What Is Third Party Liability Insurance

What is Third Party Liability Insurance?

Third Party Liability Insurance is a type of insurance policy that provides coverage for any legal liability to a third party that may arise from an insured’s activities. This type of insurance is usually required by law in certain situations, such as when operating a motor vehicle. Third Party Liability Insurance is also known as third-party insurance, liability coverage, or liability insurance.

What Does Third Party Liability Insurance Cover?

Third Party Liability Insurance typically covers damages or injuries caused by an insured’s negligence or carelessness. This type of insurance typically covers any legal fees, court costs, and/or settlements that may arise from a third party’s lawsuit against the insured. In some cases, the policy may also cover any repairs or replacements that are necessary due to the negligence of the insured.

Who Needs Third Party Liability Insurance?

Third Party Liability Insurance is typically required by law when operating a motor vehicle, such as a car, truck, or motorcycle. It is also usually required when operating certain types of machinery or equipment, such as forklifts, tractors, or boats. In some cases, it may also be required when engaging in certain types of activities, such as construction or demolition.

What Are the Benefits of Third Party Liability Insurance?

The primary benefit of Third Party Liability Insurance is the protection it provides for the insured. If a third party files a lawsuit against the insured, the policy will help to cover any legal fees, court costs, and/or settlements that may arise from the suit. It can also help to protect the insured’s assets in the event of a successful lawsuit against them. Additionally, Third Party Liability Insurance can help to provide peace of mind, knowing that the insured is protected from any potential legal liabilities.

How Much Does Third Party Liability Insurance Cost?

The cost of Third Party Liability Insurance will depend on a variety of factors, such as the type and amount of coverage desired, the type of activity being covered, and the type of vehicle or machinery being operated. Generally speaking, the cost of this type of insurance is relatively affordable, and the premiums can be paid on a monthly, quarterly, or annual basis.

Where Can I Buy Third Party Liability Insurance?

Third Party Liability Insurance can be purchased from an insurance company or an independent insurance agent. It is important to compare rates from different companies and agents to ensure that you are getting the best possible coverage for the lowest possible price. Additionally, it is important to read the policy carefully to understand the type and amount of coverage that is provided.

How is a group insurance scheme effective? - MyAnmol Insurance

What Is Third-party Insurance?

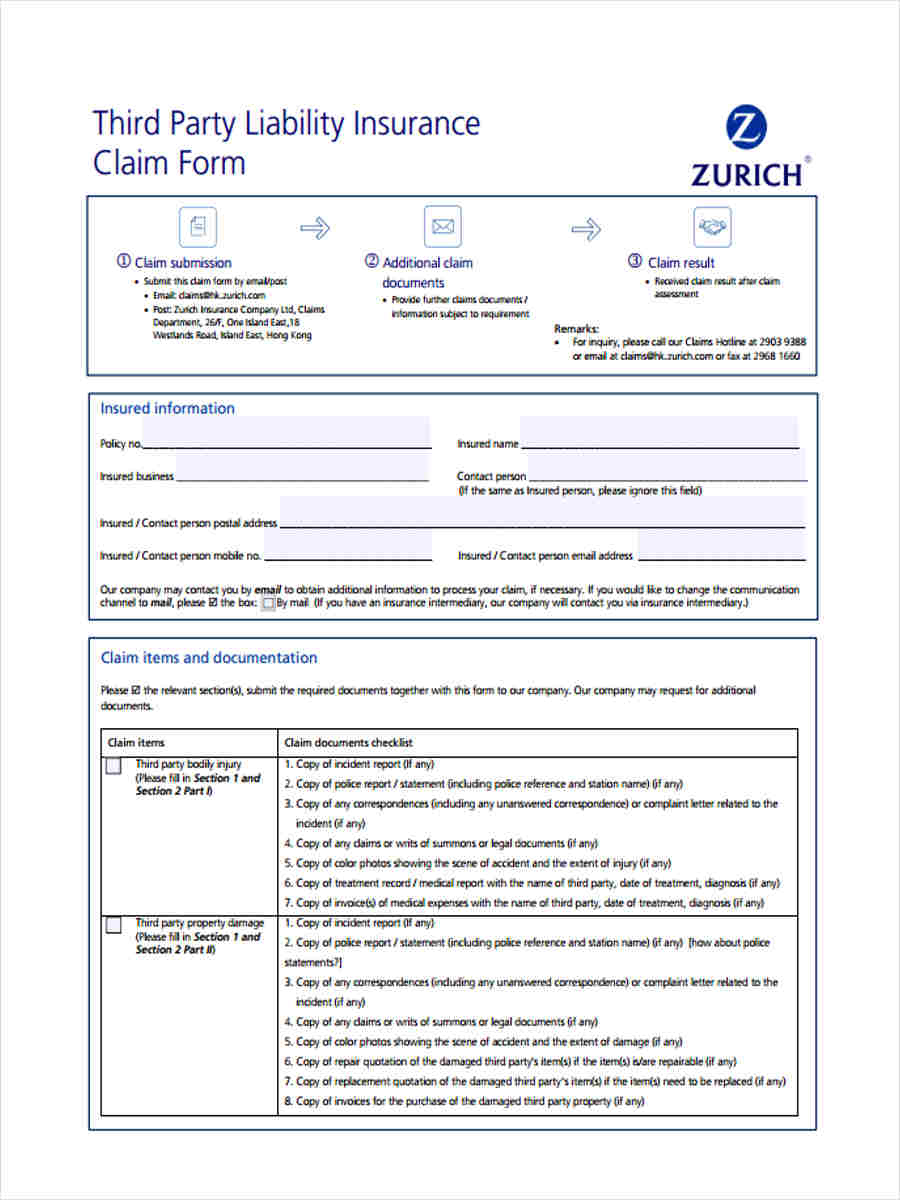

FREE 5+ Third Party Liability Forms in MS Word | PDF

What is Compulsory Third Party Liability Insurance? | iChoose.ph

PPT - Third Party Liability Protections – The Next Wave of Brownfields