How Much Property Damage Liability Do I Need

How Much Property Damage Liability Do I Need?

Property damage liability coverage is an integral part of any auto insurance policy. This type of coverage provides protection for you if you cause damage to someone else's property while driving. It can help protect you from being required to pay for the full cost of repairs or replacements out of your own pocket. Understanding how much property damage liability coverage you need is essential for getting the right amount of protection.

Minimum Requirements

Every state has its own minimum requirements when it comes to auto insurance. These minimums are the lowest amount of property damage liability coverage you must carry in order to legally drive in that state. The amount of coverage varies from state to state, but it is usually in the range of $10,000 to $25,000. Although it's important to make sure you meet your state's minimum requirements, it's also important to remember that these minimums may not be enough to fully protect you.

What Can Property Damage Liability Cover?

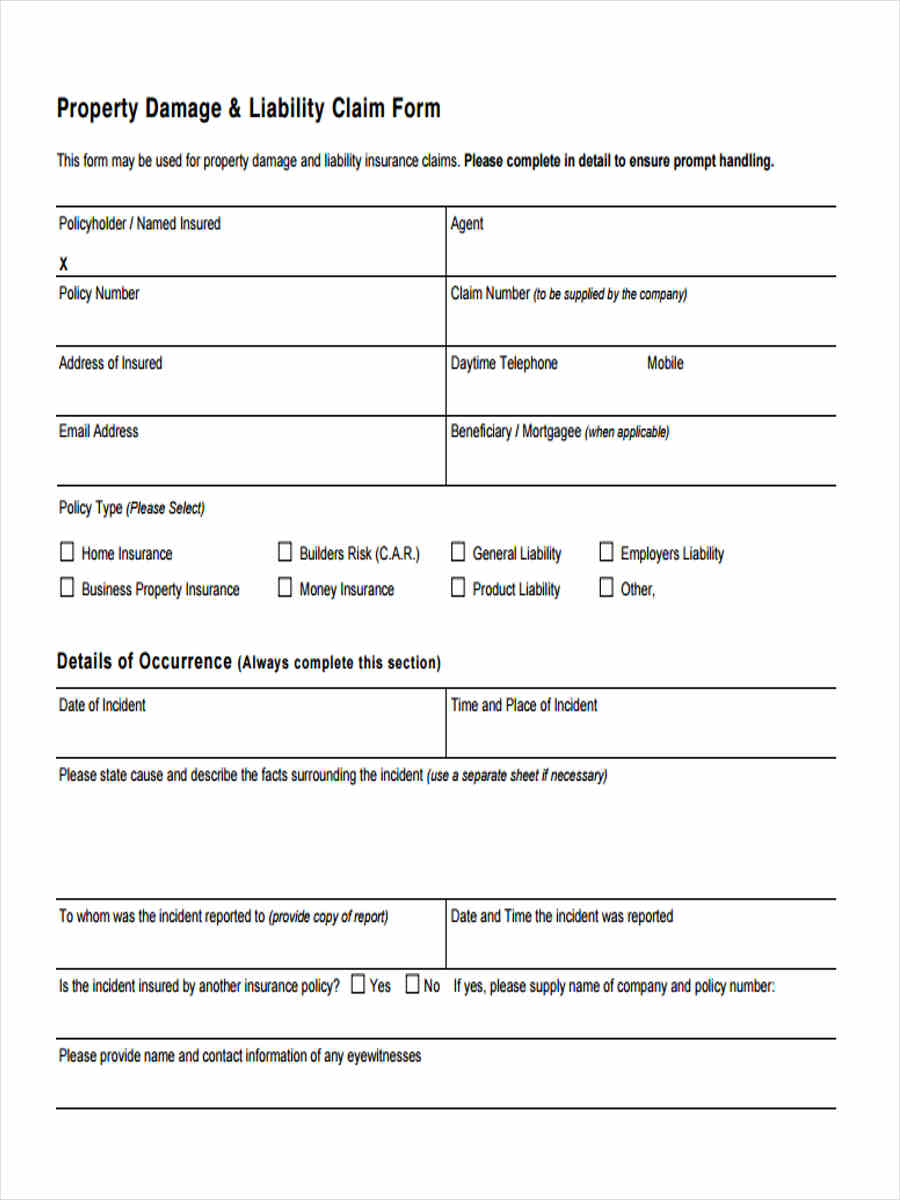

Property damage liability coverage can cover a variety of costs associated with damage you cause to someone else's property. This includes the cost of repairing or replacing any vehicles involved in the accident, as well as any damage caused to other structures or property, such as fences, lamp posts, mailboxes, or buildings. It can also cover legal fees if you are sued as a result of the accident.

How Much Is Enough?

When it comes to property damage liability coverage, it's always best to get more than the minimum. The cost of repairs or replacements can quickly add up, and if you don't have enough coverage, you could be stuck paying the difference out of pocket. A good rule of thumb is to get at least $100,000 in property damage liability coverage. This should provide enough financial protection for most scenarios.

Other Considerations

In addition to the amount of coverage, you should also consider the type of coverage you are getting. Some policies offer "comprehensive" coverage, which covers damage to your own vehicle as well as damage to someone else's property. Other policies only offer "collision" coverage, which only covers damage to your own vehicle. Make sure you know what type of coverage you are getting and that it meets your needs.

Bottom Line

Property damage liability coverage is an important part of any auto insurance policy. Understanding how much coverage you need and what type of coverage is best for you can help ensure that you have the right amount of protection. It's always best to get more than the minimum required by your state, and to consider both the amount and type of coverage you are getting. With the right amount of coverage, you can be sure that you are adequately protected in the event of an accident.

How Much Property Damage Liability Should I Have - RAELST

PPT - Chapter 10: Risk Management and Property/Liability Insurance

FREE 26+ Liability Forms in PDF | Ms Word | Excel

Property Damage Liability Release Form - PROFRTY

Commercial Liability Property Damage Insurance, Get Protected