When Should I Switch To Liability Only Car Insurance

When Should You Switch to Liability Only Car Insurance

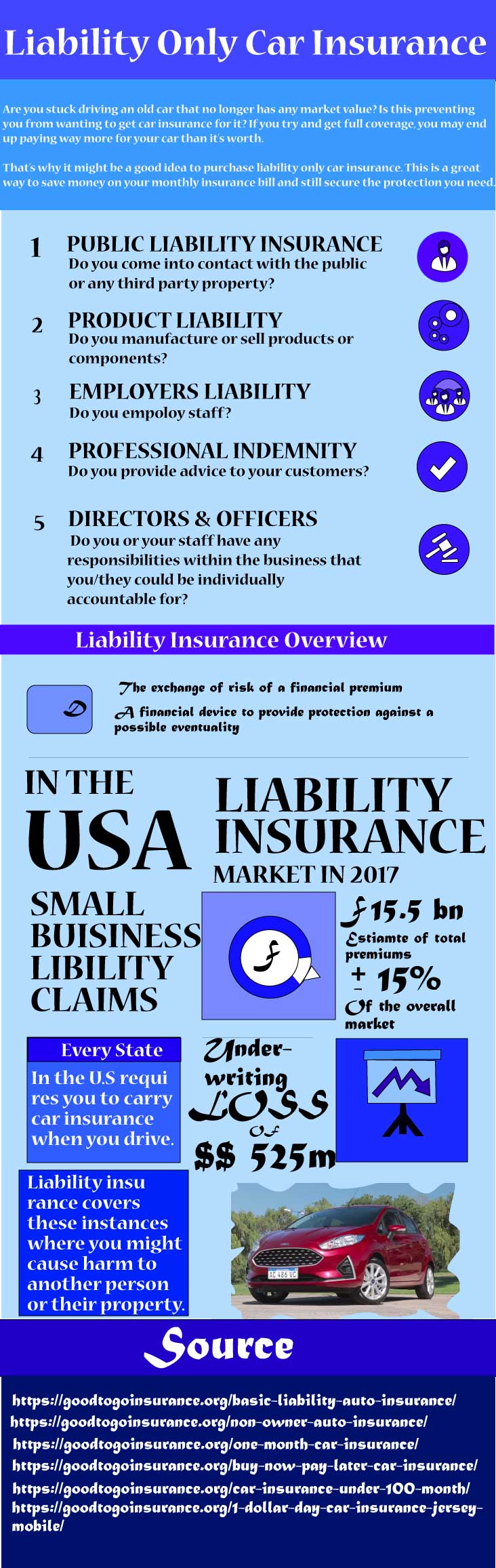

When it comes to car insurance, there are several options available, and liability only car insurance is one of them. Liability only car insurance is a type of coverage that only covers the costs of damages and injuries to other people or property if you are at fault in an auto accident. This type of coverage does not cover the cost of repairing or replacing your own car, so it is important to consider if it is the right option for you.

How Does Liability Only Car Insurance Work?

Liability only car insurance works by covering the costs of damage and injuries to other people or property if you are at fault in an accident. This type of coverage does not cover the costs of repairing or replacing your car, so you will be responsible for those costs. This type of coverage is often less expensive than comprehensive coverage, but it also provides less protection for you and your vehicle.

When Should You Switch to Liability Only Car Insurance?

The decision to switch to liability only car insurance should be based on your individual needs and circumstances. If you have an older car that is not worth much, liability only coverage may be a good choice for you. This type of coverage is also a good option for those who rarely drive or who drive mainly in low-risk areas. However, if you drive a newer car or in a high-risk area, comprehensive coverage may be a better option.

What Are the Benefits of Liability Only Car Insurance?

The main benefit of liability only car insurance is that it is typically less expensive than comprehensive coverage. This can make it a great option for those who are on a tight budget or who are looking to save on their car insurance costs. In addition, this type of coverage can provide peace of mind knowing that if you are at fault in an accident, you will be covered for the costs of damages and injuries to other people or property.

What Are the Drawbacks of Liability Only Car Insurance?

The main drawback of this type of coverage is that it does not cover the costs of repairing or replacing your own car. This means that you will be responsible for those costs if you are at fault in an accident. In addition, liability only coverage does not provide coverage for theft, vandalism, or other types of damage that may occur to your car.

Conclusion

Liability only car insurance can be a great option for those looking to save on their car insurance costs. However, it is important to consider your individual needs and circumstances before making a decision. If you have an older car or rarely drive, liability only coverage may be a good option for you. However, if you drive a newer car or in a high-risk area, comprehensive coverage may be a better choice.

What Does Liability Only For Auto Insurance Cover? - YouTube

Liability Only Car Insurance | Liability goodtogo car insurance

Things to Know About Liability-Only Car Insurance Policy

What Is Liability Insurance? | Allstate

Cheap Liability Only Car Insurance Texas - blog.pricespin.net