Can You Be On More Than One Car Insurance Policy

Wednesday, December 3, 2025

Edit

Can You Be On More Than One Car Insurance Policy?

What Are The Benefits Of Being On More Than One Car Insurance Policy?

Having more than one car insurance policy can be beneficial in many different ways. First, if you have multiple vehicles, you may be able to save money by having a single policy that covers all of them. This can make the process of filing a claim much simpler, as you won’t have to worry about filing separate claims for each vehicle. Additionally, having multiple policies can make it easier to keep track of your coverage, as you can ensure that all of your vehicles are covered by a single insurer.

Another benefit of having multiple policies is that it can provide you with greater flexibility when it comes to choosing coverage. For example, if you’re a higher-risk driver, you may be able to find a policy that offers more coverage than a single policy could provide. Additionally, you may be able to mix and match different coverage options, allowing you to customize your policy to meet your specific needs.

What Are The Drawbacks Of Having Multiple Policies?

Having multiple car insurance policies can come with a few drawbacks as well. For one, it can be more expensive to have multiple policies than a single policy. This is because insurers often charge a higher rate for multiple policies than they do for a single policy. Additionally, if you have multiple policies, you may have to pay more in fees when you make a claim, as you’ll have to pay a fee for each policy.

Another potential downside of having multiple policies is that it can be more difficult to keep track of your coverage. This is because you’ll have to manage multiple policies, which can be time-consuming and confusing. You’ll also have to remember to pay multiple premiums each month, which can be difficult to manage.

What Are The Rules And Regulations Surrounding Multiple Policies?

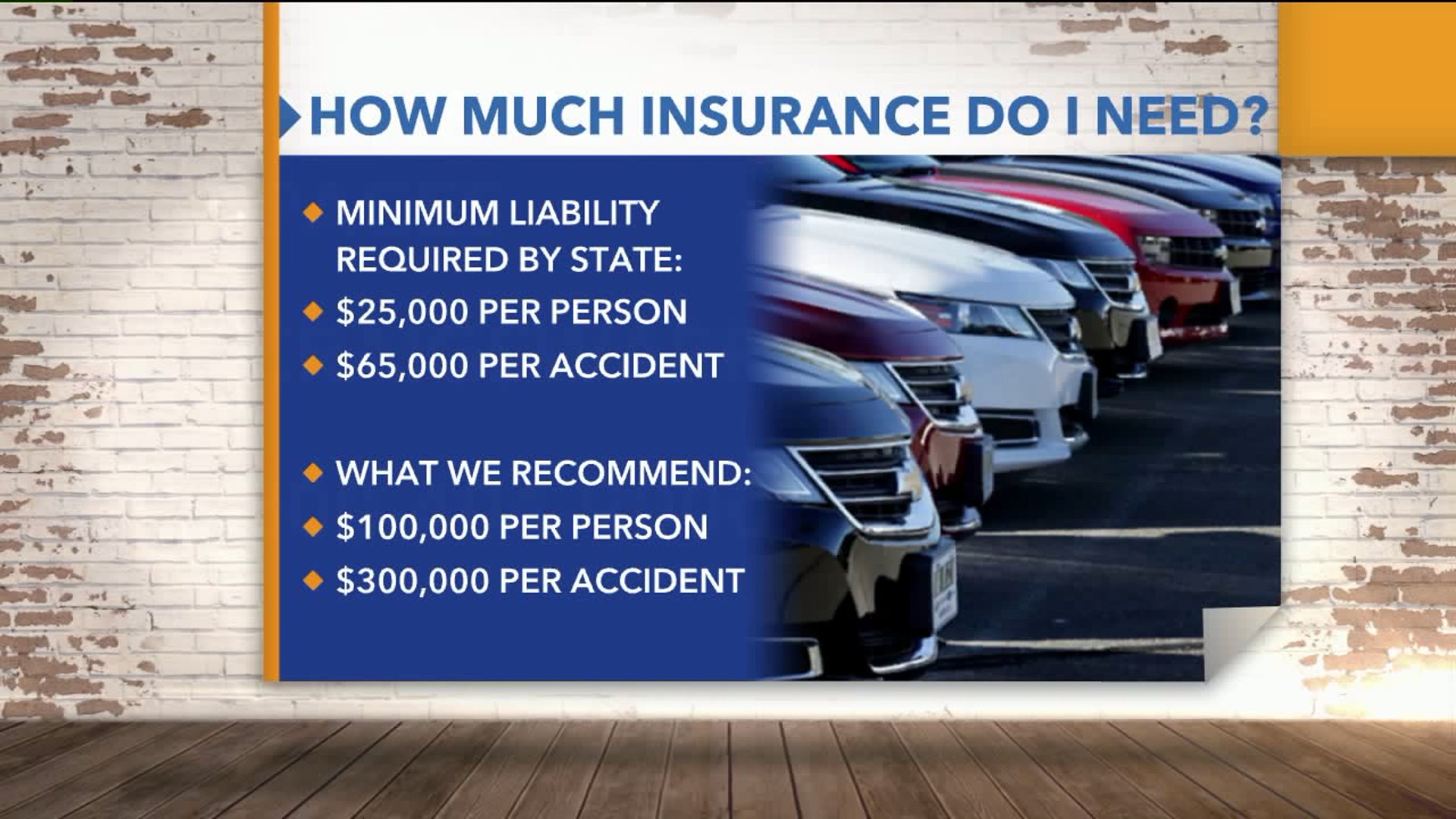

In most cases, it’s perfectly legal to have multiple car insurance policies. However, it’s important to be aware of the rules and regulations surrounding multiple policies, as there may be restrictions or limitations in place. For example, in some states, you may only be allowed to have two or three policies from the same insurer. Additionally, if you’re a high-risk driver, you may be limited in the number of policies you can have.

It’s also important to be aware of any discounts or incentives that may be available if you have multiple policies. For example, many insurers offer discounts for bundling multiple policies together. Additionally, some insurers may offer additional discounts or incentives if you have multiple policies with them.

Should You Have Multiple Car Insurance Policies?

Having multiple car insurance policies can be beneficial in some cases, but it’s important to weigh the pros and cons before making a decision. If you’re a high-risk driver, it may be beneficial to have multiple policies, as it can provide you with more coverage and flexibility. However, it’s important to remember that having multiple policies can also be more expensive and difficult to manage. Ultimately, the decision to have multiple policies should be based on your individual needs and circumstances.

Conclusion

In conclusion, it’s possible to have more than one car insurance policy. Having multiple policies can be beneficial in some cases, as it can provide you with more coverage and flexibility. However, it’s important to remember that having multiple policies can also be more expensive and difficult to manage. Therefore, it’s important to weigh the pros and cons before making a decision about whether or not to have multiple policies.

Triple A Auto Insurance - Auto Insurance Claims Step By Step Guide For

Top 10 Auto Insurance Infographics

All the Different Types of Car Insurance Coverage & Policies Explained

Motor Insurance Policy – Buy Now

Understanding auto insurance