What Does Full Coverage Auto Insurance Cover

What Does Full Coverage Auto Insurance Cover?

What Are the Basics of Full Coverage Auto Insurance?

Full coverage auto insurance is a term that is often used by car insurance companies and agents to describe a policy that has more than the minimum required by law. It usually includes liability coverage, collision coverage, comprehensive coverage, and other optional coverage.

Liability coverage is the most basic type of coverage and is required by law in most states. It covers the costs of damages to other people’s property and medical expenses if you are at fault in an accident. The costs can be paid out up to a certain limit, which is specified in the policy.

What Does Collision Coverage Cover?

Collision coverage is an optional type of coverage that pays for the repairs or replacement of your vehicle if you are in an accident. If you are at fault, collision coverage will pay for repairs to your vehicle up to the limits of your policy. If the other driver is at fault, their liability coverage will pay for repairs to your vehicle.

What Does Comprehensive Coverage Cover?

Comprehensive coverage is another optional type of coverage that pays for damages to your vehicle that were not caused by an accident. This includes damages from theft, vandalism, fire, hail, or other natural disasters. The cost of repairs is covered up to the limits of your policy.

What Other Types of Coverage Are Available?

There are other types of coverage available with full coverage auto insurance. These include medical payments coverage, which pays for medical expenses for the driver and passengers if injured in an accident. Uninsured/underinsured motorist coverage pays for damages caused by an uninsured or underinsured driver. There is also rental reimbursement coverage, which pays for a rental car if your car is damaged in an accident or stolen.

How Much Does Full Coverage Auto Insurance Cost?

The cost of full coverage auto insurance is based on many factors, including the type of car you drive, the age of the driver, the driving history, the location, and the type and amount of coverage you choose. Generally, full coverage auto insurance costs more than basic liability coverage, but it also provides more protection.

Should I Get Full Coverage Auto Insurance?

Whether or not you should get full coverage auto insurance depends on your individual situation. If you own a newer car or if you are at risk for being in an accident, then it may be a good idea to get full coverage auto insurance. However, if you have an older car, then it may not be worth it. Talk to your insurance agent to decide what type of coverage is best for you.

Auto / Car Insurance - Downey CA & Los Angeles CA - The Point Insurance

carinsurancecostokgs711

PPT - Full coverage car insurance in California PowerPoint Presentation

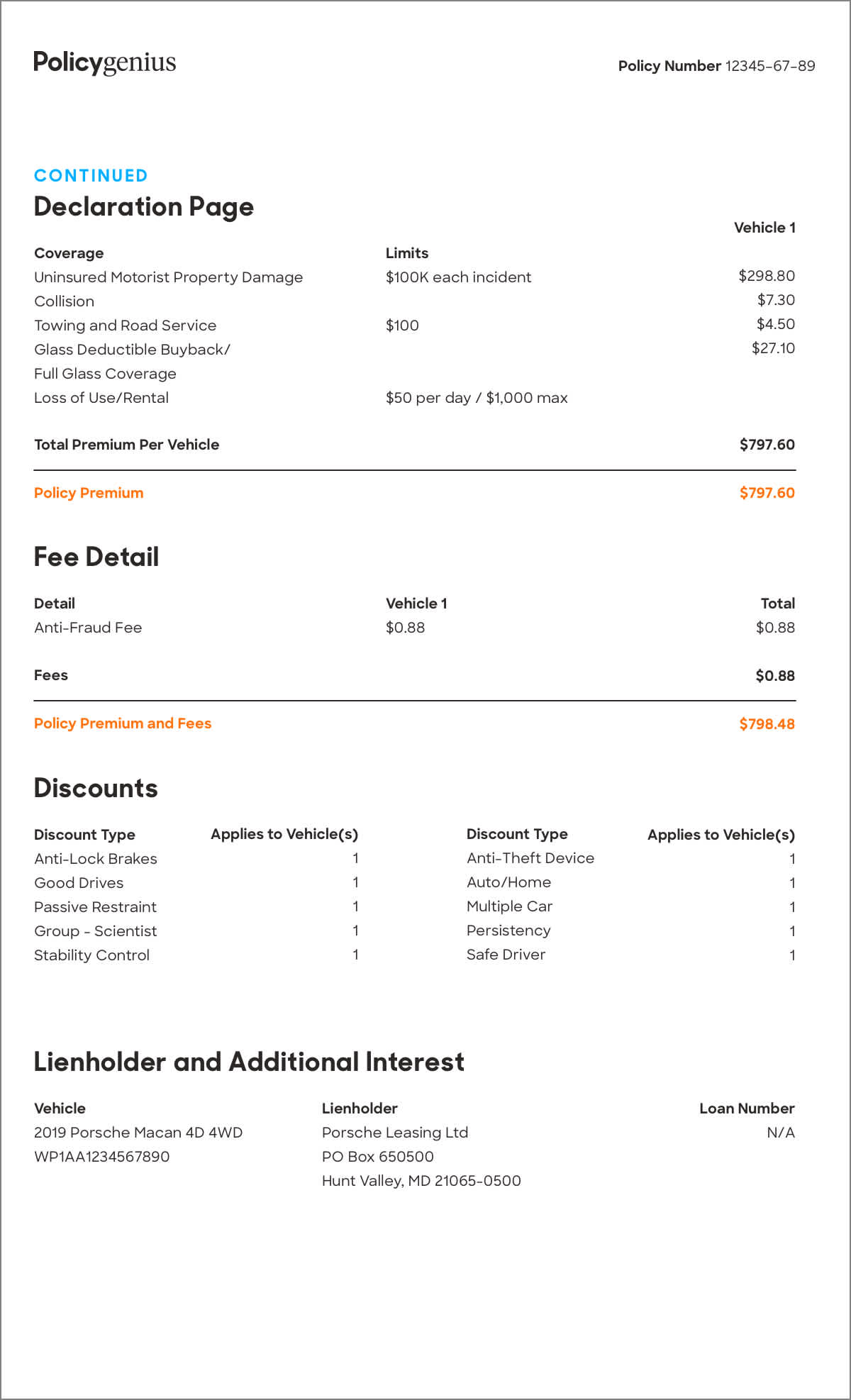

Understanding Your Car Insurance Declarations Page - Policygenius

Find The Best Full Coverage Car Insurance – Forbes Advisor