Hired And Non Owned Auto Coverage Form

Understand Hired and Non Owned Auto Coverage Form

What is Hired and Non Owned Auto Coverage Form?

Hired and Non Owned Auto Coverage Form is a type of insurance policy that provides coverage for vehicles that a company uses but do not own, such as rental cars, vehicles leased from another company or vehicles used by employees for business purposes. This type of policy may also provide coverage for accidents and damages that are caused by employees, who are driving their own vehicles for business purposes. Hired and Non Owned Auto Coverage Form is also known as a Business Auto Liability policy.

What Does Hired and Non Owned Auto Coverage Offer?

Hired and Non Owned Auto Coverage Form will provide coverage for any physical damage or loss to property or vehicles owned by the company, as well as any bodily injury or death to other people who are involved in an accident caused by the company or its employees. The policy will also provide coverage for any legal costs associated with defending the company against a lawsuit, as well as any judgments or settlements that arise from the lawsuit. In addition, the policy will provide coverage for any medical costs associated with the accident.

What Are the Benefits of Hired and Non Owned Auto Insurance?

Having Hired and Non Owned Auto Coverage Form in place can be beneficial for any company that uses vehicles for business purposes. It provides protection against any potential losses that might occur due to an accident or other incident. It also provides coverage for legal costs, medical costs and any other costs associated with the accident. Additionally, the policy can provide peace of mind, knowing that the company is protected in the event of an incident.

What Types of Companies Should Consider Hired and Non Owned Auto Insurance?

Any company that uses vehicles for business purposes should consider Hired and Non Owned Auto Coverage Form. This includes companies that lease or rent vehicles, companies that provide employees with vehicles for business use, companies that use employee-owned vehicles for business purposes and companies that use vehicles for deliveries. Additionally, companies that use employees for courier services or to provide transportation services should consider this type of coverage.

How Do I Purchase Hired and Non Owned Auto Coverage?

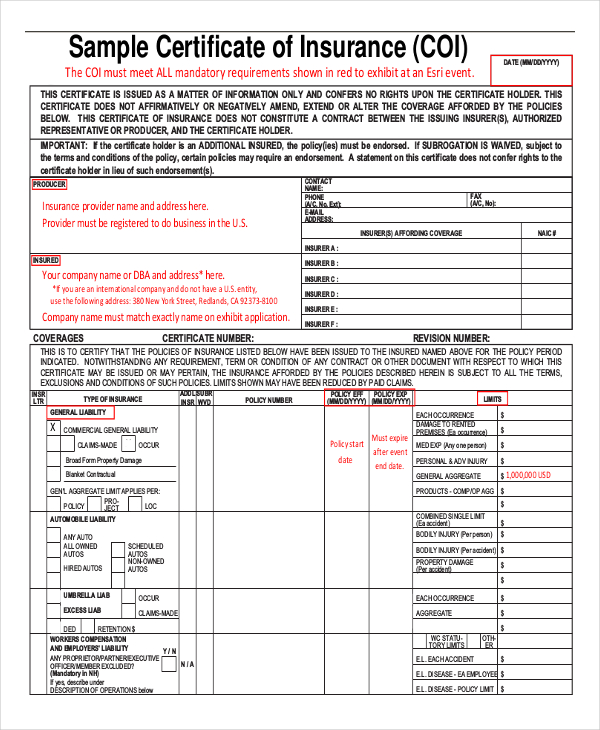

The best way to purchase Hired and Non Owned Auto Coverage Form is to contact a reputable insurance provider. An insurance provider will be able to provide a quote for the coverage and provide information about the policy's terms and conditions. Additionally, the insurance provider will be able to answer any questions that you might have about the policy and its coverage.

Conclusion

Hired and Non Owned Auto Coverage Form is an important policy for any company that uses vehicles for business purposes. It provides protection against any potential losses that might occur due to an accident or other incident. Additionally, the policy can provide peace of mind, knowing that the company is protected in the event of an incident. To purchase Hired and Non Owned Auto Coverage Form, it is important to contact a reputable insurance provider. They will be able to provide a quote for the coverage and provide information about the policy's terms and conditions.

Simply-Easier-ACORD-Forms: Instructions ACORD 137CA California Business

car insurance policy templates The Reasons Why We Love Car - bybloggers.net

COMMERCIAL AUTO BROADENING ENDORSEMENT: Fill out & sign online | DocHub

Hired & Non-Owned Auto Insurance | Insurance in 60 seconds - YouTube

Fill - Free fillable RT Specialty PDF forms