Hdfc Motor Insurance Claim Form

Understanding HDFC Motor Insurance Claim Form

What is Motor Insurance?

Motor insurance is a type of insurance policy which is designed to provide financial protection against physical damage and/or bodily injury resulting from traffic collisions and against liability that could be incurred in an accident. It covers a wide range of vehicles from cars, motorcycles, scooters, vans, trucks and tractors to buses, agricultural vehicles and even two-wheelers. Motor insurance policies are offered by many insurance providers, including HDFC.

Types of Motor Insurance

Motor insurance policies come in a variety of types, such as third-party liability insurance, comprehensive insurance, personal accident cover, and so on. Third-party liability insurance covers the expenses incurred due to accidental damage or injury caused to a third-party, such as another vehicle, a pedestrian or a property. Comprehensive insurance, on the other hand, covers both third-party liability and damage caused to the insured vehicle. Personal accident cover provides coverage for death or disability of the policyholder resulting from an accident.

HDFC Motor Insurance Claim Form

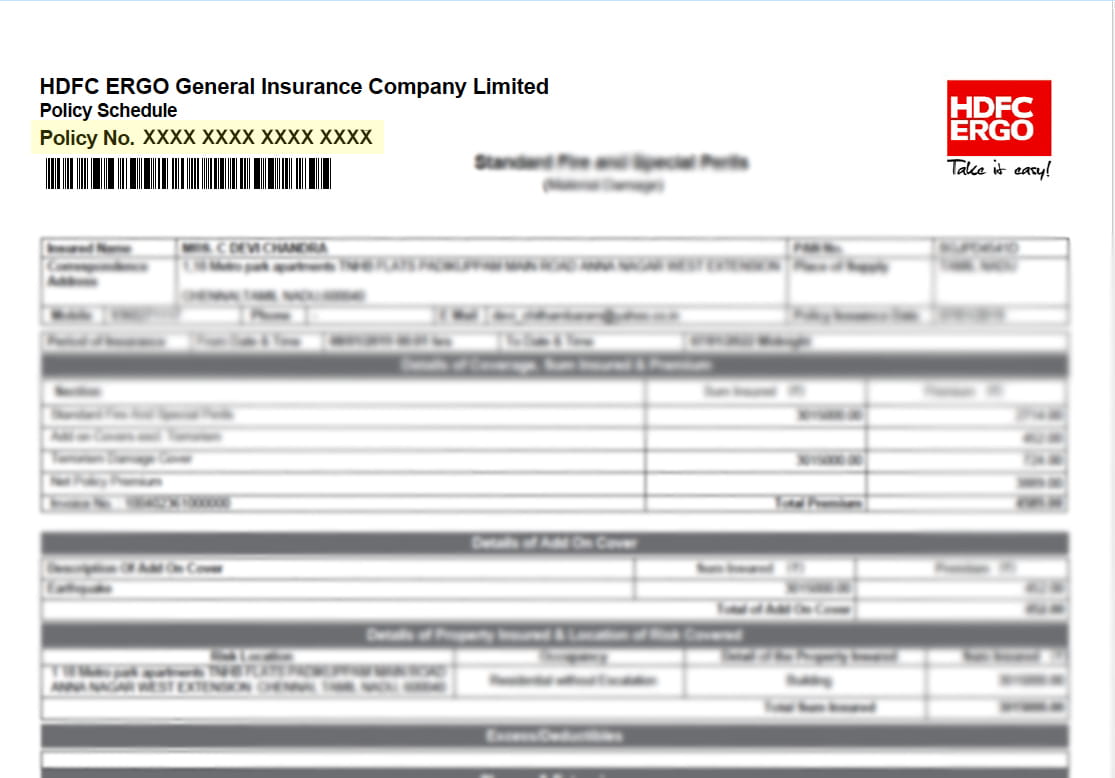

HDFC offers a wide range of motor insurance policies to suit the needs of its customers. When it comes to making a claim, HDFC’s motor insurance claim form is easy to use and understand. It is available as a downloadable PDF form, which can be filled in offline. The form is divided into three sections – personal details, policy details, and claim details. The personal details section requires the policyholder to provide basic information such as name, address, contact details, etc. The policy details section includes information about the policy, such as the policy number, premium amount, start and end date, etc. The claim details section requires the policyholder to provide information about the claim, such as the date and time of the incident, details of the vehicle, description of the incident, etc.

Documents Required for a Motor Insurance Claim

Documents are an important part of filing a motor insurance claim and must be submitted along with the claim form. Depending on the type of claim, the documents required may vary. Some of the common documents required for a motor insurance claim are the policy document, FIR copy, estimate of repair costs, bills for repair and replacement of parts, pictures of the accident scene and damaged vehicle, etc. It is important to note that all the documents should be originals and should be in the same name as the policyholder.

Things to Consider When Filing an HDFC Motor Insurance Claim

It is important to keep in mind certain things when filing an HDFC motor insurance claim. Firstly, it is important to keep in mind that the claim form should be filled in carefully and accurately. Inaccurate information may lead to delays in processing the claim. Secondly, it is important to submit all the required documents along with the form. Lastly, it is important to keep all the original documents safe and secure until the claim is settled.

Conclusion

HDFC motor insurance claim form is an easy-to-use and understand document. It is important to keep in mind certain things when filing an HDFC motor insurance claim, such as ensuring that the form is filled in accurately, submitting all the required documents and keeping the original documents safe and secure. By following these tips, you can ensure that your claim is processed quickly and efficiently.

[PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF

![Hdfc Motor Insurance Claim Form [PDF] HDFC ERGO Motor Car Insurance Form PDF Download in English – InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/hdfc-ergo-motor-car-insurance-form-1361.jpg)

Hdfc Ergo Car Insurance Policy Download Online - linxydesigns

Kyc Form Hdfc Ergo - Fill and Sign Printable Template Online | US Legal

Hdfc Ergo Car Insurance Certificate Download : HDFC ERGO Insurance App

Motor Insurance Claim Form Hdfc Ergo - INSURANCE DAY