Sbi General Car Insurance Policy Details

SBI General Car Insurance Policy Details

Introduction

SBI General Car Insurance Policy is an insurance policy offered by State Bank of India (SBI). It helps you protect your car against any damage or loss. The policy provides financial coverage for any loss or damage caused to your car due to any unexpected event like an accident, theft, fire, natural disaster, etc. It also offers you a host of other benefits like personal accident cover, 24x7 road side assistance, no-claim bonus and more.

Coverage & Benefits

SBI General Car Insurance Policy offers you a comprehensive coverage for your car. It covers all the damages caused to your car and its accessories due to any of the following events:

- Fire, explosion, self-ignition or lightning

- Burglary, housebreaking or theft

- Riot, strike or malicious act

- Accident by external means

- Terrorist activity

- Earthquake, flood, typhoon, hurricane, storm, tempest, inundation, cyclone, hailstorm, frost

- Landslide, rockslide

Apart from the coverage, the policy also offers some additional benefits like:

- Personal accident cover for the owner driver of the vehicle

- 24x7 road side assistance

- No-claim bonus (NCB) on renewal

- Cashless claim settlement at network garages

- Discounts on voluntary deductibles

Eligibility Criteria

In order to be eligible for SBI General Car Insurance Policy, you must meet the following criteria:

- You must be a citizen of India

- You must be between 18 and 65 years of age

- You must hold a valid driving license

- You must have a valid registration certificate of the vehicle

- You must have a valid insurance policy for the vehicle

Claim Process

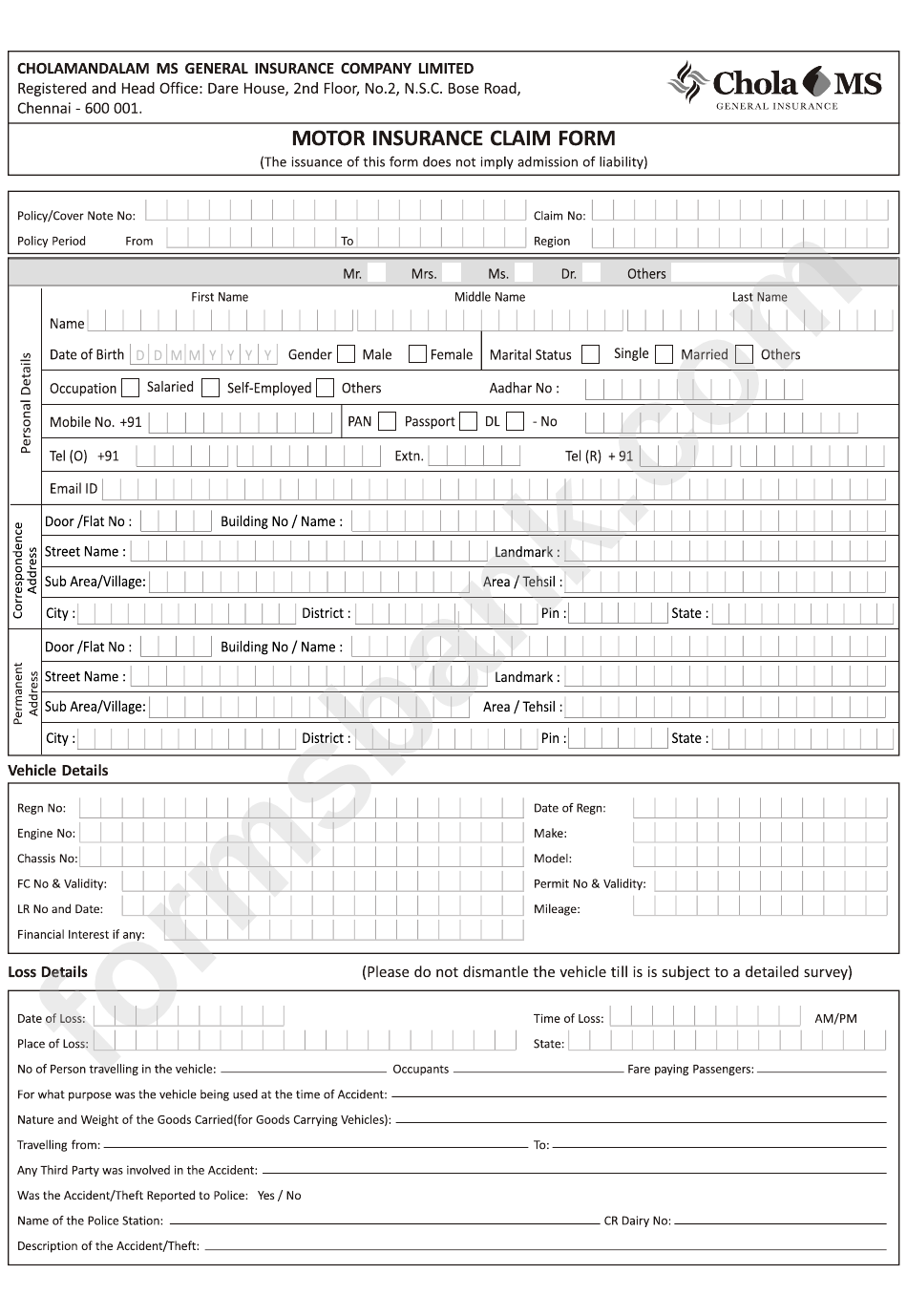

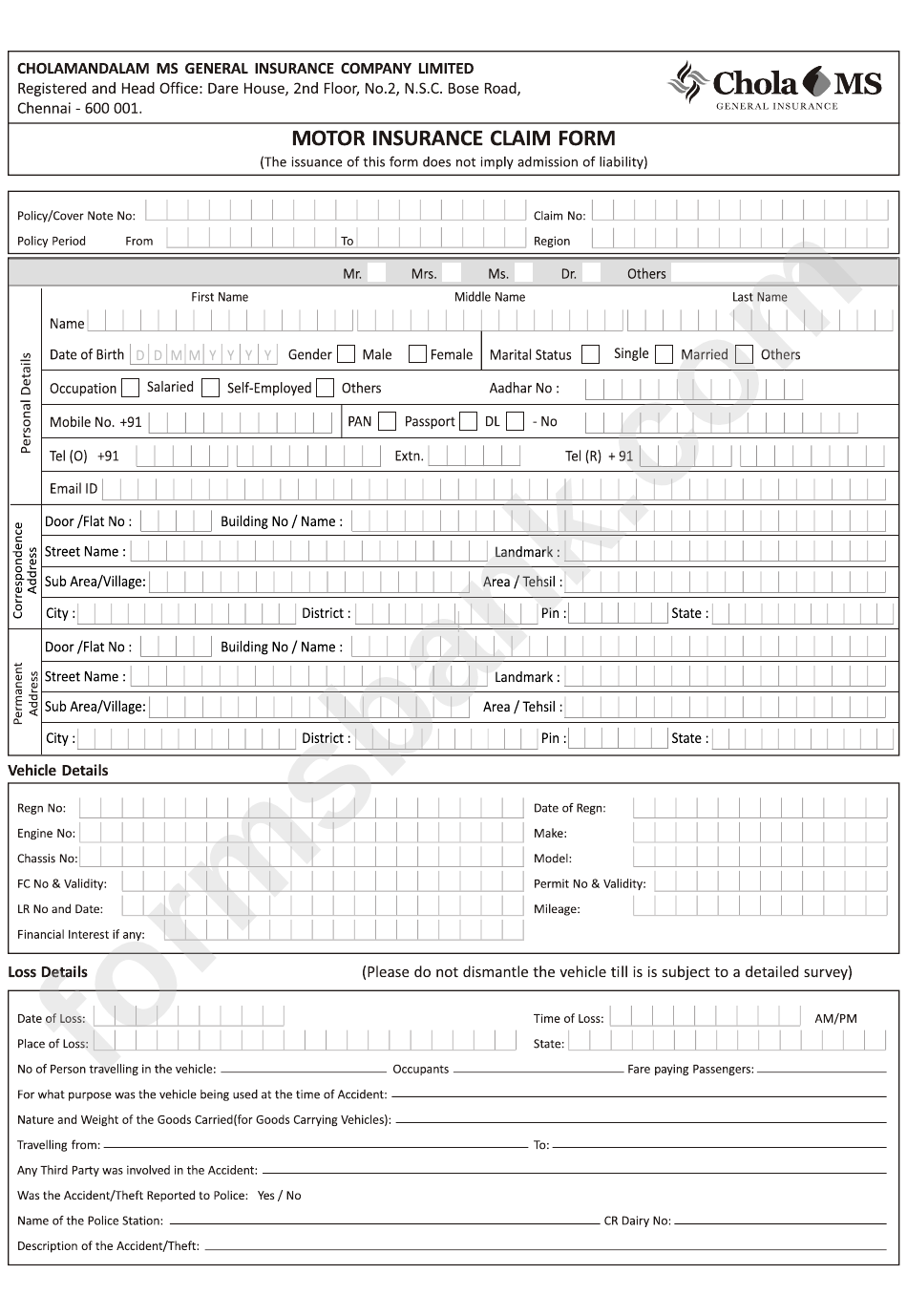

In case of any damages or losses to your car, you need to follow the claim process stated by SBI General Car Insurance Policy. The steps are as follows:

- Inform the insurer about the incident as soon as possible

- Fill out the claim form and submit it to the insurer along with relevant documents

- The insurer will then evaluate the claim and decide whether to accept or reject it

- If accepted, the insurer will reimburse the claim amount

- In case of any discrepancies, the insurer will contact you to resolve the issue

Conclusion

SBI General Car Insurance Policy is a great option for car owners who want to protect their vehicles against any damage or loss. The policy not only covers the damages caused to your car but also offers a host of additional benefits like personal accident cover, 24x7 road side assistance, no-claim bonus and more. So, if you are looking for a comprehensive car insurance policy, then SBI General Car Insurance Policy is a great choice.

Sbi General Insurance Claim Status - Awesome

Sbi General Insurance Claim Status - Awesome

Sbi Car Insurance Claim Form

SBI Online Payment | SBI General Insurance Pay Premium, Policy renewal

Sbi General Insurance Terms And Conditions - MAARUF1