Most Affordable Car Insurance In Illinois

Thursday, November 27, 2025

Edit

Finding The Most Affordable Car Insurance In Illinois

Start Shopping Around

When looking for car insurance in Illinois, the best way to start is by shopping around. There are many companies that offer various types of insurance policies, so it’s important to compare quotes and find out which one is the most affordable for you. It’s also important to remember that the cheapest quote is not always the best option, as it may not offer the coverage you need. Make sure you read the policy documents carefully to ensure you are getting the best coverage for your needs.

Understand What’s Covered

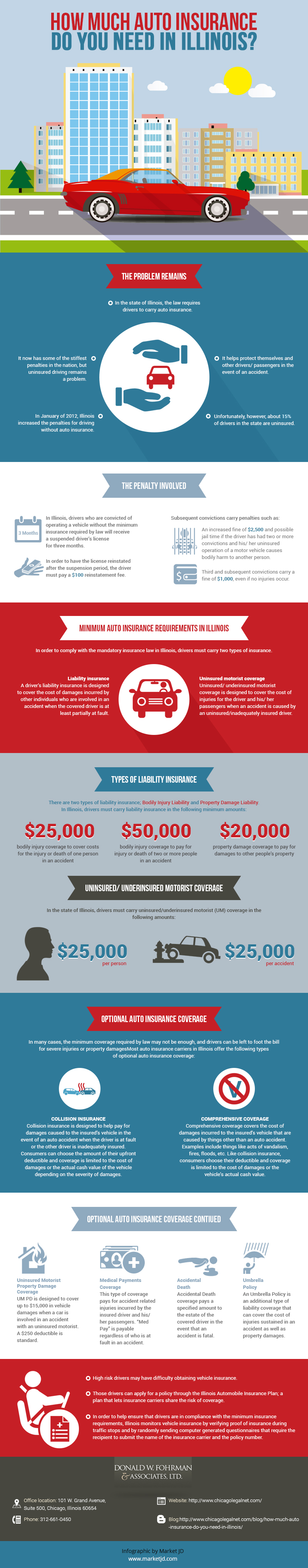

Before you purchase car insurance, it’s important to understand exactly what is covered in the policy. Different insurance policies can offer different types of coverage, so make sure you understand the details of each policy before making a decision. Generally, car insurance will cover damage caused to your car, medical expenses due to an accident, and legal fees or court costs. It’s also important to make sure you understand the limits of coverage, as this can affect the amount you need to pay out in case of an accident.

Consider Higher Deductibles

One way to save money on car insurance in Illinois is to consider raising your deductible. By raising your deductible, you’ll be responsible for paying a higher amount if you make a claim. However, this can mean lower premiums in the long run, as the insurance company won’t have to pay as much in the event of an accident. It’s a good idea to check the fine print of your policy to make sure you understand what you’re agreeing to and the amount of the deductible.

Look for Discounts

Many insurance companies in Illinois offer discounts for drivers who meet certain criteria. These discounts can be based on your driving record, the type of car you drive, or other factors. It’s also worth looking into any additional discounts that may be available, such as safe driver discounts or discounts for installing safety devices in your car. These discounts can help lower your premiums and make your insurance more affordable.

Choose Your Coverage Carefully

When looking for the most affordable car insurance in Illinois, it’s important to consider the type of coverage you’ll need. If you’re driving an older car, you may not need as much coverage as someone who drives a more expensive car. Consider what type of coverage you need and make sure you don’t get more than you need. This can help reduce your premiums and make your insurance more affordable.

Shop Around For The Best Price

It’s important to remember that the cheapest quote isn’t always the best option, as it may not offer the coverage you need. Shopping around for car insurance in Illinois can help you find the most affordable policy for your needs. Compare quotes from different companies, read the policy documents carefully, and make sure you understand the terms and conditions before you make your final decision. By taking the time to shop around, you can find the most affordable car insurance in Illinois.

Who Has the Cheapest Car Insurance Quotes in Chicago, IL? - ValuePenguin

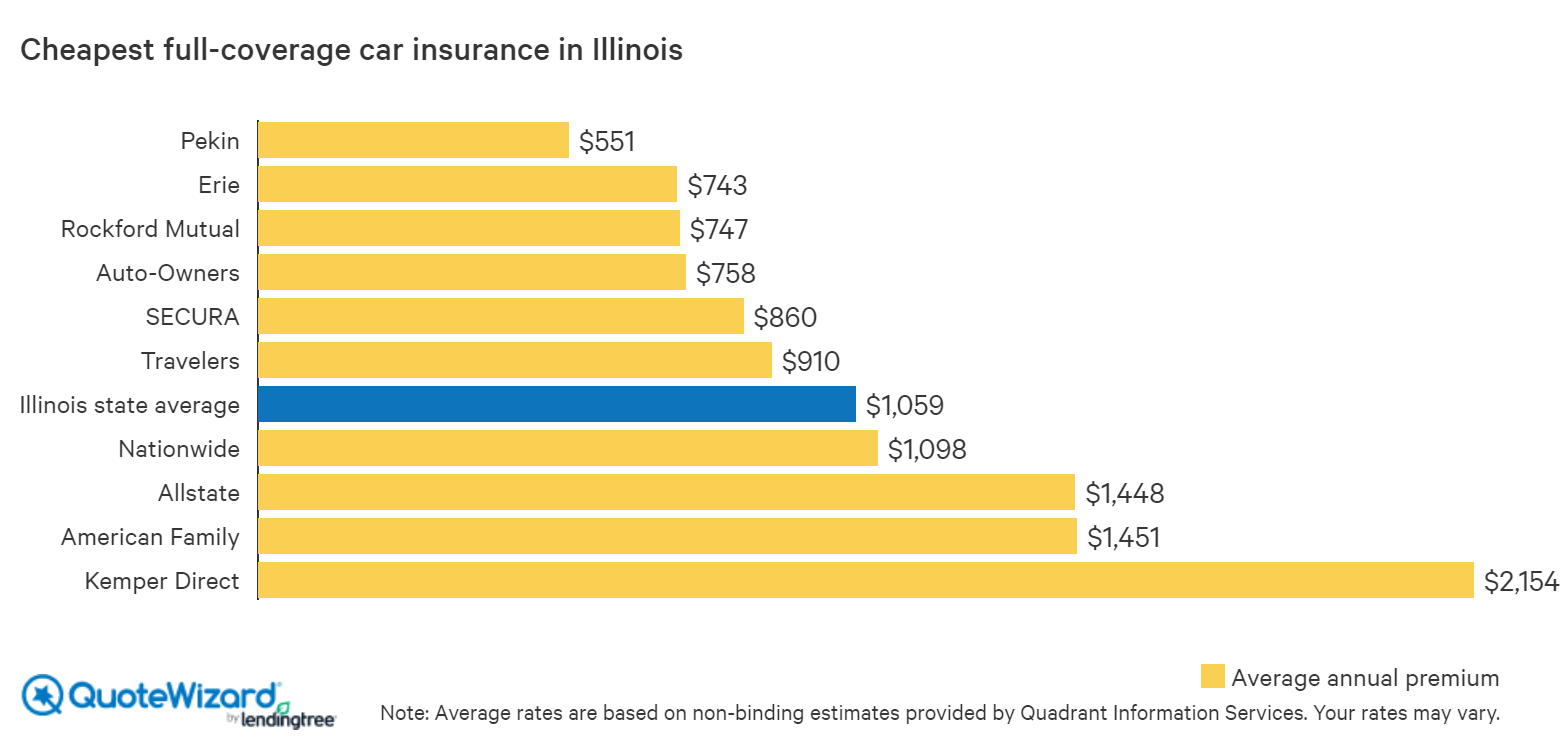

Find Cheap Car Insurance in Illinois | QuoteWizard

Cheapest car insurance in illinois - insurance

Auto Insurance Illinois | Personal Injury Lawyers

Find cheap car insurance in 8 easy steps • InsureMeta in 2020 | Cheap