Hired Non Owned Auto Insurance Cost

Saturday, December 13, 2025

Edit

Insuring a Non-Owned Vehicle: What You Need to Know About Hired Non-Owned Auto Insurance Cost

What is a Non-Owned Vehicle?

A non-owned vehicle is any vehicle that is not owned, leased, or otherwise operated by a business or individual. This includes vehicles rented or leased from a third party, such as a rental car company or a car-sharing service. Non-owned vehicles are often used for business purposes, such as making deliveries, transporting employees, or running errands. It is important to understand the risks associated with non-owned vehicles and the insurance coverage that is required to protect your business and its employees.

What is Hired Non-Owned Auto Insurance?

Hired non-owned auto insurance is a type of liability insurance that covers damages caused by a non-owned vehicle. This type of insurance is typically required when a business or individual leases or rents a vehicle for business purposes. It can also be used to provide coverage for employees who use their own vehicles for business-related activities. Hired non-owned auto insurance provides financial protection for the business in the event of an accident involving the leased or rented vehicle, as well as any vehicles owned by the business or its employees.

What Does Hired Non-Owned Auto Insurance Cover?

Hired non-owned auto insurance typically provides coverage for property damage and bodily injury to third parties, as well as medical payments for the driver and passengers of the non-owned vehicle. This type of insurance may also provide coverage for defense costs and legal fees. It is important to understand the specific coverage limits and exclusions of your policy, as well as the state laws that may apply.

What Factors Affect the Cost of Hired Non-Owned Auto Insurance?

The cost of hired non-owned auto insurance will vary depending on several factors, including the type of vehicle being rented or leased, the driver's age and driving record, the type of coverage needed, and the deductible. Businesses and individuals should also consider the risks associated with the vehicle, such as its age and condition, as well as the likelihood of the vehicle being involved in an accident.

How Can I Lower the Cost of Hired Non-Owned Auto Insurance?

Businesses and individuals can lower their insurance costs by shopping around for the best policy. Comparing quotes from different insurance companies is a good way to find the coverage that best meets your needs at the lowest cost. Additionally, businesses can lower their costs by taking steps to reduce the risk of an accident, such as providing driver safety training to employees, regularly inspecting and maintaining vehicles, and implementing policies that discourage distracted driving and other unsafe behaviors.

Conclusion

Hired non-owned auto insurance is an important type of liability insurance that provides financial protection for businesses and individuals who lease or rent vehicles for business purposes. It is important to understand the risks associated with non-owned vehicles and the costs of the insurance coverage required to protect your business and its employees. By shopping around and taking steps to reduce the risk of an accident, businesses and individuals can lower the cost of hired non-owned auto insurance.

How Much Does Legal Malpractice Insurance Cost? | Commercial Insurance

Hired & Non-Owned Auto Insurance | Insurance in 60 seconds - YouTube

Non Owned Auto Insurance: Business's Safety Net - Agency Height

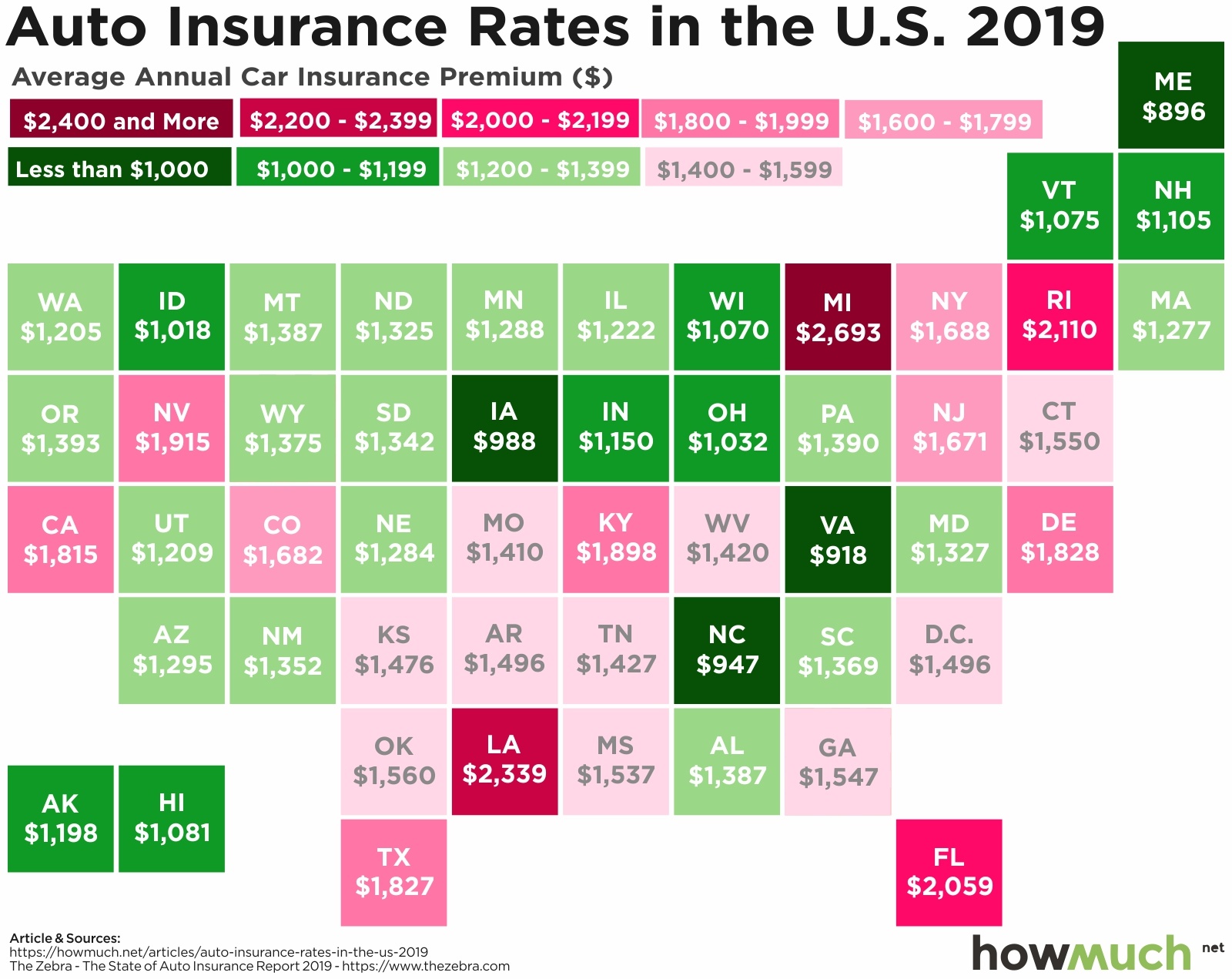

What do Americans Pay for Car Insurance in 2019? – Investment Watch

What Is Non-Owner Car Insurance and Do You Need It? | RamseySolutions.com