Cars With Lowest Insurance Group Uk

Friday, December 19, 2025

Edit

Cars with Lowest Insurance Group UK

What is an Insurance Group?

When it comes to insuring a car, the cost of the insurance depends largely on the car’s insurance group. Insurance groups are assigned to vehicles based on their characteristics, such as age, engine size, cost of repairs, security features and more. The higher the insurance group, the more expensive the insurance will be.

In the UK, insurance groups range from 1 to 50, with 1 being the lowest and cheapest to insure and 50 being the highest and most expensive to insure. Knowing which cars are in the lowest insurance groups can help drivers save money on their car insurance premiums.

Best Cars for Low Insurance Groups

The cars with the lowest insurance groups are usually small, older cars with smaller engines. Such cars are typically cheaper to repair and have fewer features, which make them cheaper to insure. Examples of cars which are in the lowest insurance groups include the Ford Ka, Fiat Panda, Volkswagen Up!, and Renault Twingo. Additionally, electric cars tend to be in lower insurance groups than petrol or diesel cars, as they are considered safer vehicles.

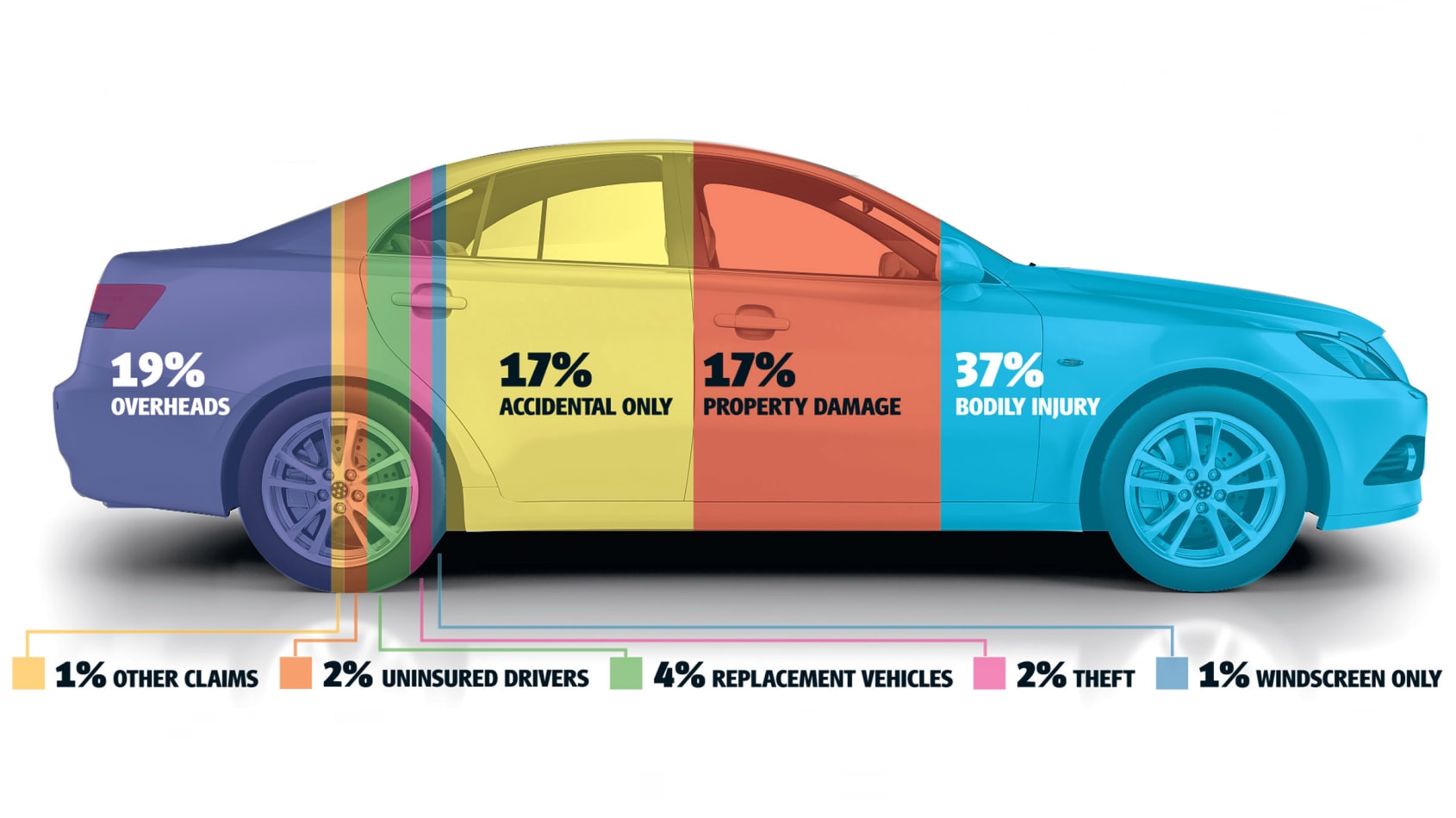

Factors which Affect Car Insurance Groups

When a car is assigned an insurance group, several factors are taken into consideration. These include the car’s security features, such as immobilisers and alarms, as well as the car’s age and engine size. The car’s repair costs are also taken into account, as well as its performance data. The car’s value is also a factor, as more expensive cars are more attractive to thieves.

Benefits of Low Insurance Groups

Lower insurance groups provide drivers with the advantage of cheaper insurance premiums. This can make a difference when it comes to deciding which car to purchase. Lower insurance groups can also make it easier to purchase insurance, as drivers in certain insurance groups may not be able to get a policy at all.

Tips for Lowering Insurance Costs

In addition to choosing a car with a lower insurance group, there are other ways to reduce the cost of car insurance. One way is to install extra security features, such as immobilisers, alarms, and tracking systems. Such features can help to reduce the cost of insurance. Drivers can also increase the excess they are willing to pay, or opt for a black box policy to reduce their premiums.

Conclusion

Choosing a car with a lower insurance group can help drivers to save money on car insurance premiums. Lower insurance groups are usually assigned to smaller, older cars with smaller engines. Other factors which affect insurance groups include the car’s security features, repair costs, performance data, and value. Additionally, drivers can install extra security features, increase the excess they are willing to pay, or opt for a black box policy in order to reduce their insurance premiums.

Top 10: Lowest Insurance Group Petrol Cars | | Honest John

Top 10: Lowest Insurance Group Convertible Cars | | Honest John

Top 10: Lowest Insurance Group Family Cars | | Honest John

Why is your car insurance premium so high? | Auto Express

car insurance - YouTube