What Is 1st 2nd And 3rd Party Insurance

What is 1st, 2nd and 3rd Party Insurance?

Insurance is a contract between two parties (the insurer and the insured) where the insurer agrees to compensate the insured in the event of a loss. Generally, insurance policies are divided into three categories, namely first party insurance, second party insurance and third party insurance. Each of these categories covers a different type of risk and offers different types of protection for the insured. In this article, we’ll discuss what each type of insurance is and how it can help protect you.

First Party Insurance

First party insurance is a type of insurance that provides protection for the insured against losses that they may suffer due to their own actions. Examples of first party insurance include car insurance, homeowners insurance and life insurance. First party insurance is designed to provide compensation for the insured in the event of a loss, such as if their car is damaged in an accident or their home is destroyed in a fire. It is important to note that first party insurance policies typically do not cover losses caused by the actions of others.

Second Party Insurance

Second party insurance is a type of insurance that provides protection for the insured against losses caused by the actions of another party. Examples of second party insurance include liability insurance, which covers losses caused by the negligence of another person or entity, and malpractice insurance, which covers losses caused by the negligence of a healthcare provider. It is important to note that second party insurance policies typically do not cover losses caused by the actions of the insured.

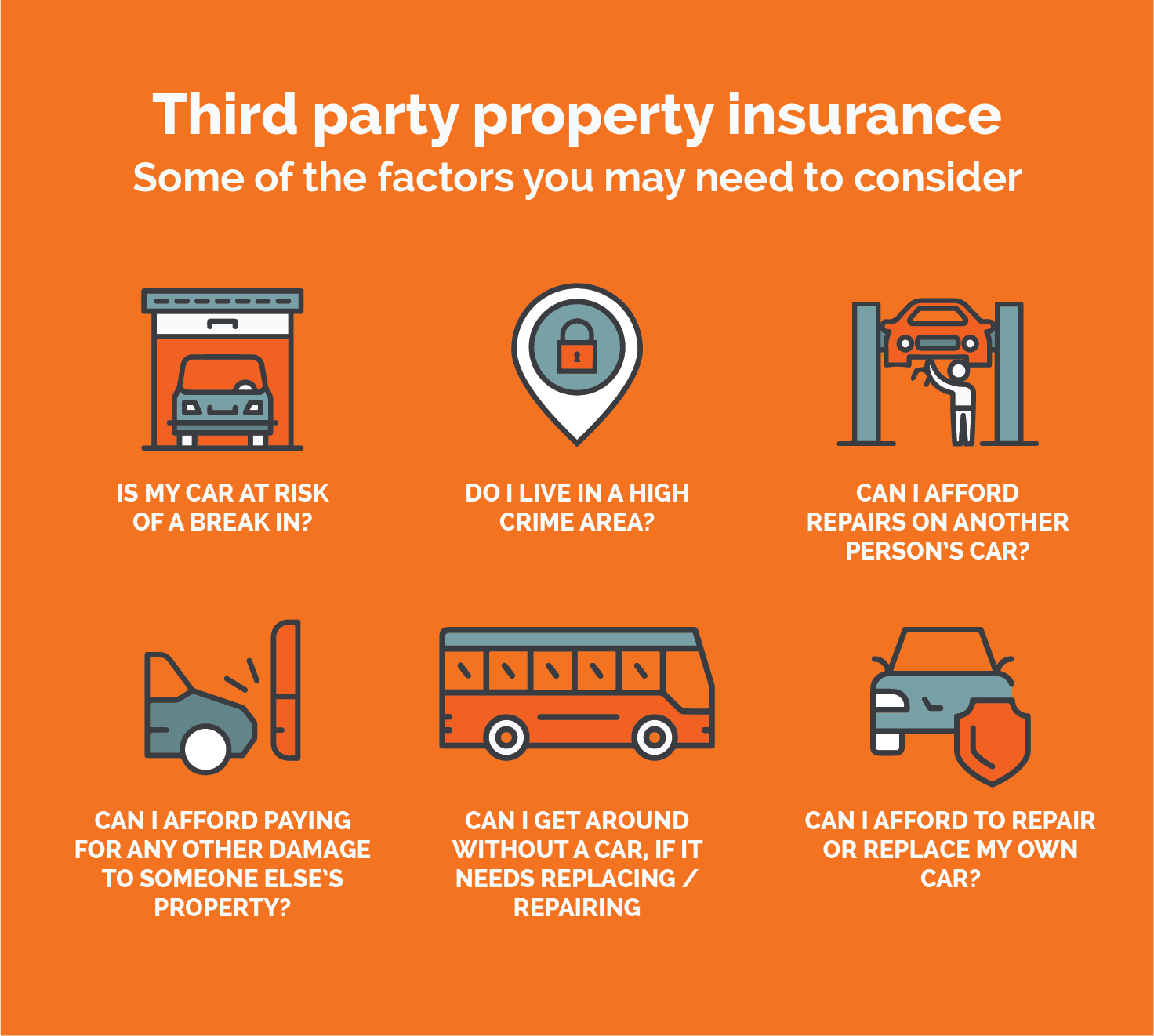

Third Party Insurance

Third party insurance is a type of insurance that provides protection for the insured against losses caused by the actions of a third party. Examples of third party insurance include product liability insurance, which covers losses caused by the negligence of a manufacturer or distributor, and professional indemnity insurance, which covers losses caused by the negligence of a professional such as a doctor or lawyer. It is important to note that third party insurance policies typically do not cover losses caused by the actions of the insured or another party.

Conclusion

Insurance policies are generally divided into three categories, namely first party insurance, second party insurance and third party insurance. Each type of insurance provides different levels of protection for the insured and covers different types of risks. It is important to understand the differences between these types of insurance in order to ensure that you are properly protected in the event of a loss.

Which Is Better Comprehensive Or Third Party Insurance - noclutter.cloud

The loss your car incurs is not covered by your insurance provider but

What Is Third-party Insurance?

What Is The Difference Between First-Party And Third-Party Insurance?

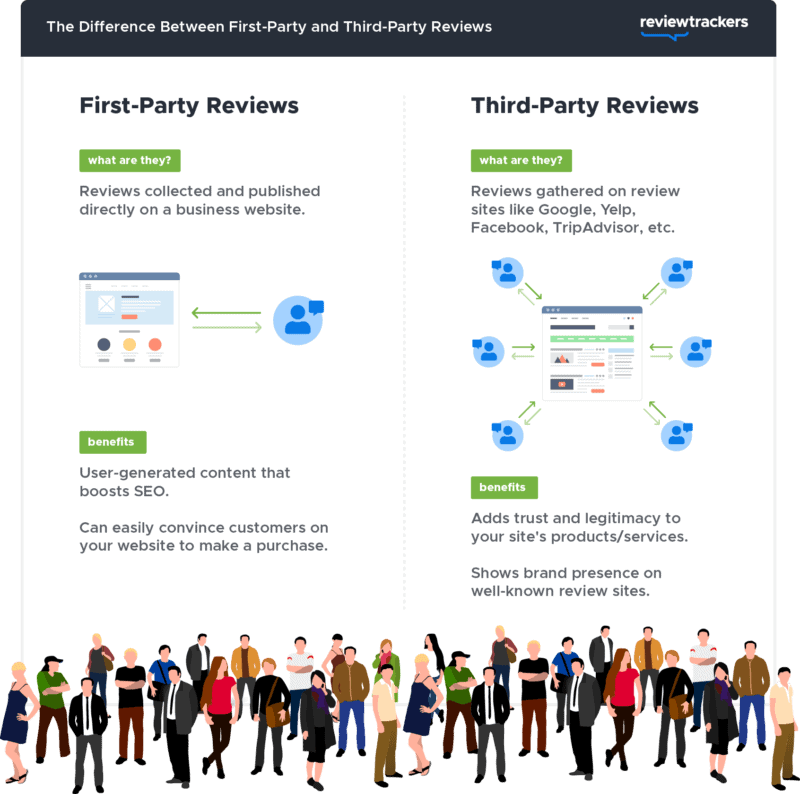

A Guide to Adapting Your Business For Uncertain Times - ReviewTrackers