How Much Is Plpd Insurance In Michigan

How Much Is Plpd Insurance In Michigan?

What Is PLPD Insurance?

PLPD insurance stands for Personal Liability and Property Damage insurance. It is an optional type of car insurance coverage that provides protection for you, the vehicle owner, in the event of an accident. PLPD insurance provides coverage for bodily injury and property damage caused by a car accident. It also covers medical expenses for the driver and passengers in the car at the time of the accident. It does not, however, provide coverage for damage to the vehicle itself. That type of coverage is called Collision insurance.

Why Do I Need PLPD Insurance in Michigan?

In the state of Michigan, you are required to have a minimum of $20,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage. This is the minimum amount of coverage you must have in order to drive legally in Michigan. PLPD insurance provides additional coverage beyond the minimum PIP and PDL coverage required by the state. It can provide coverage for medical expenses, lost wages, and other damages caused by an accident.

Factors That Affect How Much PLPD Insurance Costs

The cost of PLPD insurance in Michigan is determined by a variety of factors, including the type of vehicle, the driver’s age and driving record, the driver’s credit score, and the coverage level chosen. The type of vehicle is a major factor, as certain types of vehicles are more expensive to insure than others. The driver’s age, driving record, and credit score will also affect the cost of PLPD insurance. The coverage level chosen will also affect the cost, as higher levels of coverage will cost more than lower levels.

What Is The Average Cost of PLPD Insurance in Michigan?

The cost of PLPD insurance in Michigan will vary depending on the factors mentioned above, but the average cost of PLPD insurance in Michigan is around $1,000 per year. This is the average cost for a single vehicle, with a single driver, with the minimum required coverage. The cost could be higher or lower depending on the factors mentioned above.

How Can I Save Money On PLPD Insurance in Michigan?

There are a few ways to save money on PLPD insurance in Michigan. First, make sure you shop around for the best rates. Different insurance companies offer different rates, so comparing rates is the best way to ensure you are getting the best rate. Additionally, you can consider increasing your deductible. Increasing your deductible will lower your premium, but remember that you will be responsible for paying the higher deductible if you do get into an accident. You can also consider bundling your PLPD insurance with other types of insurance, such as home or renters insurance. This can save you money by getting a discount for multiple policies.

Conclusion

In conclusion, PLPD insurance is an important and necessary coverage for drivers in Michigan. It provides additional protection in the event of an accident and is required by law. The cost of PLPD insurance in Michigan can vary depending on a variety of factors, but the average cost is around $1,000 per year. There are a few ways to save money on PLPD insurance, including shopping around for the best rates, increasing your deductible, and bundling your PLPD insurance with other types of insurance.

Plpd Car Insurance | Life Insurance Blog

Auto Insurance Reform - How Much Will Michigan Auto Insurance Reform

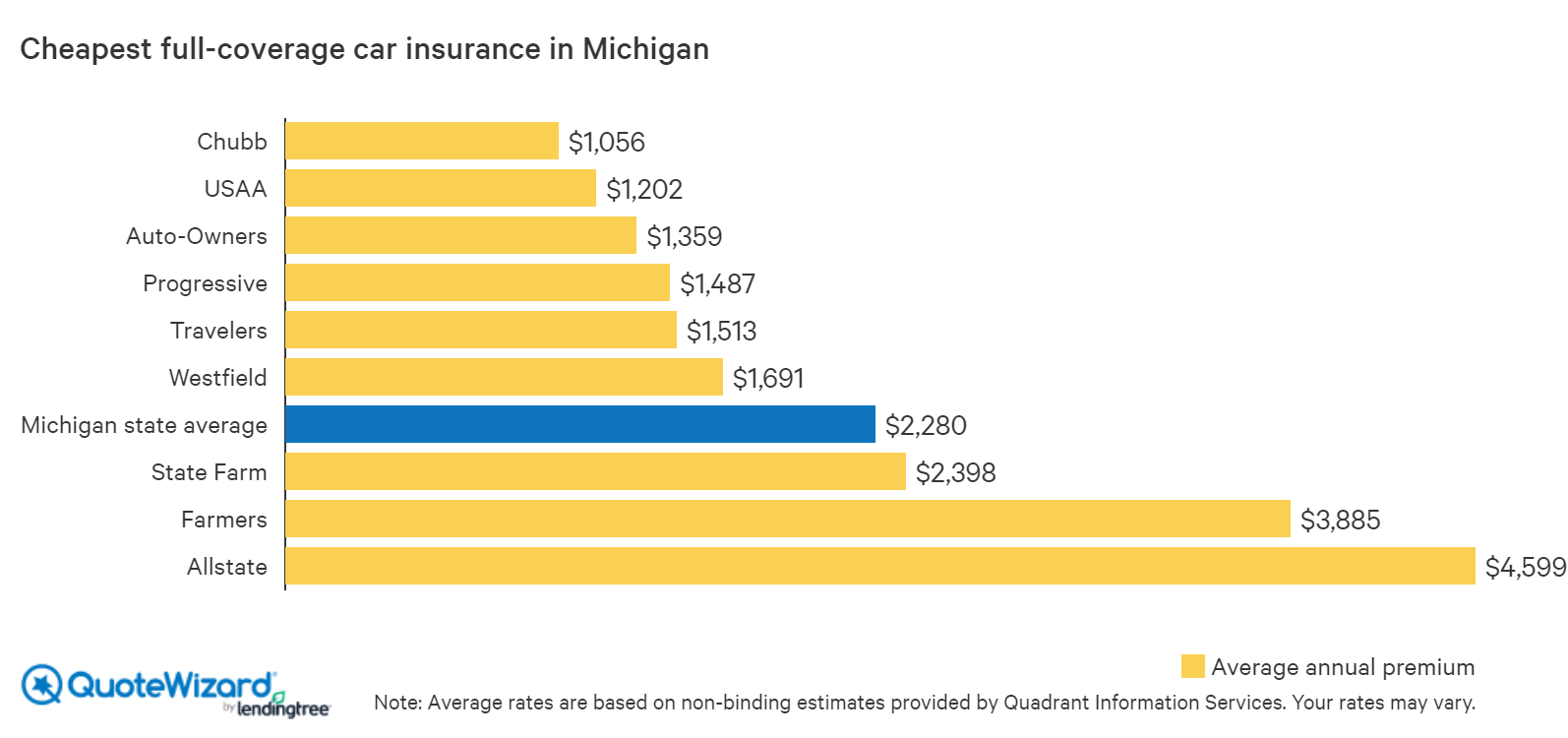

Cheapest Car Insurance in Michigan | QuoteWizard

2020 Michigan Car Insurance Report

MuskegonPundit: Report: Michigan has most expensive auto insurance in