How Many States Have No Fault Car Insurance

No-Fault Car Insurance: How Many States Offer It?

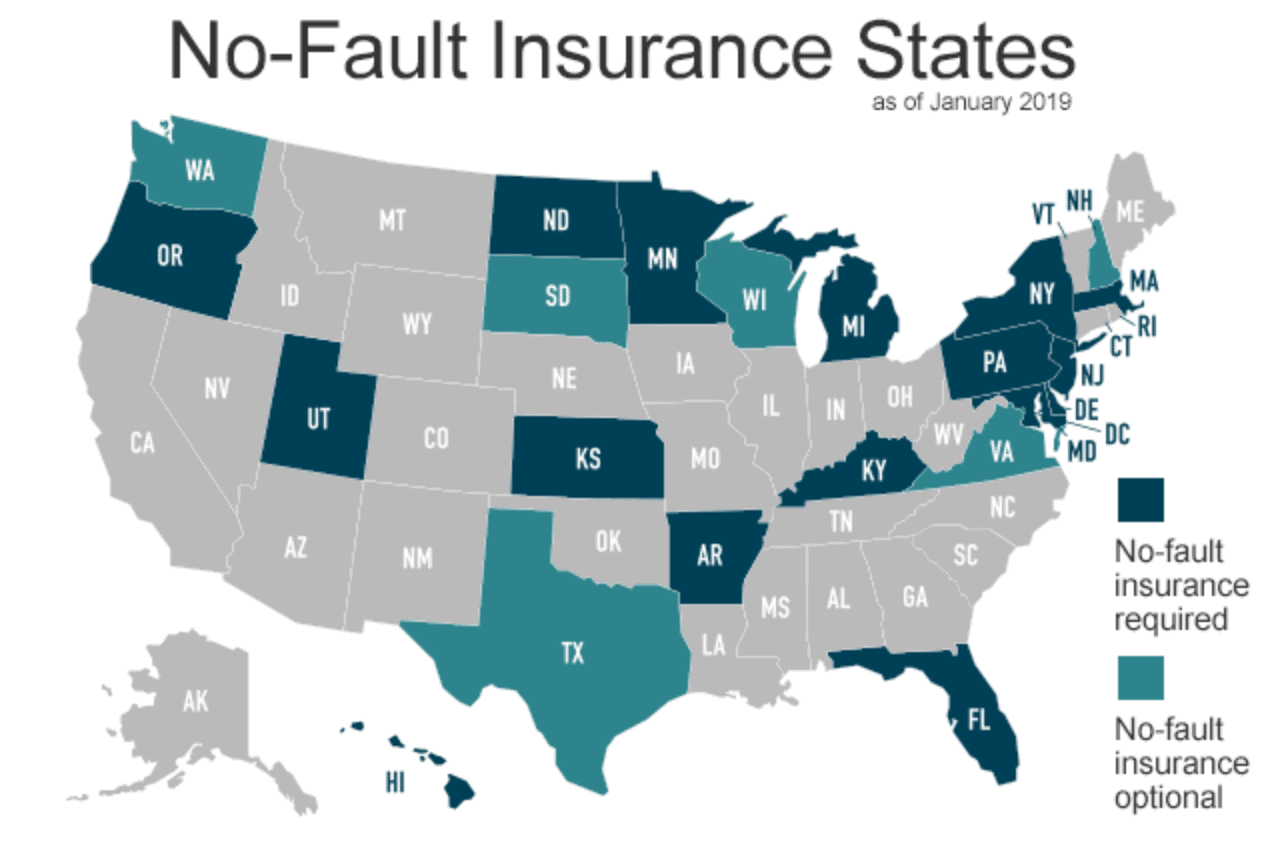

No-fault car insurance is a type of coverage that pays for medical expenses, lost wages and other associated costs, regardless of who is at fault in an accident. Currently, 12 states and Puerto Rico have a no-fault insurance system in place. This type of coverage is designed to protect drivers, passengers and pedestrians who are injured in motor vehicle accidents. In this article, we’ll discuss the states and territories that offer no-fault car insurance and how it works.

What is No-Fault Car Insurance?

No-fault car insurance is a type of coverage that pays for medical expenses, lost wages and other associated costs that may result from an accident, regardless of who is at fault. This type of coverage is designed to protect drivers, passengers and pedestrians who are injured in motor vehicle accidents. No-fault car insurance is required in 12 states and in Puerto Rico.

Under no-fault insurance systems, each driver’s insurance company pays for their medical expenses and lost wages. There is no need to sue or even to prove that the other driver caused the accident. No-fault car insurance is designed to reduce the amount of time and money spent on settling an accident. It also reduces the number of lawsuits that can be filed after an accident.

Which States Offer No-Fault Car Insurance?

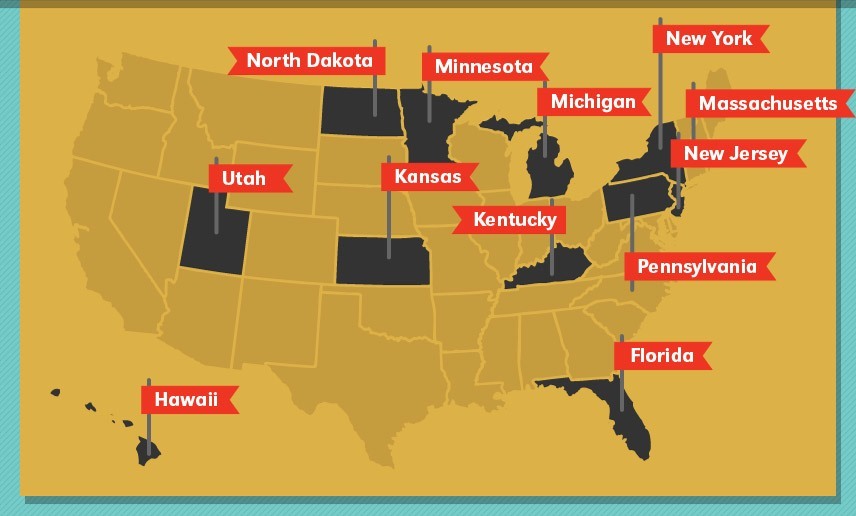

Currently, 12 states and Puerto Rico have no-fault auto insurance systems in place. These states are Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania and Utah.

In some of these states, the no-fault insurance system is only applicable to personal injury protection (PIP) coverage. In other states, the no-fault system applies to both PIP and property damage liability (PDL) coverage.

How Does No-Fault Car Insurance Work?

In no-fault states, each driver’s insurance company pays for their medical expenses and lost wages regardless of who is at fault. This is known as “personal injury protection” or “PIP” coverage. PIP coverage is required in most no-fault states. It pays for medical expenses, lost wages, funeral costs and other associated costs that may result from an accident.

In some no-fault states, drivers are also required to carry property damage liability (PDL) coverage. This type of coverage pays for damage to another person’s property caused by an accident. For example, PDL coverage would pay for damage to another car if you are at fault in an accident.

No-fault car insurance is designed to reduce the amount of time and money spent on settling an accident. It also reduces the number of lawsuits that can be filed after an accident. This type of coverage is designed to protect drivers, passengers and pedestrians who are injured in motor vehicle accidents.

Ultimate Guide to No-Fault Auto Insurance

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm

Cheap No Fault Auto Insurance Quotes - Which States and What it Means

What is No Fault Insurance? - ValuePenguin