What Is Full Car Insurance Coverage

What Is Full Car Insurance Coverage?

Car insurance is a type of insurance policy that provides financial protection in the event of a car-related incident. It covers property damage, medical bills, and legal fees, as well as other expenses related to a car accident. Full coverage car insurance is a type of policy that provides coverage for both liability and physical damage to a vehicle. It is often referred to as “comprehensive” coverage. It is important for drivers to understand what is included in full coverage car insurance and how it works.

What Does Full Coverage Car Insurance Include?

Full coverage car insurance typically includes liability coverage, which pays for damage and injuries you may cause to another person or their property, as well as physical damage coverage, which pays for damage to your vehicle. It may also include other coverages, such as uninsured/underinsured motorist coverage, personal injury protection, and rental car reimbursement. Liability coverage is often referred to as “bodily injury” and “property damage” coverage. How much coverage you get depends on your state’s minimum insurance requirements, as well as the limits you choose.

How Does Full Coverage Car Insurance Work?

When you get full coverage car insurance, you are buying both liability coverage and physical damage coverage. Liability coverage pays for any damage or injuries you may cause to another person or their property. Physical damage coverage pays for any damage to your vehicle, such as from a collision or theft. You will typically have to pay a deductible before the insurance company pays out for any claims. The deductible is the amount of money you will pay out-of-pocket before the insurance company pays for any claims.

How Much Does Full Coverage Car Insurance Cost?

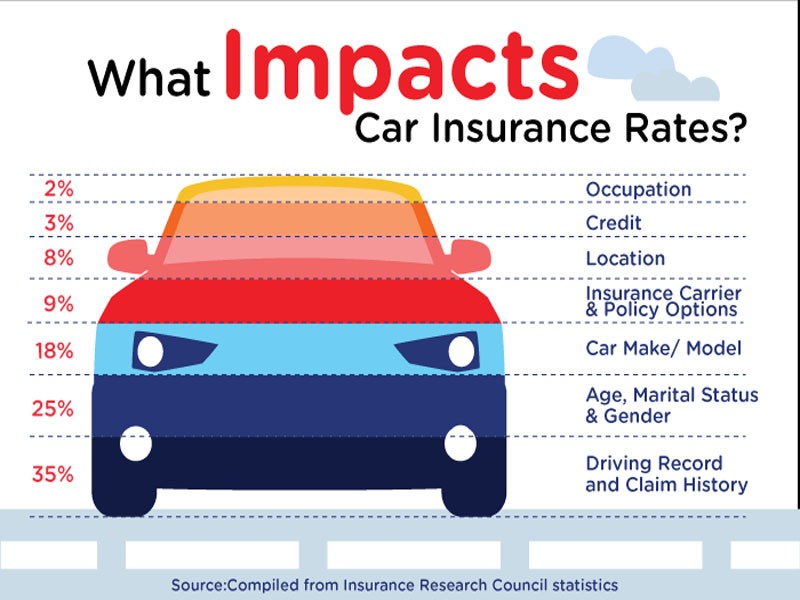

The cost of full coverage car insurance will vary depending on a number of factors, including your age, driving record, where you live, and the type of car you drive. Generally speaking, drivers with a good driving record and no prior accidents will pay less for car insurance. The type and amount of coverage you choose will also affect the cost of your policy. Generally, full coverage car insurance will cost more than basic liability coverage, but it is still important to shop around and compare quotes to get the best deal.

What Are the Benefits of Full Coverage Car Insurance?

Full coverage car insurance offers a number of benefits. It provides protection for both you and other drivers on the road, and it can help you avoid financial ruin in the event of a serious car accident. It can also provide peace of mind knowing that you are adequately protected in the event of an accident. Additionally, many insurance companies offer discounts for drivers who have full coverage car insurance, which may help lower your overall premiums.

Conclusion

Full coverage car insurance is a type of policy that provides both liability and physical damage coverage. It is typically more expensive than basic liability coverage, but it can provide peace of mind knowing that you and other drivers on the road are protected. Additionally, many insurance companies offer discounts for drivers who have full coverage car insurance, which may help lower your overall premiums. It is important to compare quotes to get the best deal on car insurance.

Vehicle Insurance Plans - Asuransi Terjamin 2022

What is Full Coverage Car Insurance? - eTrustedAdvisor

18+ Full Coverage Car Insurance Quotes - Best Day Quotes

Personal Insurance Coverage - Personal Injury Protection: How PIP

“Full Coverage” Car Insurance Explained - YouTube