What Is Gap Coverage Insurance

What Is Gap Coverage Insurance?

Gap coverage insurance is a type of auto insurance coverage that helps protect a driver from owing money if their vehicle is totaled or stolen. This type of coverage pays the difference between the amount a driver owes on their vehicle and the amount that their insurance will pay out if their car is totaled or stolen. Gap coverage is especially important for drivers who have recently purchased a new car and are still making payments on the loan. Without gap coverage, a driver could be stuck with a large amount of debt if their car is totaled or stolen.

What Does Gap Coverage Cover?

Gap coverage will cover the difference between the amount owed on a vehicle and the amount that the insurance will pay out if the car is totaled or stolen. This coverage can help protect a driver from owing money even if their car is totaled or stolen. Gap coverage also provides coverage for additional items that may be purchased with the vehicle, such as extended warranties or service contracts.

What Are the Benefits of Gap Coverage?

Gap coverage can provide a number of benefits to drivers who are still making payments on their vehicle. If a driver is in an accident and their car is totaled or stolen, gap coverage will pay the difference between the amount that the driver owes on their loan and the amount that the insurance will pay out. This can help protect a driver from owing money on their loan even if their car is totaled or stolen.

Who Should Consider Gap Coverage?

Gap coverage can be beneficial for any driver who is still making payments on their vehicle. This is especially important for drivers who have recently purchased a new car, as they can be at risk of owing money on their loan if their car is totaled or stolen. Gap coverage can also be beneficial for drivers who have purchased additional items with their car, such as extended warranties or service contracts.

What Are the Downsides of Gap Coverage?

Gap coverage can be expensive, and some drivers may not be able to afford it. Additionally, gap coverage may not be necessary for drivers who have paid off their vehicle or who have a vehicle that is worth less than the amount they owe on the loan. In these cases, gap coverage may be unnecessary, and the driver may be better off without it.

Conclusion

Gap coverage is a type of auto insurance coverage that can help protect a driver from owing money if their vehicle is totaled or stolen. Gap coverage pays the difference between the amount a driver owes on their vehicle and the amount that their insurance will pay out if their car is totaled or stolen. Gap coverage can be beneficial for drivers who are still making payments on their vehicle, but it can also be expensive for drivers who may not need it. Drivers should consider their individual situation when deciding whether or not to purchase gap coverage.

What Is Gap Insurance? - Lexington Law

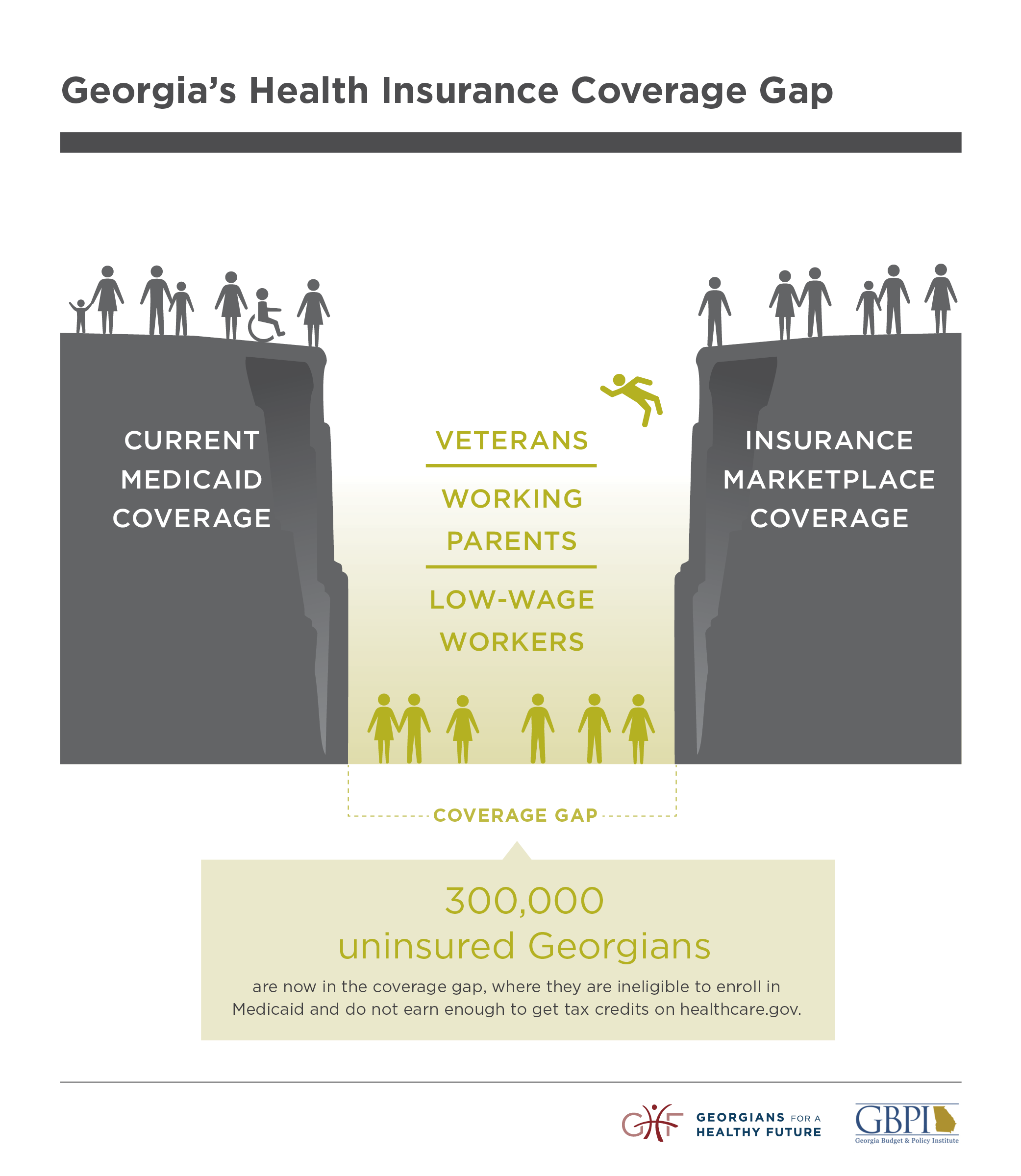

New illustrated Medicaid resource – Georgians for a Healthy Future

So, who exactly is in the coverage gap? - Care4Carolina

What is Gap Insurance? Infographic

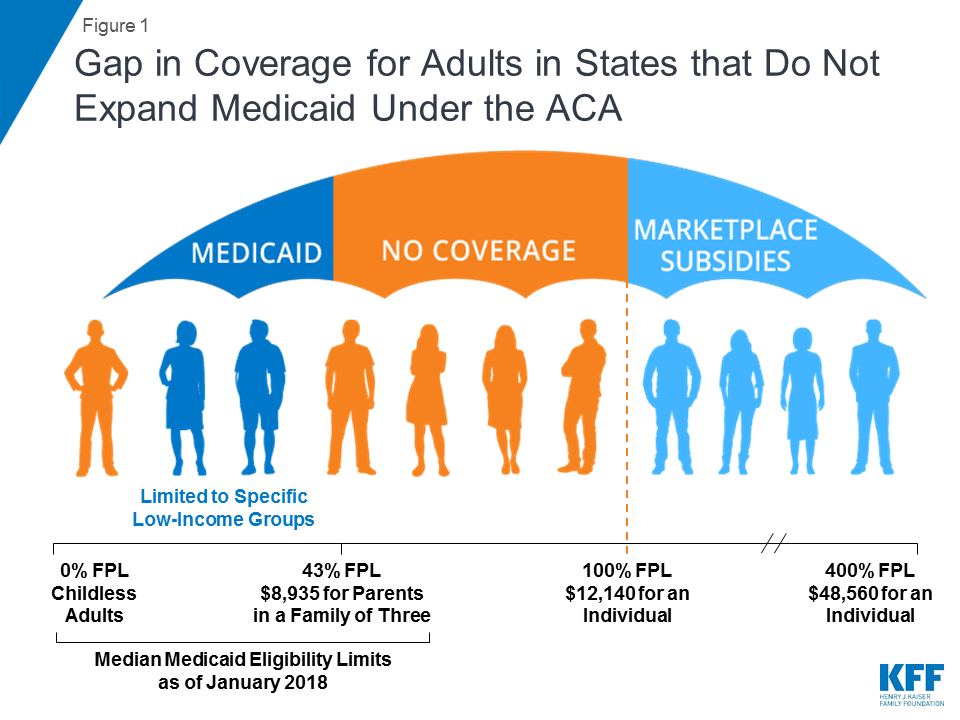

The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand