How Much Is State Minimum Car Insurance

How Much Is State Minimum Car Insurance?

When it comes to auto insurance, it’s important to make sure you are always covered and that you know how much coverage you need. Depending on where you live, the state you are in may require a certain minimum amount of auto insurance coverage. But how much is state minimum car insurance?

What Is The State Minimum Car Insurance?

State minimum car insurance is the minimum amount of auto insurance that your state requires you to have in order to legally drive. This is usually a basic liability insurance policy that takes care of the cost of damages to another person’s property or medical expenses if you are found at fault for an accident. Different states have different requirements, so it’s important to check your local laws to make sure you are in compliance.

What Does State Minimum Insurance Cover?

State minimum car insurance will cover the cost of damages to another person’s property or medical expenses in the event of an accident. It is important to note that state minimum insurance does not cover damages to your own vehicle, or any of your own medical expenses. You may want to consider additional coverage if you wish to protect your own vehicle and health.

How Much Is State Minimum Car Insurance?

The cost of state minimum car insurance can vary depending on your state and the type of vehicle you drive. Generally, minimum liability coverage starts at around $25,000 per person, with $50,000 for all persons involved in an accident and $25,000 for property damage. However, these limits can vary from state to state, so it’s important to check with your local insurance provider for the exact coverage limits in your area.

Do I Need More Than State Minimum Car Insurance?

While state minimum car insurance will provide you with the coverage you need to legally drive, it is important to keep in mind that this coverage may not be enough to cover all of the damages in the event of an accident. If you own a more expensive vehicle, or if you want to make sure you are covered if you are found at fault in an accident, you may want to consider additional coverage. Additional coverage options include comprehensive, collision, and uninsured motorist coverage.

Where Can I Find The Best Rates?

The best way to find the best rates for state minimum car insurance is to shop around. Compare different quotes from different insurance providers to make sure you are getting the best deal. You can also look for discounts and take advantage of any offers that your insurance provider may have. Additionally, make sure to keep your driving record clean and your credit score high to get the best rates.

A Guide to the BEST 9 Car Insurance Hacks No One Talks About | Cheap

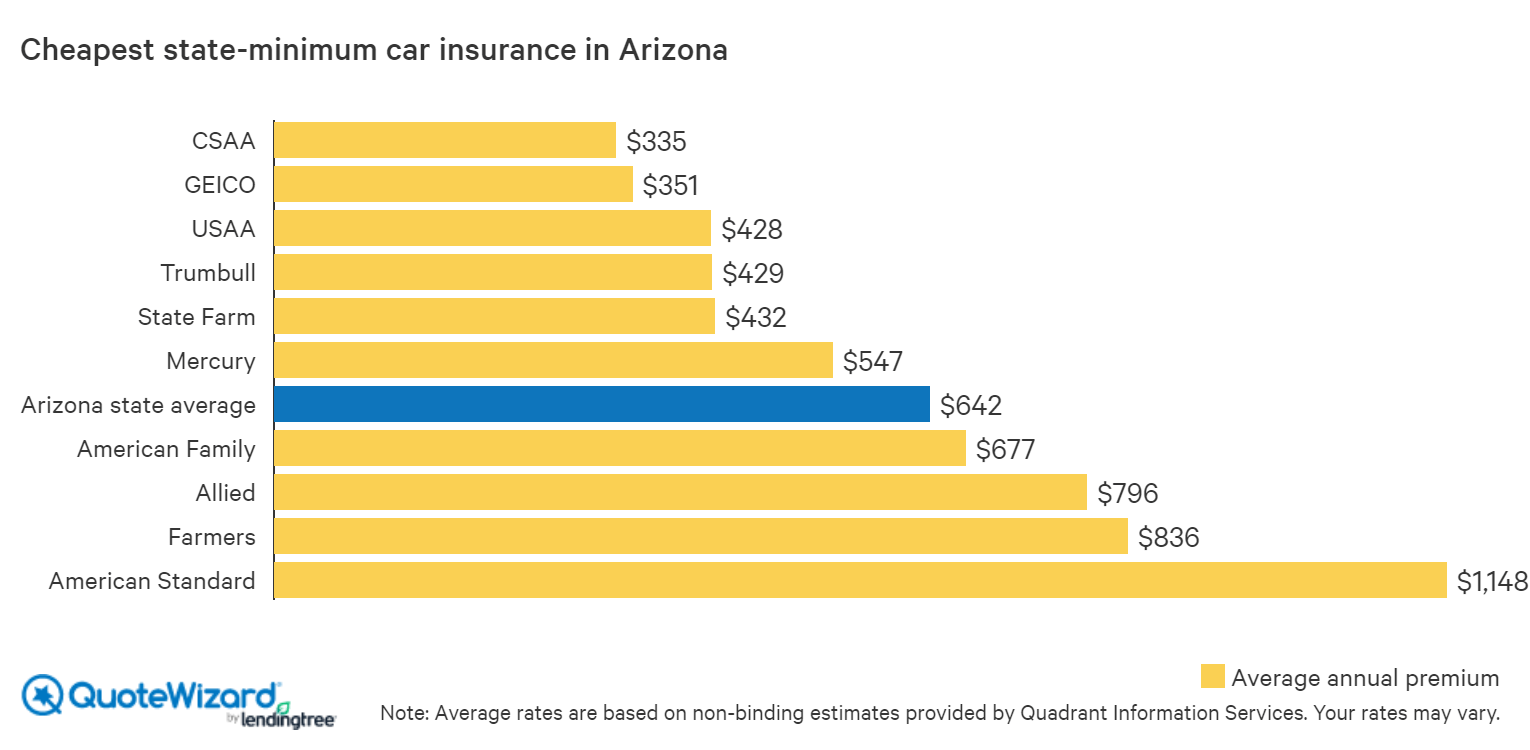

Cheap Car Insurance in Arizona | QuoteWizard

Famous What Is The Minimum Auto Insurance Coverage In New Jersey 2022

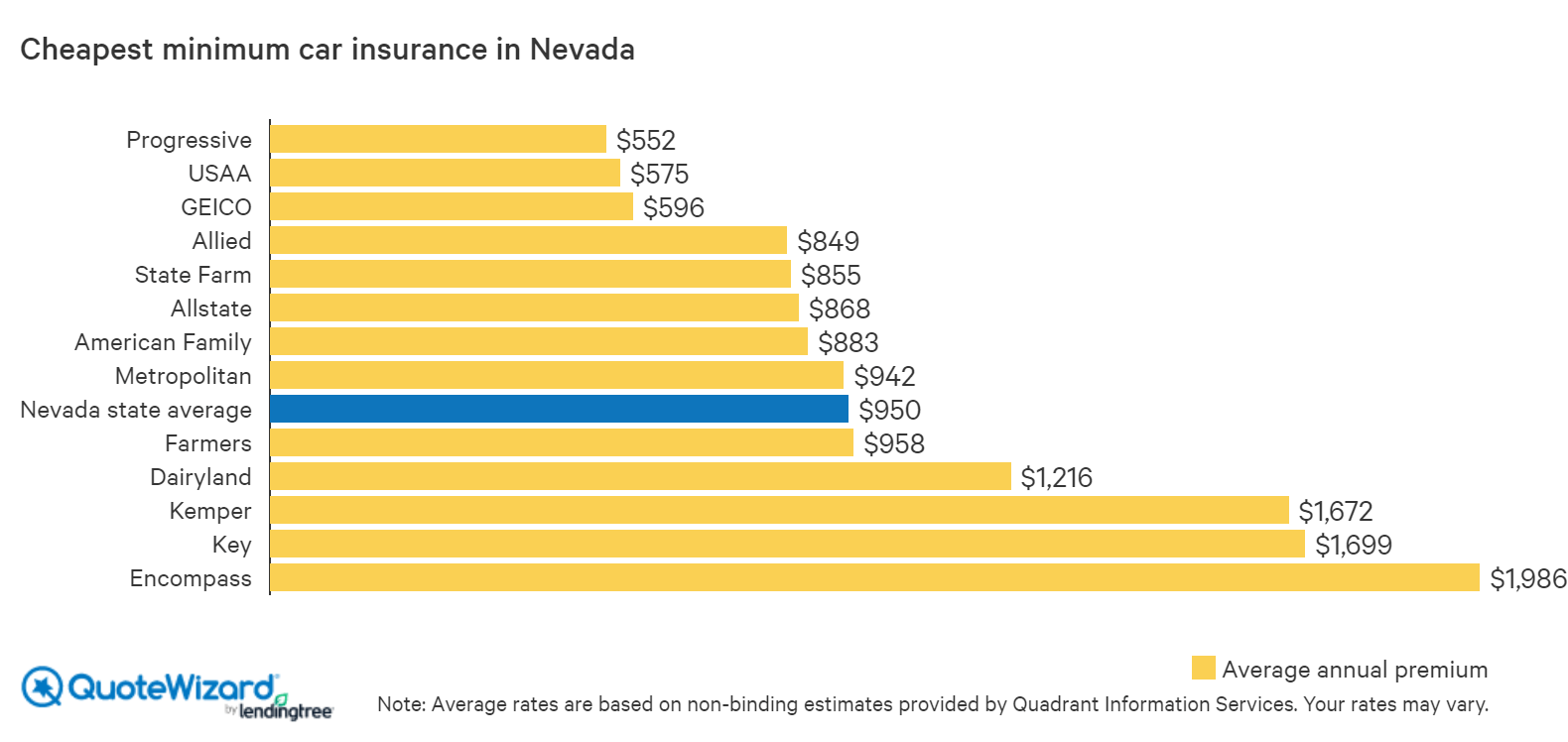

Where to Buy Cheap Nevada Car Insurance | QuoteWizard

Understanding the Minimum Car Insurance Requirements by State - Quote