What Is 6 Month Premium Car Insurance

What Is 6 Month Premium Car Insurance?

When it comes to car insurance, there are different coverage options and terms available to choose from. One of the most popular coverage options is 6-month premium car insurance. This type of car insurance plan is designed to provide coverage for a period of six months, instead of just a single month or a full year. With 6-month premium car insurance, you can save money on your car insurance and get the coverage you need without having to worry about making long-term commitments.

How Does 6 Month Premium Car Insurance Work?

6 month premium car insurance works similarly to any other type of car insurance. When you sign up for the policy, you will be required to pay a premium, either monthly or upfront. The premium you pay will depend on the type of coverage you select, the value of your car, and any additional drivers that will be listed on the policy. Once you have paid the premium, you will be covered for a period of six months. During that period, you can make claims and receive the benefits of your coverage, just as you would with a longer-term policy.

What Does 6 Month Premium Car Insurance Cover?

6 month premium car insurance typically covers the same types of risks that any other car insurance policy covers. This includes risks such as damage to your car, damage to other people’s property, medical costs, and legal costs. Depending on the type of policy you select, you may also be covered for risks such as theft, vandalism, and accidental damage.

What Are the Benefits of 6 Month Premium Car Insurance?

The main benefit of 6 month premium car insurance is that it allows you to save money on your car insurance. Since you are only required to pay for coverage for six months at a time, you can often get a cheaper rate than you would with a longer-term policy. Additionally, 6 month premium car insurance gives you the flexibility to change your coverage or switch insurers mid-term without having to wait until the end of the year. This can make it easier to find the best coverage and save money on your car insurance.

What Should You Consider Before Choosing 6 Month Premium Car Insurance?

Before you sign up for 6 month premium car insurance, it is important to consider the pros and cons of this type of policy. While 6 month premium car insurance does offer the potential to save money, it may not be the best option for everyone. Additionally, some insurers may require you to pay a cancellation fee if you switch insurers or cancel your policy mid-term, so it is important to read the fine print before signing up.

Conclusion

6 month premium car insurance is a great option for those who want to save money on their car insurance. This type of policy allows you to enjoy the benefits of car insurance without having to make a long-term commitment. However, it is important to consider the pros and cons of this type of policy before signing up, as some insurers may require you to pay a cancellation fee if you switch insurers or cancel your policy mid-term.

ALL You Need to Know About the Average Car Insurance Cost

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

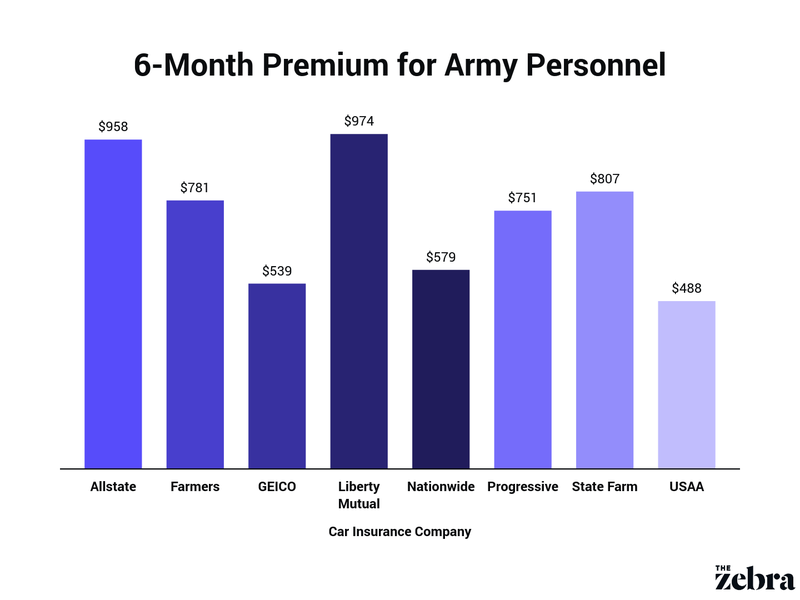

Best Car Insurance for Army Personnel (With Rates) | The Zebra

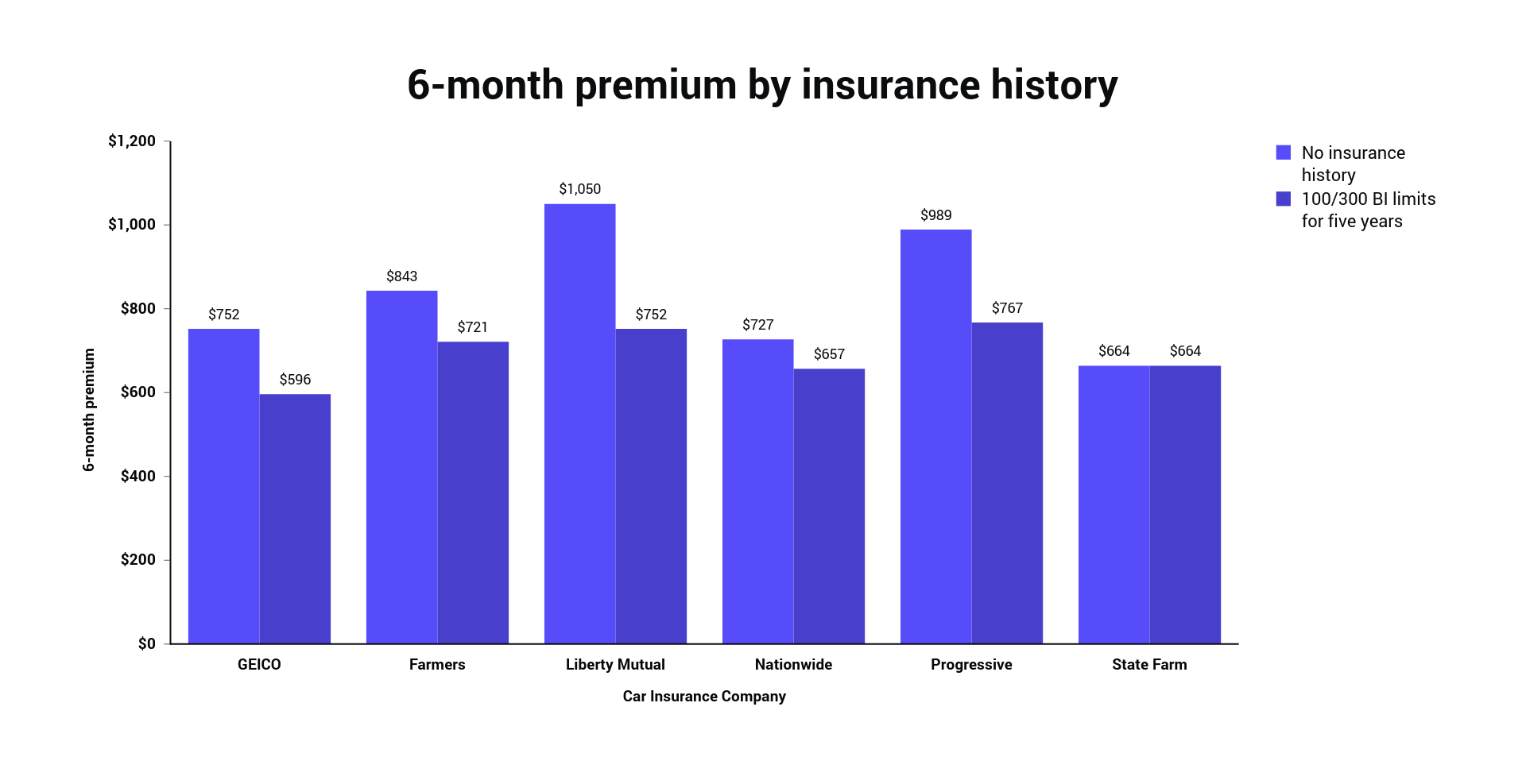

Which Company Has the Best Cheap Car Insurance in 2020? | The Zebra

What's the Average Auto Insurance Cost Per Month? | The Lazy Site