The Zebra Auto Insurance Report

The Zebra Auto Insurance Report: What You Need to Know

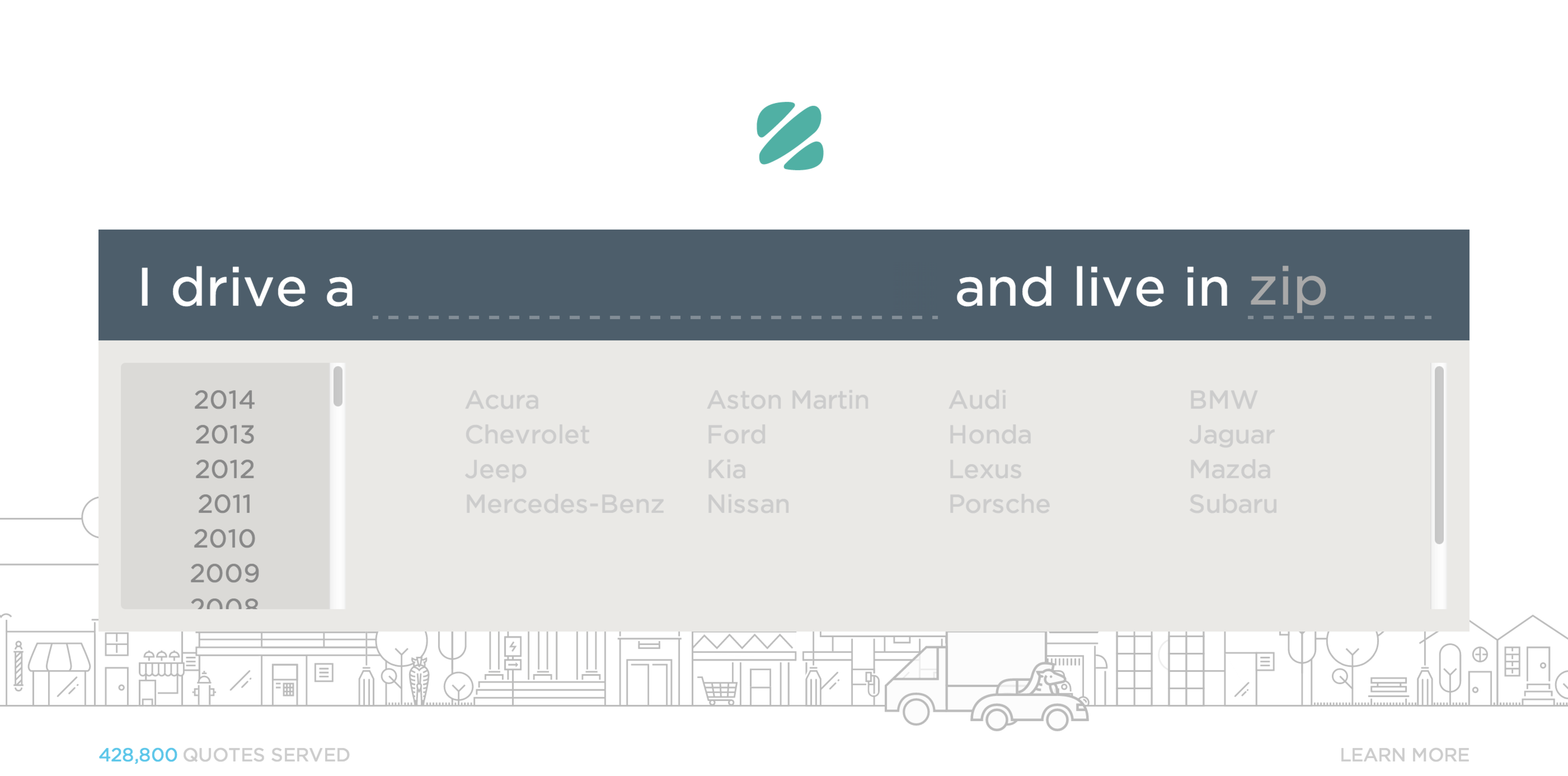

The Zebra recently released its annual auto insurance report, and it’s packed with information about the trends, costs, and regulations of the auto insurance industry. The Zebra is a company that helps drivers compare car insurance quotes and find the right coverage for their needs. This report is a valuable resource for anyone who wants to learn more about the auto insurance market and how they can save money on their policy.

Key Findings of the Report

The report found that auto insurance rates in the United States have steadily risen over the last decade. In 2019, the average rate for car insurance was $1,470 per year, which is about a 25% increase from 2009. The report also found that the cost of auto insurance varies widely across states and even within states. For example, the cost of car insurance in California can range from $819 to over $3,000 per year. The report also revealed that the number of uninsured drivers is on the rise, with an estimated 14.4% of drivers on the road lacking insurance.

The Impact of Insurance Regulations on Rates

The report found that insurance regulations have a significant impact on rates. States with stricter regulations, such as California and New York, tend to have higher rates. Regulations on minimum liability coverage, uninsured motorist coverage, and the ability to sue for damages all play a role in determining the cost of auto insurance. The report also found that insurance companies are more likely to increase rates in states with more stringent regulations.

Factors That Affect Your Auto Insurance Rates

The report found that a variety of factors can affect your auto insurance rates. Your age, gender, location, driving record, and the type of car you drive all play a role in determining your auto insurance rates. The report also found that insurance companies are increasingly taking credit scores into account when setting rates. The report concluded that the best way to get the lowest rate is to shop around and compare quotes from multiple providers.

Tips for Saving Money on Car Insurance

The report offered several tips for saving money on auto insurance. The first is to take advantage of discounts that are available. Many insurance companies offer discounts for safe driving, good grades, and low mileage. The report also suggested bundling policies, raising deductibles, and using public transportation when possible. Finally, the report suggested that drivers shop around and compare quotes from multiple insurers to ensure they are getting the best rate.

Conclusion

The Zebra auto insurance report is a valuable resource for anyone looking to understand the auto insurance industry and save money on their policy. The report revealed that auto insurance rates have steadily increased over the last decade and that regulations and other factors can significantly impact rates. The report also offered several tips for saving money on car insurance, such as taking advantage of discounts, bundling policies, and comparing quotes from multiple providers.

The Zebra Reveals the Truth Behind Auto Insurance Rate Hikes in

The Zebra Study Finds U.S. Car Insurance Rates at All-Time High

Do You Know Your Car Insurability? | Budgets Are Sexy

Insurance Zebra Launches A Kayak For Auto Insurance – TechCrunch

Survey: Americans in the Dark about Car Insurance - Insurance News