Auto Repair Business Insurance Cost

Auto Repair Business Insurance Cost: What to Consider

As an auto repair business owner, you know that you need to get the proper insurance coverage to protect your business. From liability to property damage, it’s important to get the right coverage at the right price. But how do you determine what you need and how much it will cost?

What Type of Insurance Do You Need?

The type of insurance you need will depend on the type of business you have, the services you provide, and the risks you face. For example, if you do a lot of work on brakes and tires, you may need to add additional coverage for any injuries a customer might sustain due to faulty workmanship. Additionally, if you store customer vehicles on your property, you may need to add a property damage policy to cover any damage that could be caused by a customer's vehicle.

The type of auto repair business insurance you need will also depend on the size and scope of your business. For instance, if you work on high-end vehicles, you may need specialized coverage for parts and labor. If you rent or lease space for your business, you may need additional coverage for your building and equipment.

What Does Auto Repair Business Insurance Cost?

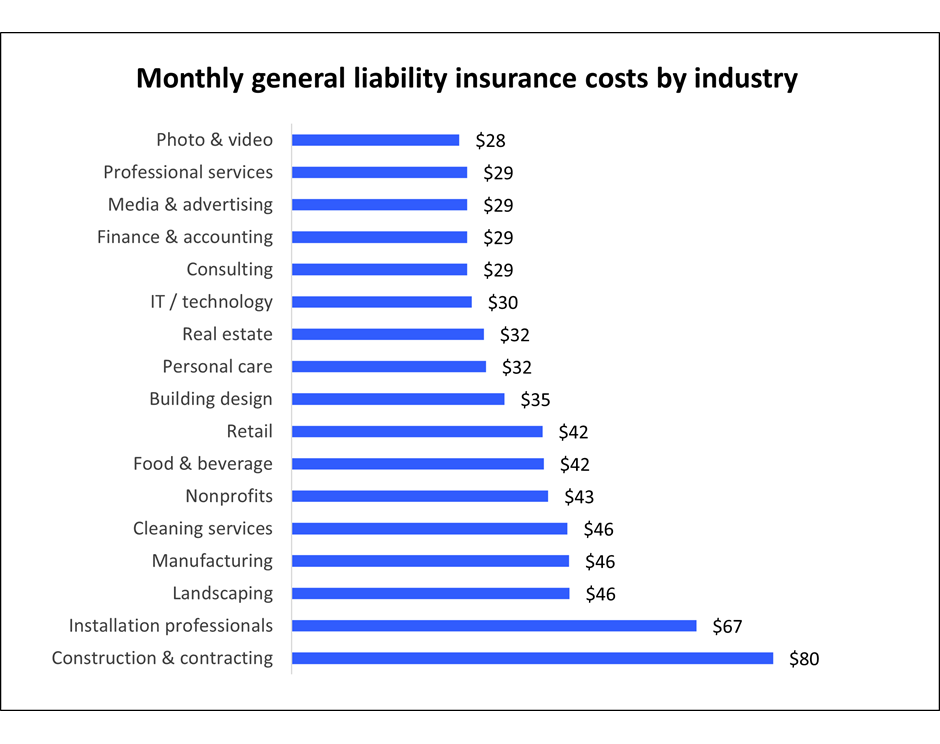

The cost of auto repair business insurance will depend on the type and amount of coverage you need. Generally, liability insurance will cost a few hundred dollars a year, while property damage coverage can be more expensive. It’s important to shop around and compare rates from different insurance companies to ensure you’re getting the best deal.

Your location can also affect the cost of insurance. For example, if you’re located in an area with high rates of theft and vandalism, you may need to pay more for property damage coverage. Additionally, the size and scope of your business can affect the cost, as larger businesses typically need more coverage.

What Should You Consider When Shopping for Auto Repair Business Insurance?

When shopping for auto repair business insurance, you should consider the type and amount of coverage you need, as well as the cost. Additionally, you should look for an insurance company that specializes in the type of coverage you need and has a good reputation for providing excellent customer service.

It’s also important to consider any discounts you may be eligible for. Many insurance companies offer discounts for businesses that have a good safety record or that have taken steps to minimize risk. Additionally, some companies offer discounts for businesses that have installed security systems or other protective measures.

Conclusion

Auto repair business insurance is an important part of running a successful business. It’s important to consider the type and amount of coverage you need and the cost of the insurance before making a decision. Additionally, you should look for an insurance company that specializes in the type of coverage you need and has a good reputation for providing excellent customer service.

How Much Does Auto Repair Shop Insurance Cost? | Commercial Insurance

Looking at the costs of auto insurance in Ontario, and ways motorists

What's the average cost of car insurance in the US? - Business Insider

Does Car Insurance Cost More For Business Use - Business Walls

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins