Cheap Liability Car Insurance Alabama

Cheap Liability Car Insurance Alabama: Get Coverage for Less

What is Liability Car Insurance?

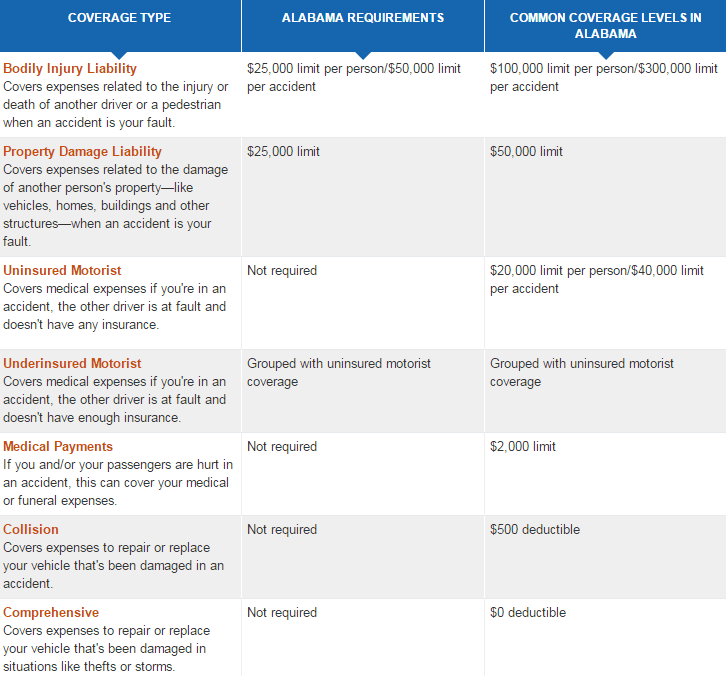

Liability car insurance is a type of car insurance coverage that is designed to protect you from financial losses that are caused by injuries or damages that you are held responsible for. Liability insurance is an important type of coverage to have since it can help protect you from paying out of pocket for these damages. In Alabama, liability car insurance is mandated by law. You must purchase at least the minimum amount of liability coverage in order to legally operate a car in the state.

What are the Requirements for Liability Car Insurance in Alabama?

In Alabama, drivers are required to purchase the following minimum amounts of liability car insurance: $25,000 for bodily injury or death of one person, $50,000 for total bodily injury or death of two or more persons, and $25,000 for property damage. These are the absolute minimum amounts of coverage that you must have in order to legally operate a car in the state.

How Can I Get Cheap Liability Car Insurance in Alabama?

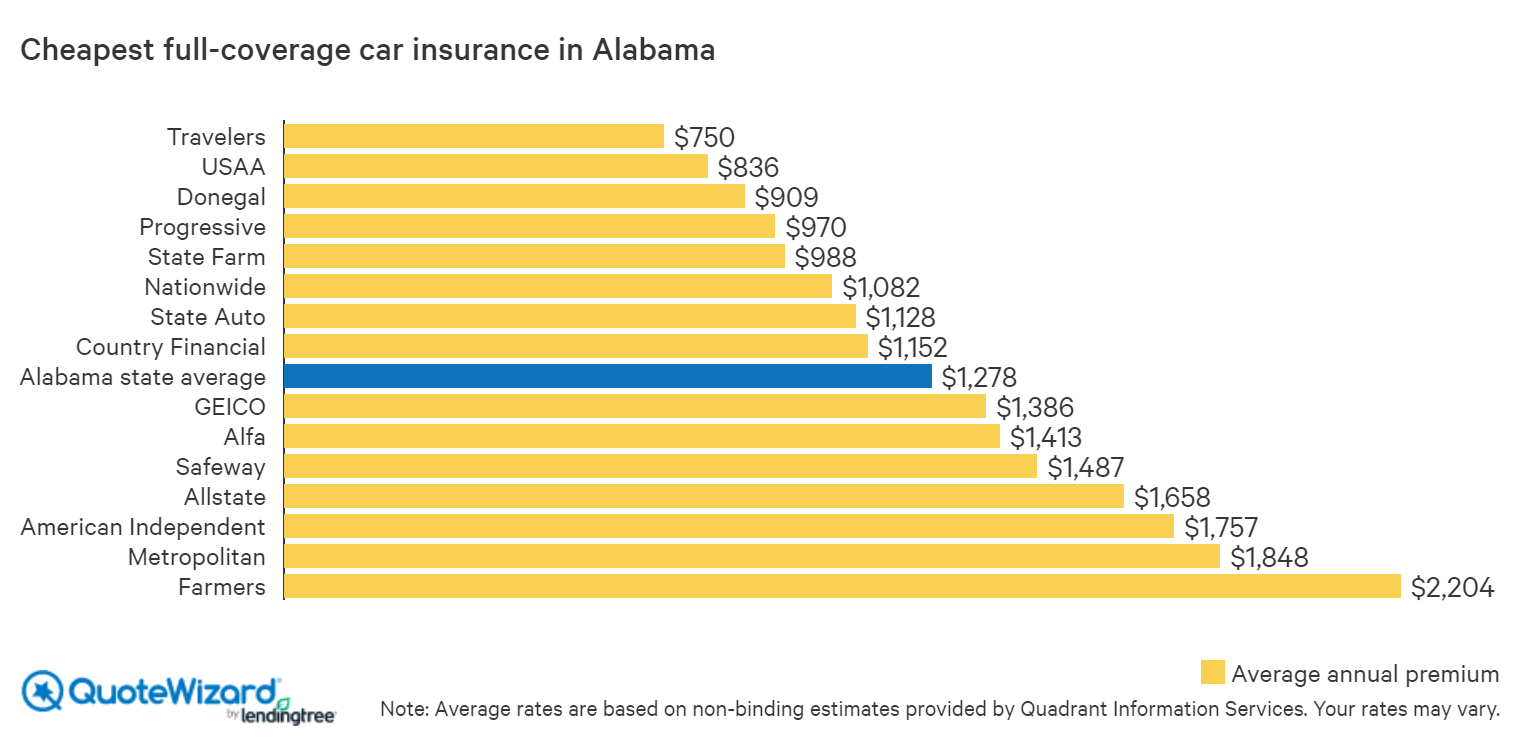

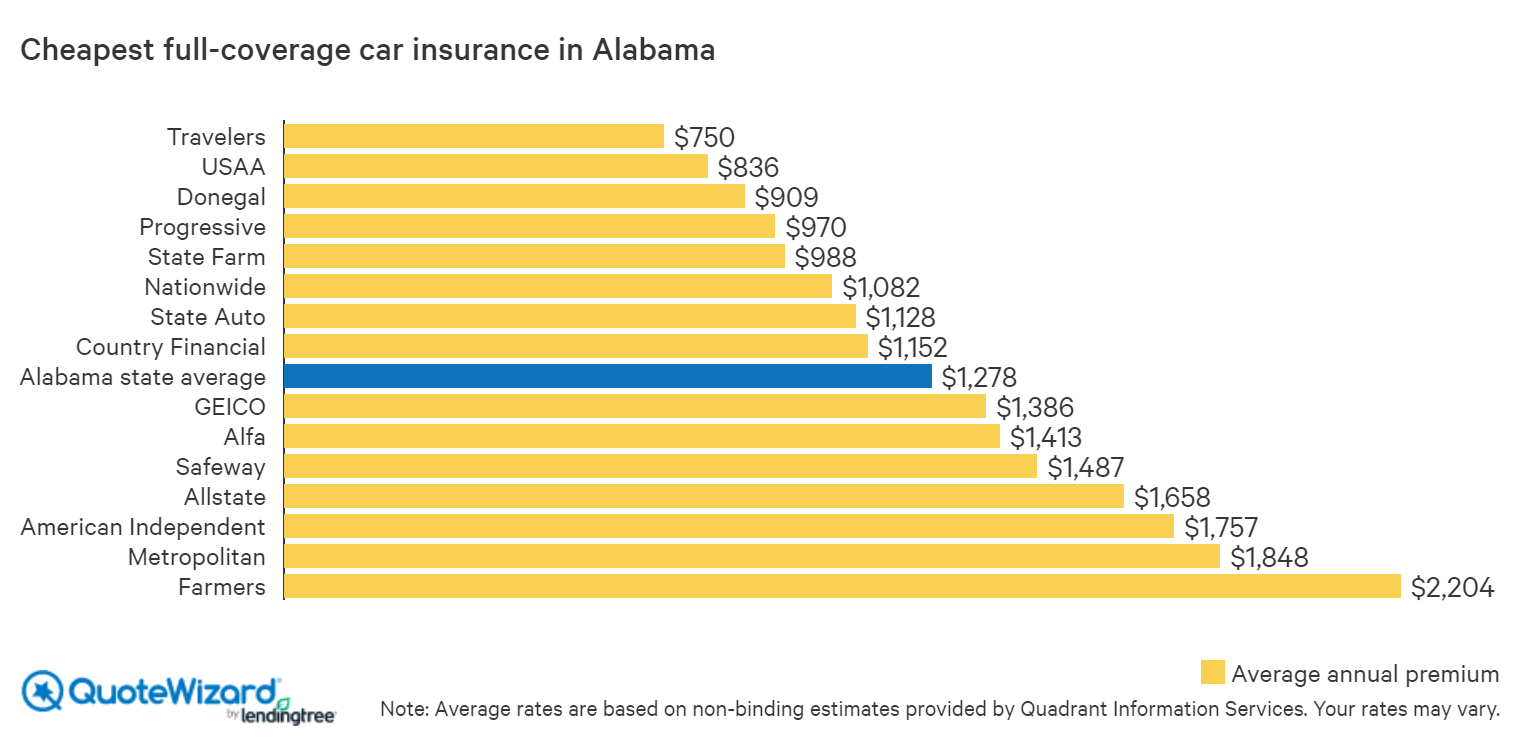

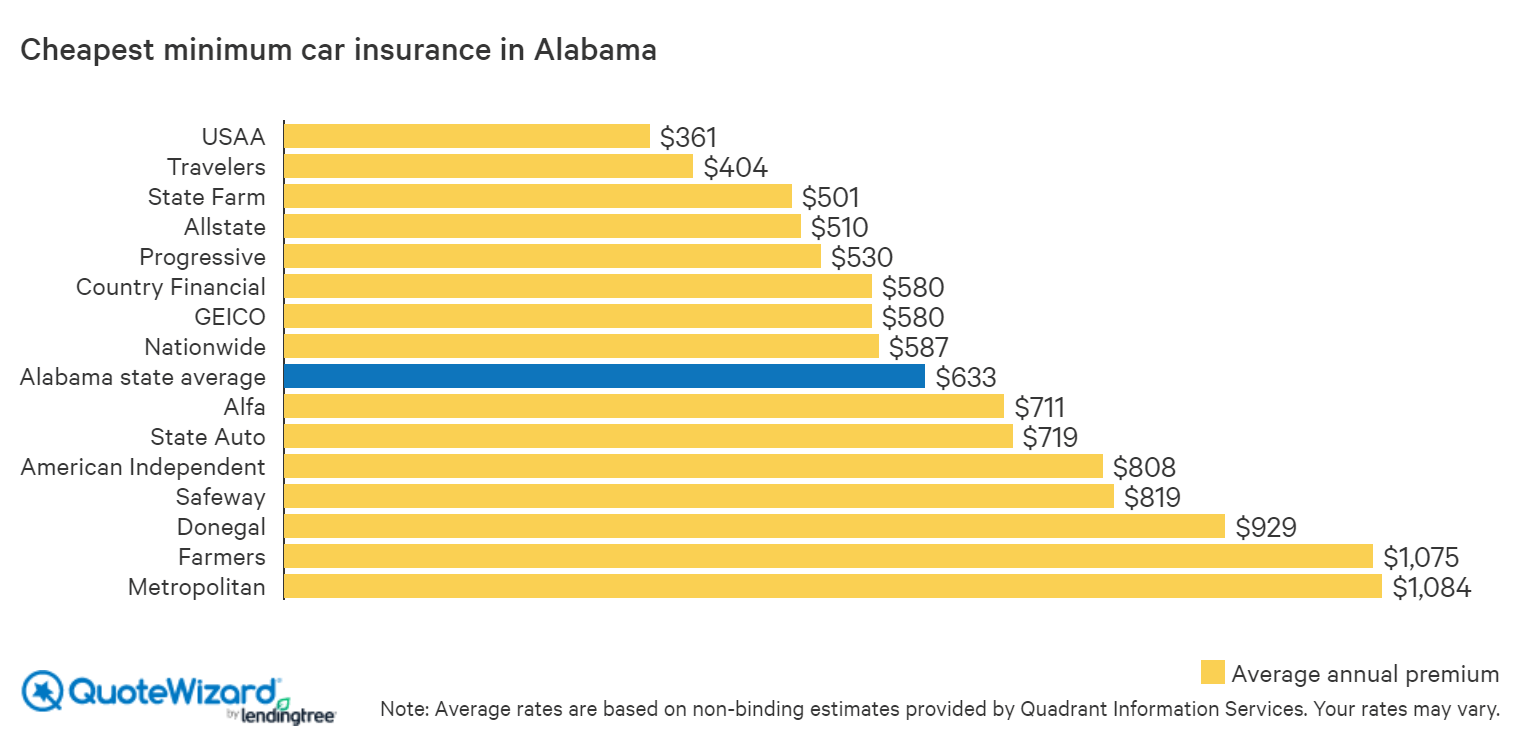

If you are looking for cheap liability car insurance in Alabama, there are a few things you can do. First, shop around. There are a variety of different insurers that offer car insurance in the state, so it pays to shop around and compare rates. You can also look for discounts. Many insurers offer discounts for things like having a clean driving record, having multiple vehicles insured with the same company, or taking a defensive driving course. Finally, consider raising your deductible. By raising your deductible, you can lower your overall premium.

What Other Types of Car Insurance Should I Consider?

In addition to liability insurance, there are a variety of other types of car insurance that you should consider when purchasing coverage. Collision and comprehensive coverage are two of the most common types of car insurance that drivers purchase. Collision coverage helps to cover the cost of repairs or replacements to your vehicle if it is damaged in an accident, while comprehensive coverage helps to cover the cost of repairs or replacements to your vehicle if it is damaged or stolen in a non-accident situation. Both types of coverage can help protect you financially in the event of an accident or other unexpected event.

How Can I Get Started?

If you are looking for cheap liability car insurance in Alabama, the best place to start is by shopping around and comparing rates. You can do this online or by talking to a local insurance agent. Make sure to ask about any discounts that may be available, and consider raising your deductible to get the lowest possible rate. Once you have found the right coverage for you, make sure to read your policy carefully and understand the terms and conditions. This will help ensure that you are fully protected in the event of an accident or other unforeseen event.

Find Cheap Car Insurance in Alabama | QuoteWizard

Find Cheap Car Insurance in Alabama | QuoteWizard

car insurance - cheap auto insurance in alabama - Top 10 best insurance

djbordnerdesign: Automobile Insurance Alabama

Cheap Car Insurance in Alabama 2019