Insurance For Rental Cars Usa

Rental Car Insurance In The USA

Do You Need Insurance When Renting A Car?

Renting a car in the United States can be a great way to explore the country, but it's important to know what type of insurance you need to protect yourself. It's important to understand that most car rental companies in the US require you to have some type of insurance coverage in order to rent a car. This can be a confusing process, as there are a variety of different types of insurance coverage available. In this article, we'll explain the different types of rental car insurance coverage available in the US, and how to determine which type is right for you.

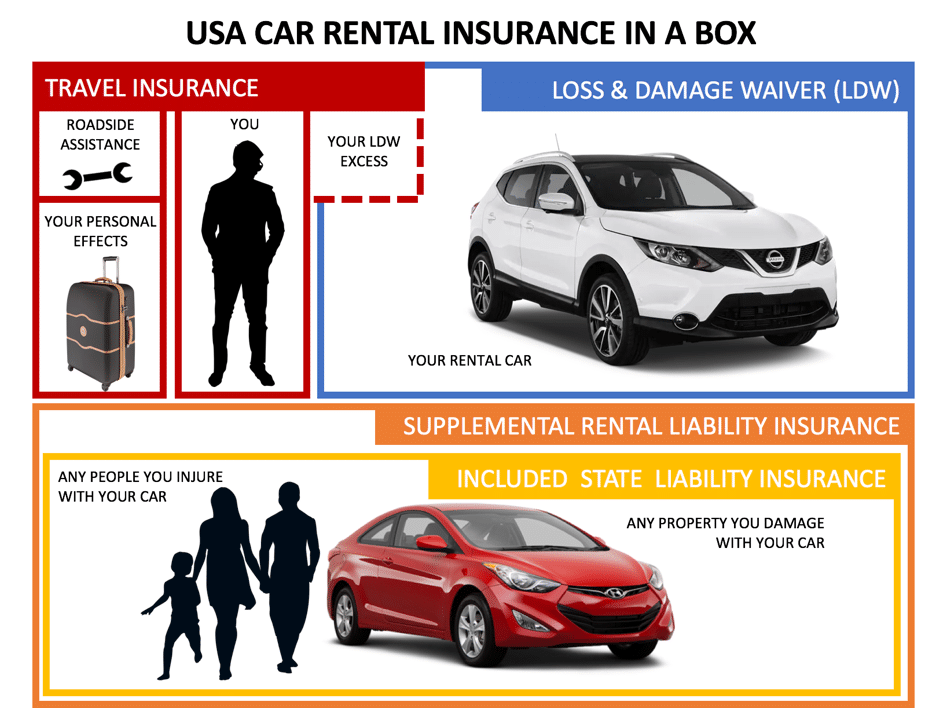

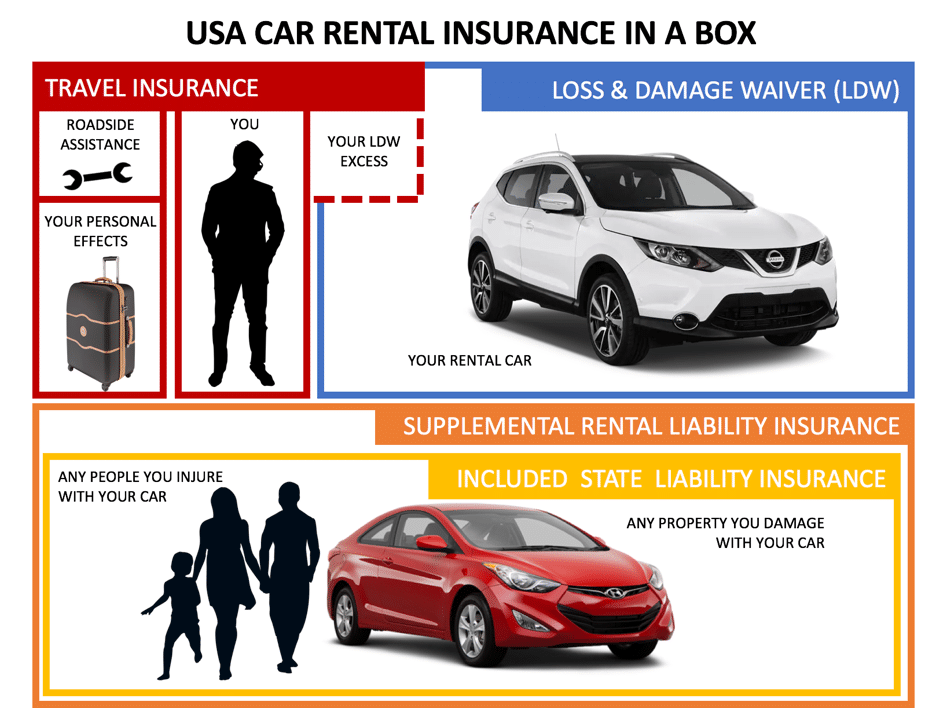

Types Of Insurance Coverage

When it comes to rental car insurance, there are two main types of coverage available. The first is liability coverage, which is required by law in all states. This coverage protects you from any damage you may cause to someone else's property or person in the event of an accident. The second type of coverage is collision coverage, which covers damage to your rental car from a collision, regardless of who is at fault. Additionally, some rental car companies may offer additional coverage, such as personal accident insurance, which covers medical bills for you and your passengers in the event of an accident.

Do You Need Insurance?

If you're renting a car in the US, you'll need to determine whether you need insurance coverage. This will depend on a few factors, including the rental company's policy and your current car insurance policy. Most rental car companies require you to have liability insurance, but if you already have car insurance, your policy may cover this. Additionally, if you have comprehensive or collision coverage on your current policy, you may not need to purchase additional coverage from the rental car company. Be sure to check your current policy to determine what type of coverage you already have.

How Much Does Insurance Cost?

The cost of insurance for a rental car in the US can vary widely, depending on the type of coverage you choose. Liability insurance is typically relatively inexpensive, as it is required by law in all states. Collision coverage, on the other hand, can be quite expensive, as it covers damage to your rental car regardless of who is at fault. Additionally, some rental car companies may offer additional coverage such as personal accident insurance, which can also be expensive.

What Is The Best Insurance Option?

The best insurance option for you will depend on a variety of factors, including your current car insurance policy, the rental company's policy, and the type of coverage you choose. If you already have comprehensive or collision coverage on your current policy, you may not need to purchase additional coverage from the rental car company. However, if you don't have adequate coverage, it may be worth it to purchase insurance from the rental car company to protect yourself from any potential damages. Be sure to read the rental car company's policy carefully before making a decision.

Renting a Car in the USA - What Insurance Do I Need? - Sling Adventures

Is Getting Insurance On Rental Cars Worth The Money? | Michigan Auto

Budget Rental Car Supplemental Liability Insurance - 1 | Blake Marina

A Guide To Car Rental Insurance vs. Personal Auto Insurance Coverage

Should I Purchase Rental Car Insurance? | Central Oregon