What Is Bodily Injury And Property Damage Liability

What Is Bodily Injury And Property Damage Liability?

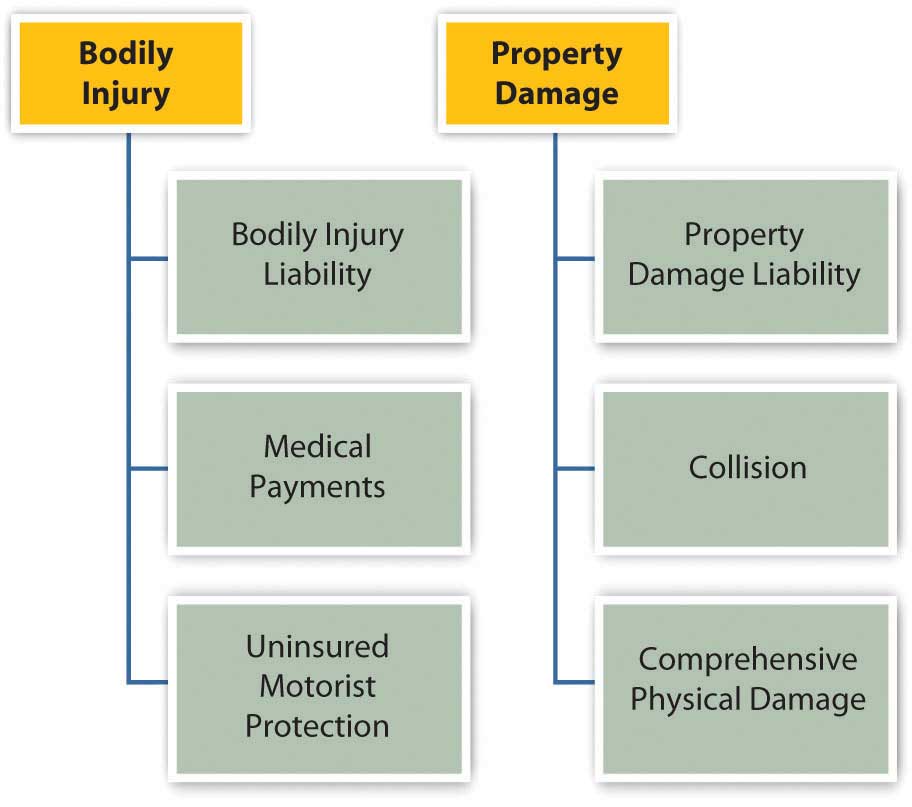

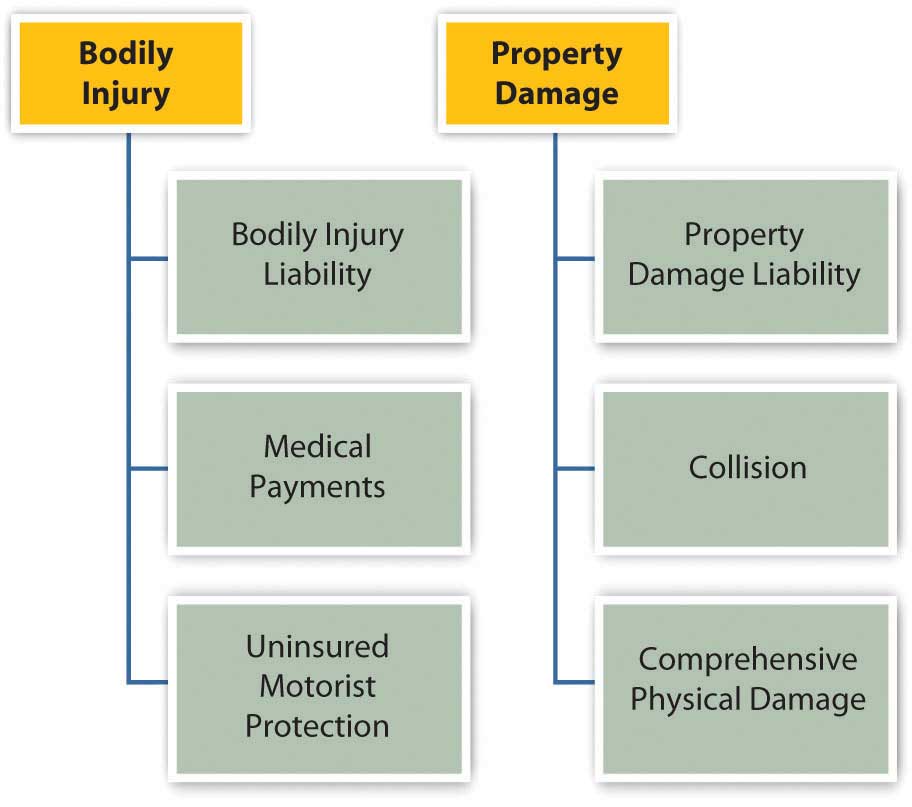

Bodily injury and property damage liability are two of the most important coverage types that you need to understand when it comes to automobile insurance. Being aware of what these two types of coverage entail will help you make an informed decision about your car insurance policy. This article will explain what bodily injury and property damage liability are, how they are different, and how they are related.

What Is Bodily Injury Liability?

Bodily injury liability is a type of car insurance that covers the costs associated with any physical harm that you cause to another person in an accident. This includes medical bills, lost wages and even funeral expenses, depending on the severity of the injury. This type of coverage also applies if you are deemed at fault for an accident, meaning that it will cover the cost of any damages caused by you. It is important to note that this type of coverage does not cover any damage to your own vehicle.

What Is Property Damage Liability?

Property damage liability is another form of coverage, and it is designed to cover the cost of any damage done to another person's property. This includes damage to their vehicle, as well as any other property that may have been affected by the accident. This type of coverage is often required by law, as it helps to protect the other person from financial loss due to an accident that was your fault. This coverage is also separate from any coverage that may be included in your own car insurance policy.

How Are Bodily Injury and Property Damage Liability Different?

The biggest difference between bodily injury and property damage liability is the type of coverage that they provide. Bodily injury liability covers any physical harm caused to another person, while property damage liability covers any damage done to another person's property. It is important to note that these two types of coverage are not mutually exclusive, and in many cases, you may need both types of coverage to be adequately protected.

How Are Bodily Injury and Property Damage Liability Related?

Although bodily injury and property damage liability are two separate coverage types, they are usually purchased together in one policy. This is because the two coverage types are related in that they both protect you from financial loss due to an accident that was your fault. By having both types of coverage, you are ensuring that you are adequately protected in the event of an accident, no matter what the cause.

Conclusion

Understanding what bodily injury and property damage liability are is essential when it comes to choosing the right car insurance policy. Knowing the differences between the two coverage types, as well as how they are related, can help you make an informed decision about your car insurance. Remember, having both types of coverage will ensure that you are protected in the event of an accident, no matter what the cause.

Bodily Injury Property Damage Liability How Much - Property Walls

Auto insurance final presentation

The Difference Between a Bodily Injury & Property Damage Liability Claim

What Is Car Liability Insurance Coverage - CarProTips.net

Bodily Injury Property Damage - Do your liability limits cover your