Insurance On New Vehicle Purchase

Tuesday, November 25, 2025

Edit

Insurance On New Vehicle Purchase

Why Do We Need Insurance?

When you purchase a new vehicle, you should consider getting insurance. Insurance is designed to protect you, your vehicle and third parties from financial loss in the event of an accident or other unforeseen incident. It is also mandatory in many countries and states, so it is important to make sure you are adequately covered. Without insurance, you could be liable for a large amount of money if you are involved in an accident, or if your vehicle is stolen.

Different Types Of Insurance

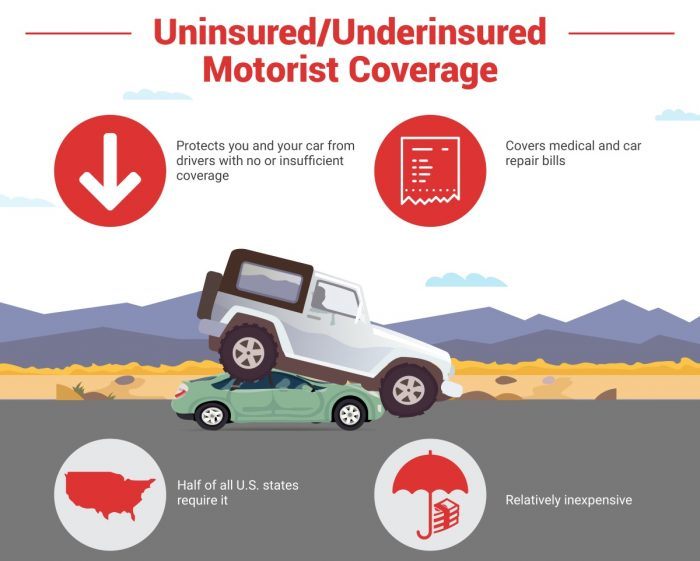

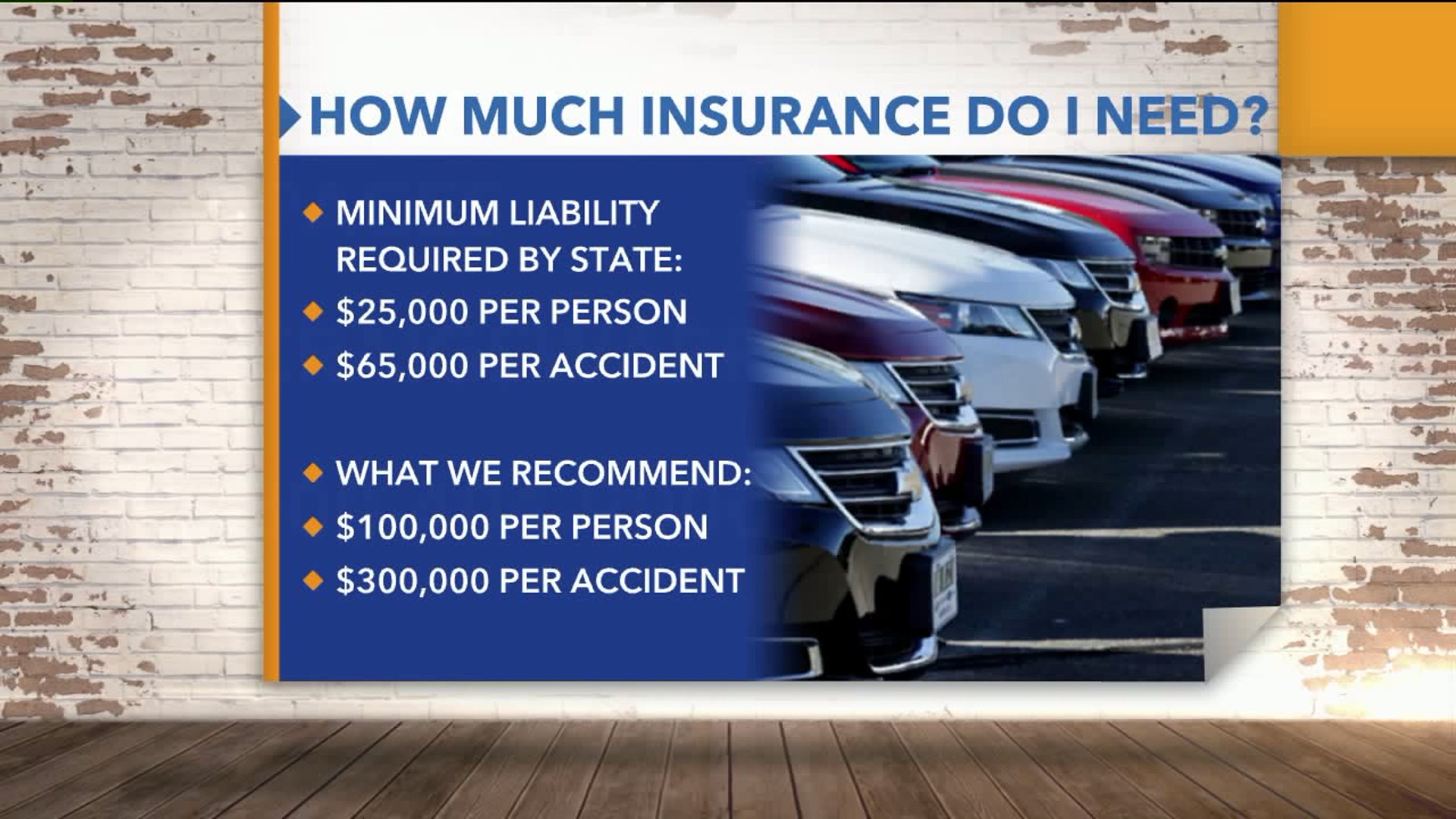

There are several types of insurance available for new vehicle purchases. Liability insurance is the most basic type and is typically required by law. This insurance covers any damage you may cause to another person or property with your vehicle. Comprehensive insurance covers damage to your vehicle and can also provide coverage for theft and vandalism. Collision insurance covers damages caused by an accident with another vehicle or object. Uninsured motorist insurance protects you from losses incurred due to an uninsured motorist. There are also additional types of insurance available such as medical payments coverage and rental reimbursement coverage.

How To Get Insurance

When you purchase a vehicle, you should contact your local insurance provider to get a quote. You can also shop around online for the best rates. Before you buy a policy, make sure to read the fine print and understand the coverage you are getting. It is also important to review your policy periodically to make sure you are still adequately covered.

How Much Does Insurance Cost?

The cost of insurance will vary depending on the type of policy you choose and the vehicle you are insuring. Generally, the higher the value of the vehicle, the higher the cost of insurance. Other factors that can affect the cost of insurance include your driving record, the type of vehicle, and your age and gender. It is important to compare different policies and providers to get the best rate.

How To Save Money On Insurance

There are a few ways you can save money on insurance for your new vehicle. You can look for discounts such as multi-car discounts, good driver discounts, and discounts for safety features. You can also increase your deductible to lower your premiums. The deductible is the amount you agree to pay out-of-pocket in the event of a claim. The higher the deductible, the lower your premiums will be. Lastly, you can consider buying a less expensive vehicle that is cheaper to insure.

Conclusion

Insurance is an important part of owning a new vehicle. It is important to understand the different types of insurance and how much it will cost. You should also shop around for the best rates and look for discounts to help lower the cost of your insurance policy. By taking the time to find the right insurance policy, you can save money and ensure you are adequately covered in the event of an accident.

Now take Car and Bike Insurance via Amazon Pay | DataReign

Car Insurance Explained - Car Insurance Quotes Explained : The three

Understanding auto insurance

How To Pay Less For Car Insurance - belledesignltd

Get The Best Car Insurance For Yourself - Funender.com