Low Deposit Car Insurance For Young Drivers

Monday, November 10, 2025

Edit

Low Deposit Car Insurance For Young Drivers

Introduction

Buying car insurance, especially for young drivers, can be a difficult and expensive process. But it doesn’t have to be. Many insurers offer low deposit car insurance for young drivers, which can make life much easier. Low deposit car insurance means that you need to pay a smaller down payment at the start of your policy, and can spread the rest of the cost of the policy out over a number of months. This means that you can drive away with the peace of mind that you are covered by a quality insurer, but for a much lower initial outlay than normal.

What is Low Deposit Car Insurance?

Low deposit car insurance is a type of insurance policy that allows you to spread the cost of the policy out over a number of months. Instead of having to pay the entire cost of the policy upfront, you can pay a smaller down payment, and then make regular payments over the course of the policy. This means that you can get the protection you need without having to pay the full cost of the policy upfront.

Why is Low Deposit Car Insurance for Young Drivers Popular?

Low deposit car insurance for young drivers is popular for a number of reasons. Firstly, it makes it much easier for young drivers to get the coverage they need. Many young drivers are on tight budgets, and may not have the disposable income to pay the full cost of a policy upfront. Secondly, low deposit car insurance helps to spread the cost out over a number of months, which can make it much easier to budget for. Finally, low deposit car insurance can also help to reduce the overall cost of a policy, as the insurer can spread the cost of the policy out over a number of months.

What are the Benefits of Low Deposit Car Insurance for Young Drivers?

The main benefit of low deposit car insurance for young drivers is that it makes it much easier to get the coverage they need. Young drivers are often on tight budgets, and so being able to spread the cost of the policy out over a number of months can make it much easier to budget for. Additionally, low deposit car insurance can also help to reduce the overall cost of a policy, as the insurer can spread the cost out over a number of months. Finally, low deposit car insurance can also help to reduce the risk of a young driver defaulting on their payments, as the insurer can spread the payments out over a period of time.

How to Find Low Deposit Car Insurance for Young Drivers?

Finding low deposit car insurance for young drivers is relatively easy. The first step is to shop around and compare quotes from different insurers. This can help to ensure that you get the best deal possible. Additionally, it is also important to look for any special offers or discounts that may be available. Many insurers offer discounts for young drivers, so it is important to look out for these. Finally, it is also important to read the terms and conditions of any policy you are considering carefully, as this can help to ensure that you are getting the best deal possible.

Conclusion

Low deposit car insurance for young drivers is a great way to get the coverage you need, without having to pay the full cost of the policy upfront. It can also help to make budgeting easier, as well as reduce the risk of defaulting on payments. Additionally, there are a number of special offers and discounts available, so it is important to shop around and compare quotes from different insurers. Finally, it is important to read the terms and conditions of any policy you are considering carefully, as this can help to ensure that you are getting the best deal possible.

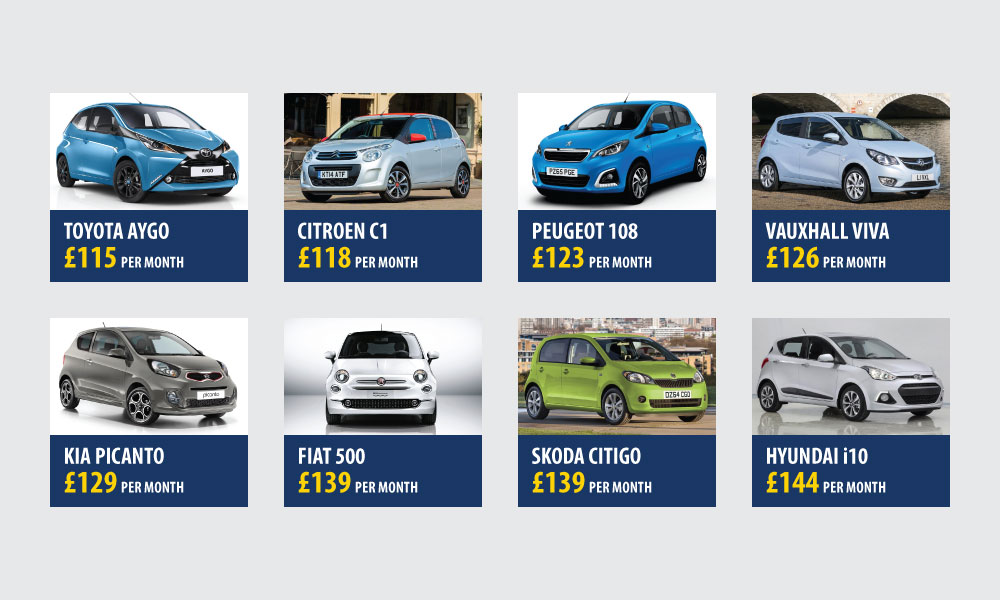

LOW DEPOSIT, LOW INSURANCE CARS FOR YOUNG DRIVERS - CVC Direct Business

Young Drivers Insurance Review | Visual.ly

Cheap car insurance for young drivers

Best Auto Insurance Companies For Young Drivers - Insurance Reference

Cheap Car Insurance with Low Deposit Monthly For Young Drivers Online #