Renters And Car Insurance Bundle

Renters And Car Insurance Bundle: All You Need To Know

What is Renters and Car Insurance Bundle?

Renters and car insurance bundle is a combination of two different types of insurance policies that are related to a person’s personal property and vehicle. This bundle includes renters insurance, which provides coverage for a person’s possessions if they are stolen or damaged in an accident, and car insurance, which provides coverage for a person’s vehicle if it is damaged in an accident. By bundling together both renters insurance and car insurance, a person can save money on their insurance premiums, as well as have one company to deal with when it comes to filing a claim.

What Does Renters Insurance Cover?

Renters insurance covers a person’s personal property, such as furniture, electronics, clothing, and other items, in the event that they are stolen or damaged in an accident. This type of insurance also covers a person’s liability in the event that someone is injured on their property, such as if a guest slips on a wet floor or is injured in some other way. Renters insurance also covers a person’s additional living expenses if they are forced to move out of their rental unit due to an accident or natural disaster.

What Does Car Insurance Cover?

Car insurance covers a person’s vehicle in the event that it is damaged in an accident. This type of insurance covers the cost of repairs to the car, as well as any medical bills that may be incurred as a result of the accident. Car insurance also provides coverage for other drivers who may be injured in the accident, and for any property that may be damaged in the accident. Additionally, car insurance may provide coverage for a person’s legal fees if they are sued as a result of an accident.

What Are the Benefits of Renters and Car Insurance Bundle?

The main benefit of a renters and car insurance bundle is that it allows a person to save money on their insurance premiums. By bundling their renters insurance and car insurance together, a person can often get a discount on their premiums. Additionally, having both renters and car insurance bundled together means that a person only has to deal with one insurance company when it comes to filing a claim. This can make the process of filing a claim much easier and less stressful.

Who Should Consider Getting a Renters and Car Insurance Bundle?

Anyone who owns a car and rents a home should consider getting a renters and car insurance bundle. This type of bundle is especially beneficial for people who are on a tight budget and are looking for ways to save money on their insurance premiums. Additionally, it is important for people to make sure that they have adequate coverage to protect their possessions and vehicles in the event of a disaster or accident. By bundling their renters insurance and car insurance together, a person can make sure that they have the coverage they need.

Conclusion

A renters and car insurance bundle is a great way for people to save money on their insurance premiums while also making sure that they have the adequate coverage they need to protect their property and vehicles. By bundling both renters insurance and car insurance together, a person can save money on their premiums and only have to deal with one company when it comes to filing a claim. Anyone who owns a car and rents a home should consider getting a renters and car insurance bundle.

Auto + Home Insurance Bundles - Frisco TX | JGS Advisors

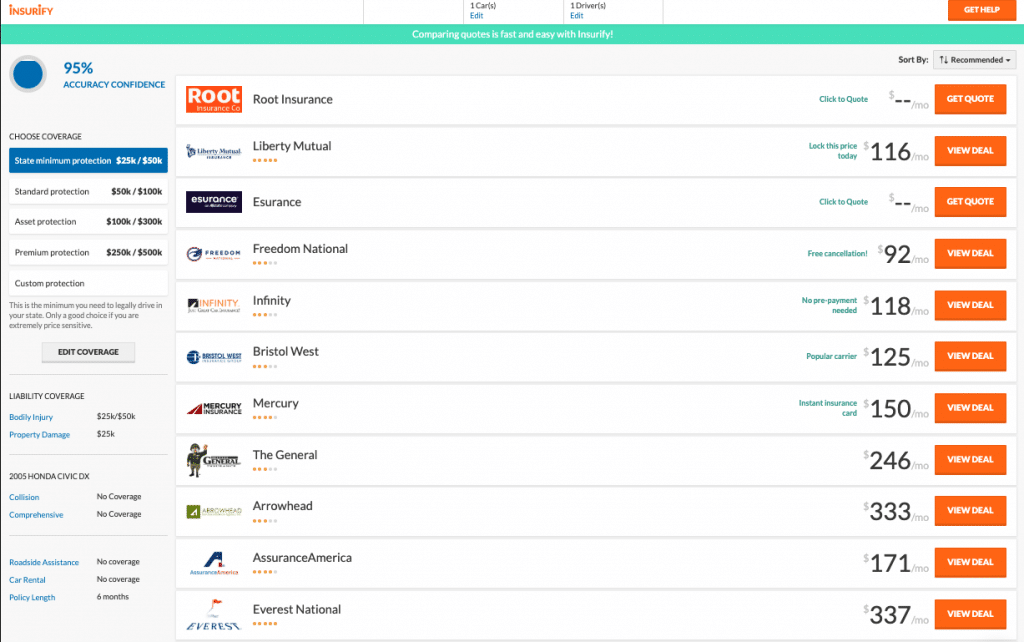

Car and Renters Insurance Bundle Quotes: 2021 Discounts, Comparison

12+ Progressive Renters Insurance Quote - Best Day Quotes

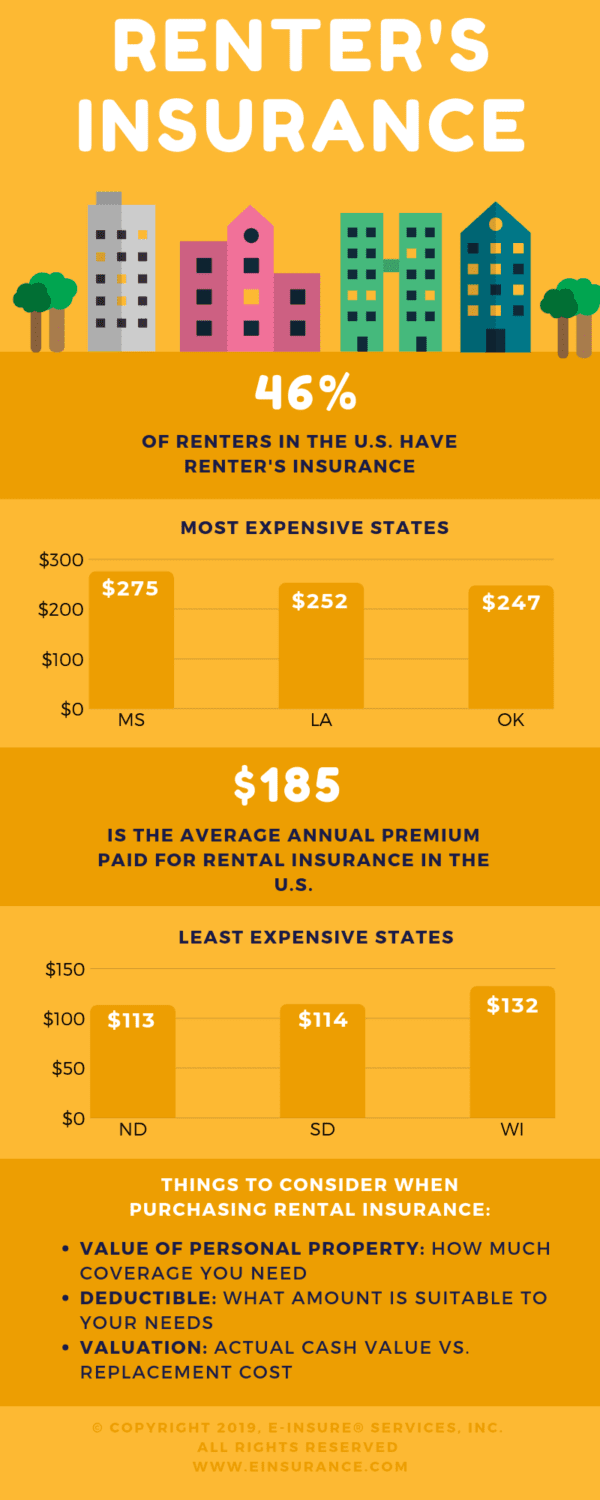

Renters Insurance Quotes Compare | EINSURANCE

Renter’s Insurance: Why Your Tenant Needs It - Pro Realty