Best Car Insurance With Gap Coverage

Saturday, December 6, 2025

Edit

What Is Gap Coverage For Car Insurance?

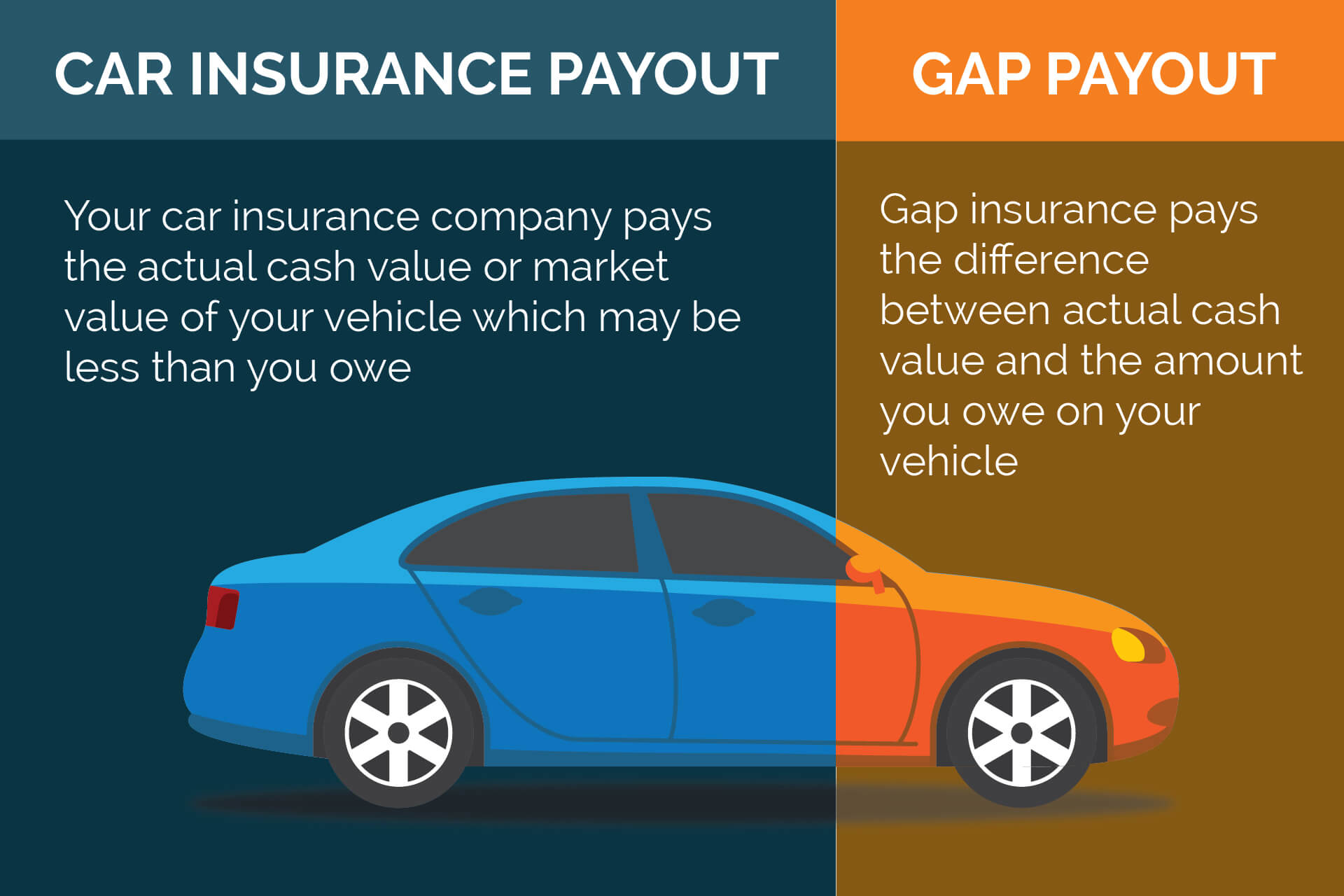

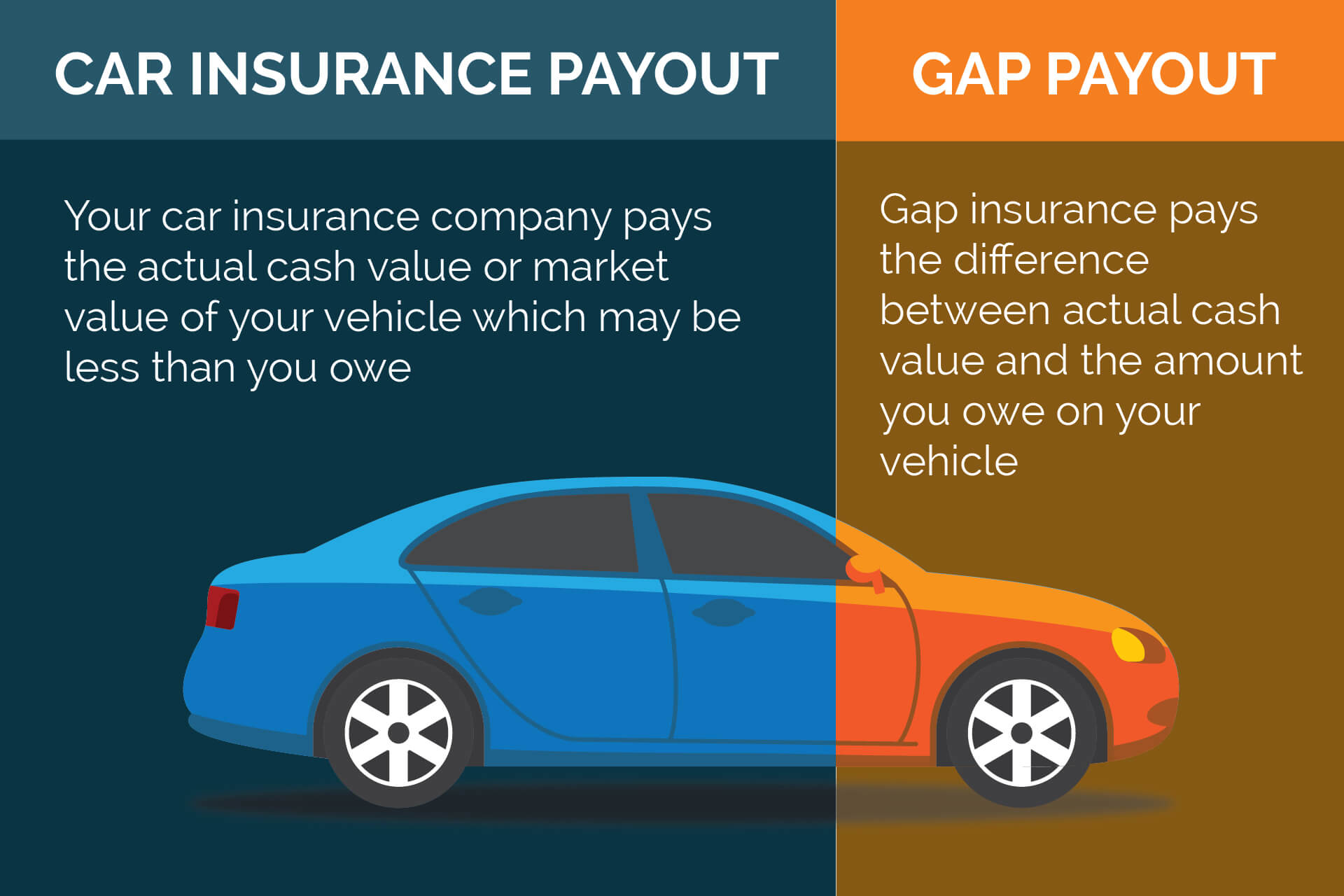

Gap coverage is a type of auto insurance that pays out the difference between the actual cash value (ACV) of a car that’s totaled and the amount of money you still owe on the loan for the car. It’s also known as “guaranteed auto protection” or “loan/lease gap coverage.”

Gap coverage is usually offered by car dealerships and auto insurance companies. It can be added to existing auto insurance policies or purchased as a stand-alone policy. Gap coverage is an optional type of auto insurance that’s designed to protect consumers who have recently purchased a car and are still paying off the loan for it.

What Does Gap Coverage Cover?

Gap coverage is designed to protect you in the event that your car is totaled or stolen and you owe more money on the loan than the car is worth. This can happen if you get into an accident and the repairs are more expensive than the car is worth, or if the car is stolen and not recovered.

Gap coverage will pay the difference between the amount you owe on the loan or lease and the actual cash value of the car. This means that you won’t be left with a large bill to pay off if you’re in an accident or your car is stolen.

Who Needs Gap Coverage?

Gap coverage is especially important for people who are financing or leasing a new car, since they may owe more money on the loan than the car is worth. This is because new cars lose a significant amount of their value as soon as they are driven off the lot.

Gap coverage can also be helpful for people who are buying a used car, since they may owe more money on the loan than the car is worth if the car depreciates in value faster than expected.

How Much Does Gap Coverage Cost?

The cost of gap coverage depends on the company offering it and the amount of coverage you choose. Generally, gap coverage costs between $20 and $30 a year.

Some auto insurance companies offer gap coverage as an add-on to existing policies, while others offer it as a stand-alone policy. Some car dealerships also offer gap coverage when you purchase a car from them.

Which Companies Offer Gap Coverage?

Most major auto insurance companies offer gap coverage, including Allstate, GEICO, Progressive, Farmers Insurance, and State Farm.

You can also purchase gap coverage from some car dealerships, such as Ford, Honda, and Toyota. The cost of gap coverage purchased from a car dealership may be higher than the cost of gap coverage purchased from an auto insurance company.

How Can I Save Money On Gap Coverage?

To save money on gap coverage, you should compare rates from different companies and car dealerships. You should also make sure you’re getting the coverage that’s right for you, as some policies may offer more coverage than you need.

You can also save money on gap coverage by making sure you keep your car in good condition. A car that’s in good condition will have a higher resale value, which means you’ll owe less on the loan if the car is totaled or stolen.

Finally, if you’re financing or leasing a new car, you should consider making a larger down payment. This will reduce the amount of money you owe on the loan, which means you won’t need as much gap coverage.

Car Insurance Market Value

What is the Coverage Gap - Close the Gap NC

Understanding Auto Insurance "Gap Coverage"

Auto Loan Guaranteed Asset Protection (GAP) Coverage - Schultz

Do Not Get Taken For A Ride When Looking For Auto Insurance — shaketext5