Maryland State Car Insurance Minimums

Maryland State Car Insurance Minimums

What Are the Car Insurance Requirements in Maryland?

If you are driving a car in Maryland, you must have car insurance. Depending on the type of vehicle you own, the state of Maryland requires you to have a minimum amount of insurance coverage. This includes coverage for bodily injury, property damage, and uninsured motorist coverage. Liability insurance is required in order to legally drive in the state, and it can help you protect yourself and your assets in the event of an accident.

What Are the Liability Insurance Requirements in Maryland?

In Maryland, you must have a minimum of $30,000 in bodily injury coverage per person, with a maximum of $60,000 per accident. You must also have at least $15,000 in property damage coverage. This coverage is designed to help pay for the costs of repairing or replacing a damaged vehicle. Additionally, you must have $30,000 in uninsured motorist coverage in the event that you are in an accident with an uninsured driver.

What Are the Optional Types of Car Insurance Coverage in Maryland?

In addition to the required liability coverage, there are also several optional types of car insurance coverage in Maryland. These include comprehensive coverage, which pays for damage to your car in the event of a non-accident, such as a fire or theft. Collision coverage pays for repairs in the event of an accident, regardless of who is at fault. Other optional coverage includes rental car reimbursement, towing and labor coverage, and medical payments coverage.

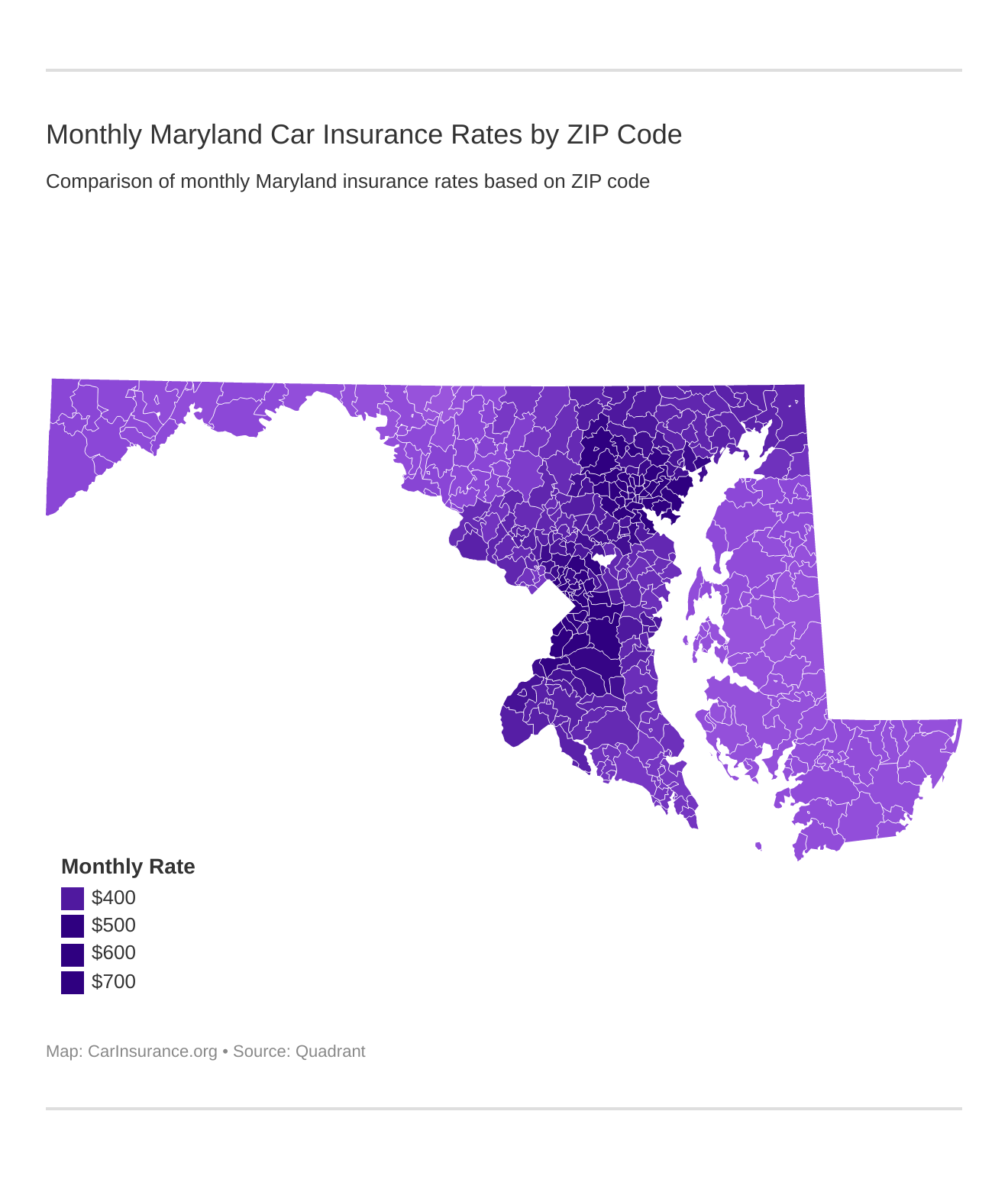

What Is the Cost of Car Insurance in Maryland?

The cost of car insurance in Maryland varies depending on several factors, such as your driving record, the type of vehicle you drive, and the amount of coverage you choose. Generally speaking, younger drivers and drivers with a history of accidents can expect to pay higher premiums. It is important to shop around and compare rates from different insurance companies in order to find the best deal.

What Are the Penalties for Driving Without Insurance in Maryland?

Driving without insurance in Maryland is a serious offense. If you are caught without insurance, you could face a fine of up to $1,000 and up to one year in jail. Additionally, your driver’s license could be suspended for up to three months. If you are involved in an accident without insurance, you could be held personally liable for any damages caused.

Conclusion

Driving without insurance can lead to serious consequences in Maryland. Therefore, it is important to make sure that you have the required minimum amount of insurance coverage in order to legally drive in the state. Additionally, you may want to consider purchasing optional coverage in order to protect yourself and your vehicle in the event of an accident. By shopping around and comparing rates, you can find an affordable insurance policy that meets your needs.

Cheap Car Insurance in Maryland 2019

Average Monthly Car Insurance Maryland - blog.pricespin.net

Car Insurance Quotes Maryland - ShortQuotes.cc

Maryland Car Insurance (Rates + Companies) – CarInsurance.org

The 9-Minute Rule for What Does Full Coverage Ca | carinsurancecosthrha045