Best Third Party Rental Car Insurance

Third-Party Rental Car Insurance: What You Need to Know

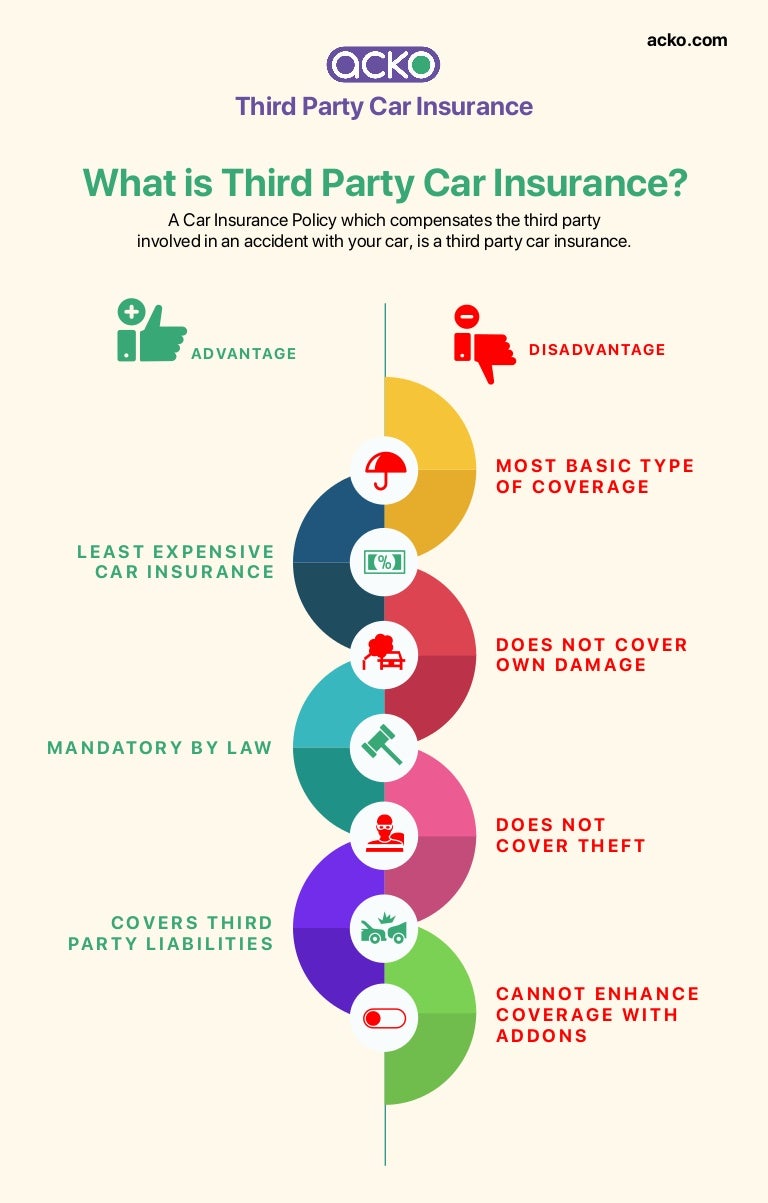

Renting a car can be a great way to get around when you’re travelling, but it often comes with a certain level of risk. This is why it’s important to consider third-party rental car insurance. This type of insurance provides coverage for damage to the rental vehicle, as well as any medical costs that may arise from an accident involving the rental car.

Third-party rental car insurance is a type of insurance policy that provides coverage for the cost of repairing or replacing a rental car should it be damaged or stolen. It also provides coverage for any medical costs that may arise from an accident involving the rental car. This type of insurance is typically offered by the rental car company, but it can also be purchased from an independent provider.

When purchasing third-party rental car insurance, it’s important to make sure that the coverage is adequate for your needs. Make sure that the policy covers the maximum amount of damage that can be caused to the rental car, as well as any medical bills that may arise from an accident. It’s also important to check that the policy provides coverage for any personal items that are stored in the rental car.

Types of Third-Party Rental Car Insurance

There are several different types of third-party rental car insurance available. The most common type is known as “collision and comprehensive” coverage. This type of coverage provides coverage for the cost of repairing or replacing the rental car should it be damaged or stolen. It also provides coverage for any medical bills that may arise from an accident involving the rental car.

Another type of third-party rental car insurance is known as “medical payments” coverage. This type of coverage provides coverage for any medical bills that may arise from an accident involving the rental car. This type of coverage is typically offered by the rental car company, but it can also be purchased from an independent provider.

Finally, some rental car companies also offer “liability coverage”. This type of coverage provides coverage for any damage that is caused by the rental car to another person or property. Liability coverage is typically required by law in most states, and it is typically offered by the rental car company, but it can also be purchased from an independent provider.

How to Choose the Right Third-Party Rental Car Insurance

When choosing a third-party rental car insurance policy, it’s important to make sure that the coverage is adequate for the type of rental car you plan to rent. Make sure that the policy covers the maximum amount of damage that can be caused to the rental car, as well as any medical costs that may arise from an accident. Additionally, make sure that the policy provides coverage for any personal items that are stored in the rental car. Finally, make sure that the policy provides coverage for any legal costs that may arise from an accident involving the rental car.

It’s also important to consider the cost of the policy. Third-party rental car insurance policies can vary significantly in terms of price, so it’s important to compare different policies in order to find the most cost-effective option. It’s also important to make sure that the policy includes all the coverage that you need, as some policies may only provide limited coverage.

Finally, it’s important to make sure that the policy is easy to understand. Make sure that the policy is written in plain language, and that you understand all of the terms and conditions. This will ensure that you understand what is and isn’t covered, and that you can make an informed decision about the right policy for you.

Third-Party Insurance in Nigeria - GetInsurance

What Is The Difference Between Comprehensive Car Insurance And Third

Acko Car Third Party Insurance / Which is best third party insurance or

Third Party Property Car Insurance | iSelect

Third Party Insurance: Buy & Renew Third Party Car Insurance Online