Lv Car Insurance Death Of Policyholder

Lv Car Insurance Payout Following Death of Policyholder

LV (Liverpool Victoria) car insurance is amongst the most widely used car insurance policies in the UK. It offers a range of features, including a wide range of coverage options and a commitment to customer service. However, one of the most important aspects of any car insurance policy is the financial protection it provides in the event of a policyholder's death. In this article, we will discuss the LV car insurance payout following the death of a policyholder.

LV Car Insurance: What Does It Cover?

LV car insurance provides a range of coverage options for its policyholders. These coverage options include third-party liability, personal injury, and legal expenses and uninsured driver protection. LV car insurance also provides additional coverage options such as no-claim discount and breakdown cover. In addition, LV car insurance offers a range of optional extras, such as windscreen cover and courtesy car cover.

LV Car Insurance Payout Following Death of Policyholder

In the event of a policyholder's death, LV car insurance provides a lump sum payment to the policyholder's estate. This payment is known as a death benefit and is designed to help cover any outstanding debts or costs that the policyholder may have been responsible for. In addition, the death benefit can also be used to cover funeral expenses and other costs associated with the policyholder's death.

How Much Does the Death Benefit Pay Out?

The amount of the death benefit payout varies depending on the type of policy taken out by the policyholder. Most LV car insurance policies provide a lump sum payment of up to £25,000. This amount is usually paid out within two to three days of the policyholder's death. It is important to note that the death benefit is only payable if the policyholder has passed away due to an accident or illness that was covered by the policy.

How To Make a Claim

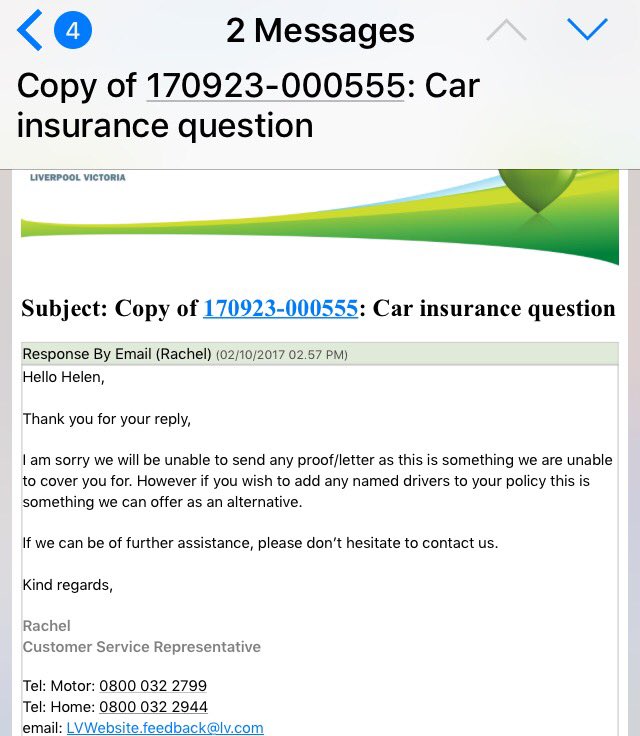

In order to make a claim on the death benefit, a surviving family member or close friend must contact LV car insurance and provide proof of the policyholder's death. This proof usually consists of a death certificate or a coroner's report. Once the claim has been processed, the death benefit payout will be made directly to the policyholder's estate. It is important to note that the death benefit can only be claimed once and cannot be transferred to another policyholder.

Conclusion

LV car insurance provides a range of coverage options, including a death benefit in the event of a policyholder's death. The death benefit is a lump sum payment of up to £25,000 and is designed to help cover any outstanding debts or costs that the policyholder may have been responsible for. To make a claim on the death benefit, a surviving family member or close friend must contact LV car insurance and provide proof of the policyholder's death.

Lv Car Insurance Quotes | Walden Wong

LV Car Insurance

Lv Car Insurance Quote Number City Of Kenmore Washington

Lv Car Insurance Quote Phone Number | NAR Media Kit

LV= Electrifies Insurance