Auto Insurance For Business Use

Auto Insurance for Business Use

Having auto insurance is an essential part of owning a car, and for business use, it becomes even more important. Business owners need to make sure that their vehicles are properly insured, so that their business is not affected in the event of an accident. When it comes to auto insurance for business use, there are a few things that business owners should consider before making a purchase.

Types of Auto Insurance for Business Use

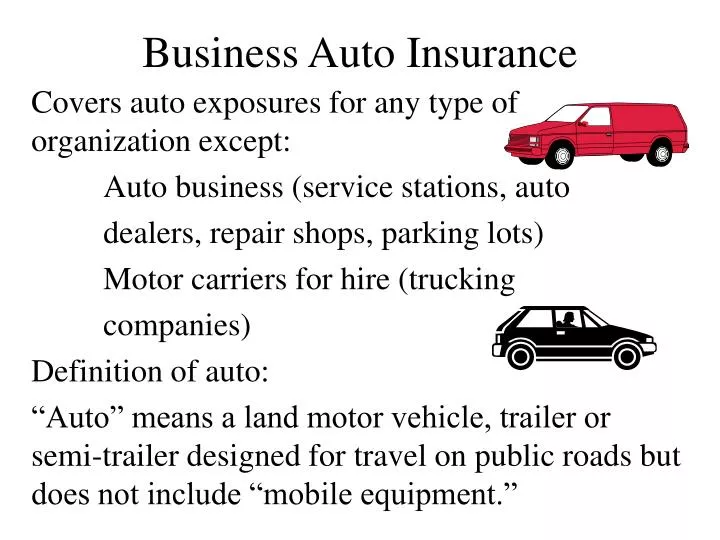

When looking for auto insurance for business use, there are a few different types that you can choose from. The most common type is commercial auto insurance, which is specifically designed for businesses. This type of insurance is typically more expensive than regular auto insurance, but it can provide more comprehensive coverage. It is important to shop around and compare different policies to ensure that you are getting the best deal.

What Does Auto Insurance for Business Cover?

When purchasing auto insurance for business use, it is important to understand what the policy covers. Generally speaking, commercial auto insurance will cover any damage to the vehicle, as well as liability for any injuries or property damage caused in an accident. It is also important to note that some policies may also include coverage for rental car costs and other expenses related to vehicle breakdowns.

Choosing the Right Auto Insurance for Business

When shopping for auto insurance for business use, it is important to make sure that the policy you choose meets the needs of your business. You should consider the type of vehicles you use, the amount of coverage you need, and the amount of risk that your business faces. It is also important to research the various insurance companies and compare their rates and coverage options. This will help you make sure that you are getting the best deal possible.

Additional Coverage Options

In addition to the basic coverage that is included in most auto insurance policies for business use, there are several additional coverage options you may want to consider. These include coverage for medical expenses, uninsured/underinsured motorist coverage, and comprehensive coverage. These additional coverages can help to protect your business from financial losses in the event of an accident or other incident.

Finding the Right Auto Insurance for Business

When it comes to finding the right auto insurance for business use, it is important to do your research. Take the time to compare different policies and coverage options to ensure that you are getting the best deal. Additionally, it is important to work with an experienced insurance agent who can help you find the right coverage for your business. With the right auto insurance policy in place, your business can be protected in the event of an accident.

Top 10 Auto Insurance Infographics

Top 10 Auto Insurance Infographics

PPT - Business Auto Insurance PowerPoint Presentation, free download

Car Insurance Requirements for California Vehicle Owners

Do you need business auto insurance Orlando FL | Lake Mary | Heathrow