Home Insurance Dwelling More Than Appraised

Home Insurance Dwelling More Than Appraised

What Does It Mean?

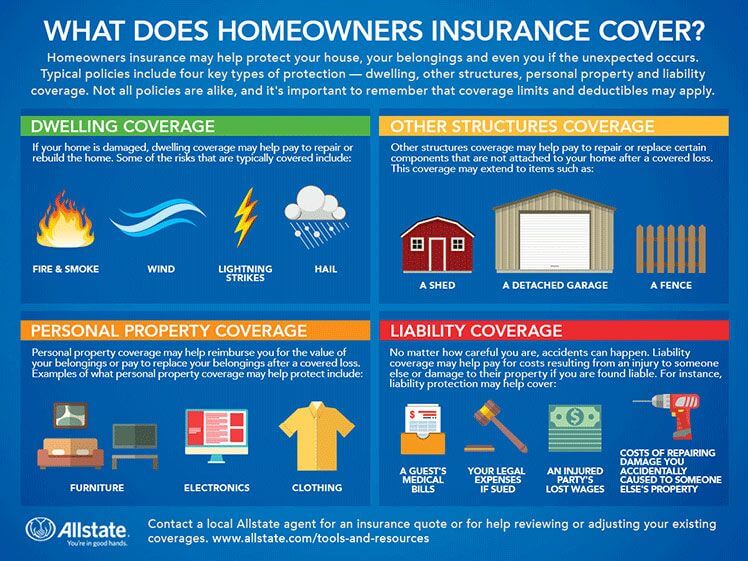

When a homeowner purchases home insurance coverage, they are typically required to provide an appraised value of the dwelling. This appraised value is used to determine the coverage limits of the policy. In some cases, the homeowner may purchase an insurance policy with a dwelling value that exceeds the appraised value. This means that the policy provides more coverage than the home is worth.

The reason why homeowners might purchase a home insurance policy with a higher dwelling value is simple – they want to have peace of mind knowing that their home is protected from any potential losses. It is important to understand that the higher dwelling value does not necessarily mean that the policy will pay out more money in the event of a claim. Instead, it simply means that the coverage limits are higher than the appraised value.

Reasons For Doing This

There are several reasons why a homeowner might choose to purchase a home insurance policy with a higher dwelling value than the appraised value. The primary reason is that the homeowner wants to be sure that their home is sufficiently protected in the event of a loss. For example, if the appraised value of the home is lower than the purchase price, the homeowner may want to have a higher dwelling value to ensure that their home is fully covered in the event of a claim.

Another reason why a homeowner may choose to purchase a policy with a higher dwelling value is that the cost of the policy may be lower. Since the coverage limit is higher, the insurer may be willing to offer a discounted rate. Additionally, if the homeowner is expecting to make any improvements to the home in the near future, they may want to purchase a policy with a higher dwelling value to ensure that the improvements are covered.

Things to Consider

When considering a policy with a higher dwelling value than the appraised value, it is important to understand that this does not necessarily mean that the policy will pay out more money in the event of a claim. The policy will only pay out what is covered under the terms of the policy. Additionally, the higher dwelling value may mean that the cost of the policy is higher.

It is also important to understand that the higher dwelling value does not necessarily mean that the home will be fully protected in the event of a claim. The policy may have other limitations that may restrict the amount of coverage. Additionally, the policy may have a deductible, which is the amount that the policyholder is responsible for paying before the insurance company pays out on a claim.

Conclusion

When purchasing a home insurance policy, homeowners may choose to purchase a policy with a dwelling value that exceeds the appraised value. This can provide additional peace of mind knowing that their home is fully protected. However, it is important to understand that the higher dwelling value may mean that the cost of the policy is higher and that the policy may have other limitations that may restrict the coverage. It is important to understand all the terms of a policy before purchasing it.

Understanding Homeowners Insurance: Dwelling Coverage | Homeowners

http://www.modularhomepartsandaccessories.com/homeinsuranceproviders

What Does Homeowners Insurance Cover? | Allstate

Home Insurance Coverage a Dwelling

Homeowner's insurance overview #homeowners | Home insurance, Homeowners