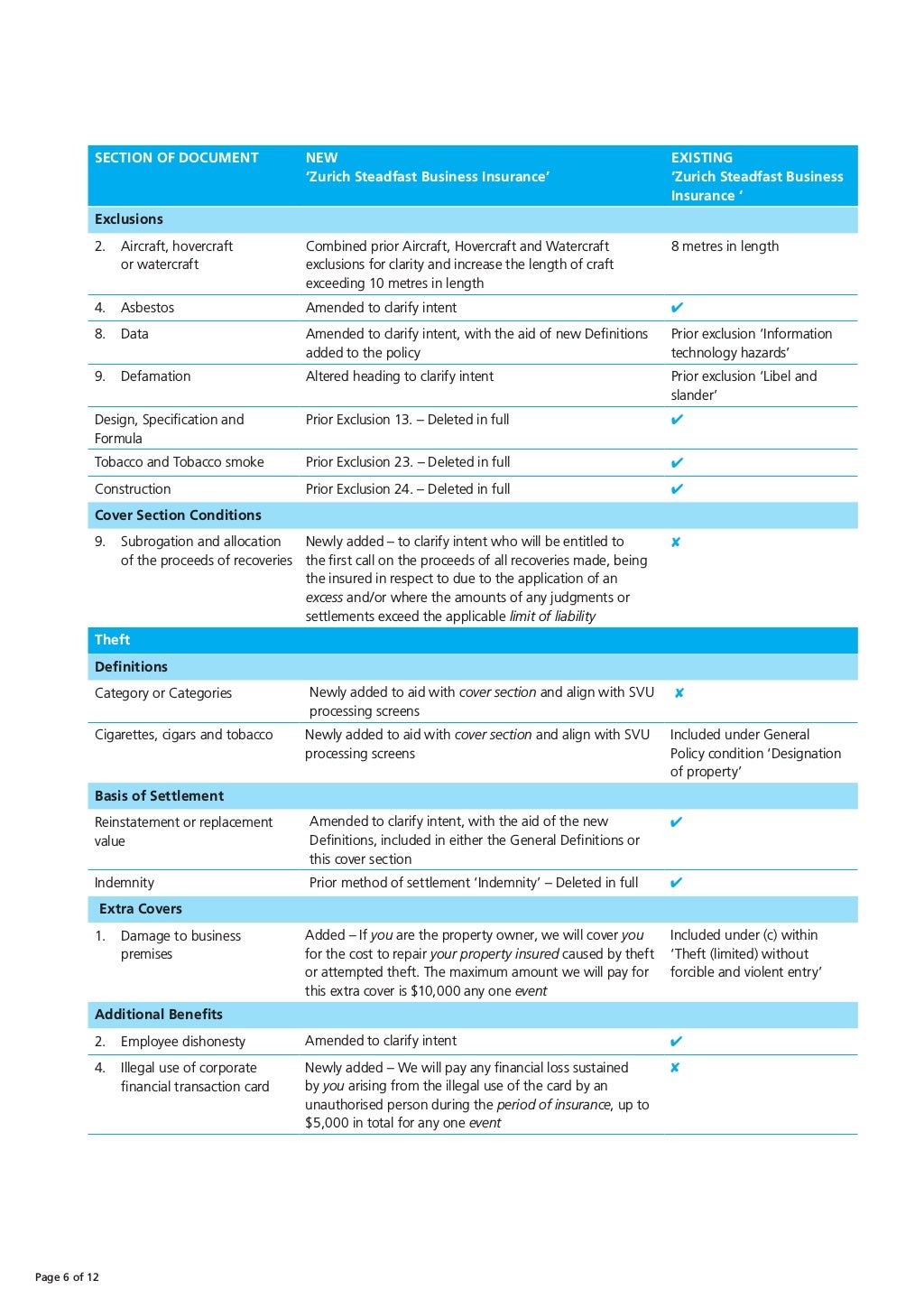

Zurich Steadfast Business Insurance Quick Reference Guide

Zurich Steadfast Professional Indemnity Policy Wording