Icici Lombard Motor Insurance Claim Status

All You Need to Know About Icici Lombard Motor Insurance Claim Status

What is Motor Insurance?

Motor insurance, or vehicle insurance, is an insurance policy that safeguards you against financial loss in the event of an accident involving your vehicle. It covers the cost of any damage to your car and any third-party property. Motor insurance is a necessary requirement for all vehicles driven on public roads in India, and you must have a valid policy in order to legally drive your vehicle.

Why Do You Need ICICI Lombard Motor Insurance?

ICICI Lombard is one of India’s leading motor insurance providers. They offer comprehensive insurance plans that are tailored to meet the needs of individual customers, as well as businesses. They provide a range of benefits, such as coverage for damage caused by accidents, theft, fire and natural disasters. They also offer personal accident cover, legal liability cover and more. With ICICI Lombard motor insurance, you can be sure that you are receiving the best coverage possible.

How to Check Your ICICI Lombard Motor Insurance Claim Status?

If you have filed a claim with ICICI Lombard motor insurance, you can easily check the status of your claim online. All you need to do is log in to the ICICI Lombard website, then click on ‘My Account’. From there, you will be able to see the status of your claim. You can also check the status of your claim by calling the customer service number or by sending an email.

What is the Procedure to File a Claim with ICICI Lombard Motor Insurance?

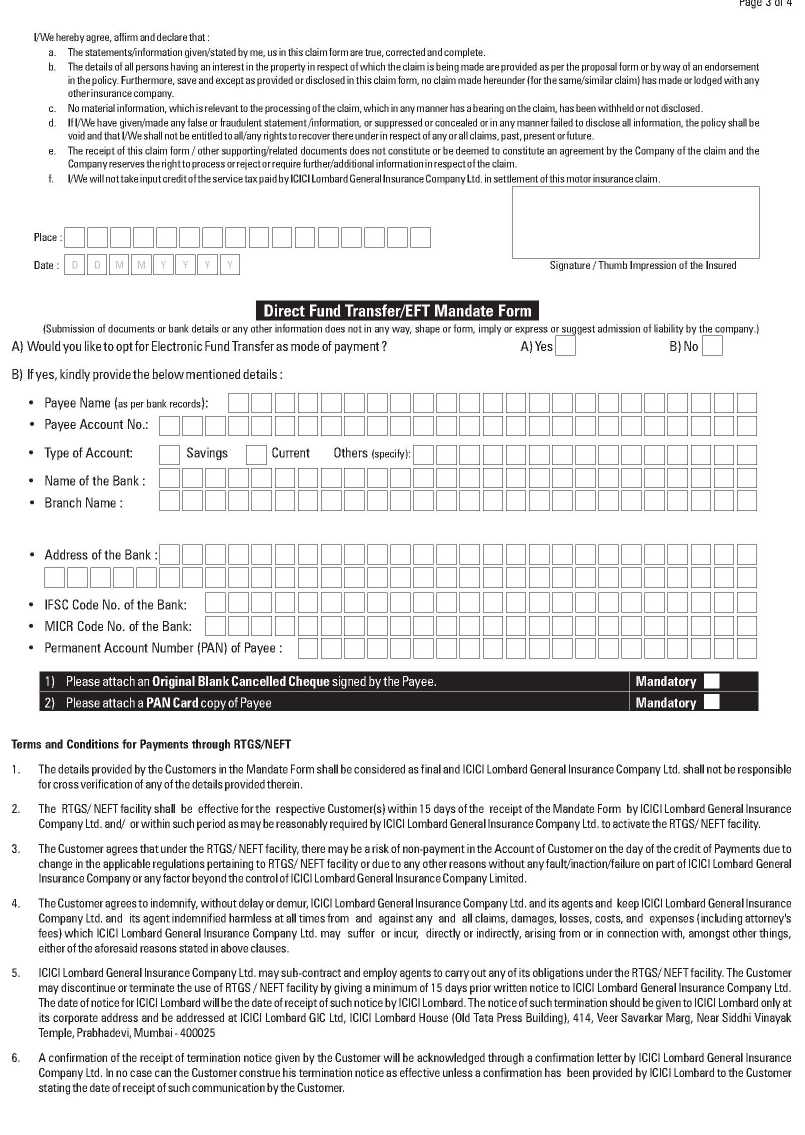

If you have been involved in an accident and need to file a claim with ICICI Lombard motor insurance, you should first contact the customer service number. You will need to provide the customer service representative with your policy number and any other details required. Once your claim has been accepted, you will need to fill out a claim form and submit it along with any relevant documents. Once the claim form has been accepted, you will receive a claim reference number that can be used to track the progress of your claim.

What Documents are Required to File a Claim with ICICI Lombard Motor Insurance?

When filing a claim with ICICI Lombard motor insurance, you will need to provide certain documents. This includes a copy of your valid driver’s license, a copy of your vehicle registration certificate, and a copy of the FIR (FIR is a report filed by the police in case of an accident). You may also need to provide a copy of your medical insurance policy, if applicable. Additionally, you will need to provide a copy of the repair bills and other documents related to the accident.

Conclusion

ICICI Lombard motor insurance is a great choice if you are looking for comprehensive coverage. They provide a range of benefits and their customer service is top-notch. Furthermore, they make it easy to check the status of your claim online or by phone. With ICICI Lombard motor insurance, you can be sure that you are receiving the best coverage possible.

ICICI Lombard Claim Status- How to check your claim status

ICICI Lombard Claim Status- How to check your claim status

ICICI Lombard Claim Status- How to check your claim status

icici lombard motor claim form - YouTube

ICICI Lombard Two Wheeler Insurance Claim - 2020 2021 Student Forum