Freeway Taxi Insurance Policy Wording

Everything You Need to Know About Freeway Taxi Insurance Policy Wording

The Need for Taxi Insurance

Taxi insurance is an important protection for taxi drivers, as it provides financial protection in the event of an accident or other covered incident. It’s essential for taxi drivers to have the right insurance policy wording for their unique circumstances. Without the right coverage, drivers may find themselves financially liable for damage and/or injury resulting from a taxi ride.

Taxi insurance policy wording can be confusing to understand, and it’s important to make sure that you fully understand the coverage you are purchasing. It’s also important to make sure that the policy is up-to-date and covers all of the potential risks that you face as a taxi driver. The following information will help you understand the basics of taxi insurance policy wording and what you need to know to make sure you have the proper coverage.

What Does Freeway Taxi Insurance Cover?

Freeway taxi insurance policy wording generally covers the expenses that would be incurred if the insured drivers were involved in an accident or other covered incident. This includes the cost of the repairs to the vehicle, the medical expenses for any injured passengers or drivers, and the costs associated with any legal action that may be taken. Depending on the specific policy, it may also include coverage for any property damage, theft, and other related costs.

In addition to the above, Freeway taxi insurance may also provide coverage for other expenses such as towing and storage, rental cars, and lost wages. It’s important to read your policy carefully to make sure that all of the coverage that is necessary for your business is included.

Important Factors to Consider

When selecting the right insurance policy wording for your taxi service, it’s important to make sure that you take into consideration any potential risks that you may face as a driver. This includes the type of vehicles that you use, the number of passengers that you transport, and the areas that you typically drive in. It’s also important to make sure that you understand the specific limits of your coverage and what is excluded.

For example, some policies may exclude certain types of passengers such as those under the influence of drugs or alcohol. Additionally, some policies may exclude coverage for any damage to the vehicle caused by an uninsured passenger. Be sure to ask your insurance provider about these types of exclusions, so that you can make sure that you have the coverage you need.

Checking for Discounts

When shopping for taxi insurance, it’s important to check for any discounts that may be available. Many insurance providers offer discounts for drivers who have a clean driving record, a good credit score, and a history of safe driving. Additionally, some providers may offer discounts for drivers who maintain a certain level of coverage, so it’s important to ask your provider about any potential discounts that may be available.

Conclusion

Freeway taxi insurance policy wording is an important protection for taxi drivers, and it’s important to make sure that you understand the coverage you are purchasing. It’s also important to make sure that you take into consideration any potential risks that you may face as a driver and to check for any discounts that may be available. By understanding your coverage and taking the time to shop around, you’ll be able to find the right policy wording for your unique needs.

Freeway Insurance Quotes : Freeway Insurance Cheap Car Insurance Home

Freeway insurance locations near me - insurance

Pin on Daily posts

Wonder If You are Taxi Driver? | Taxi, Taxi driver, Insurance

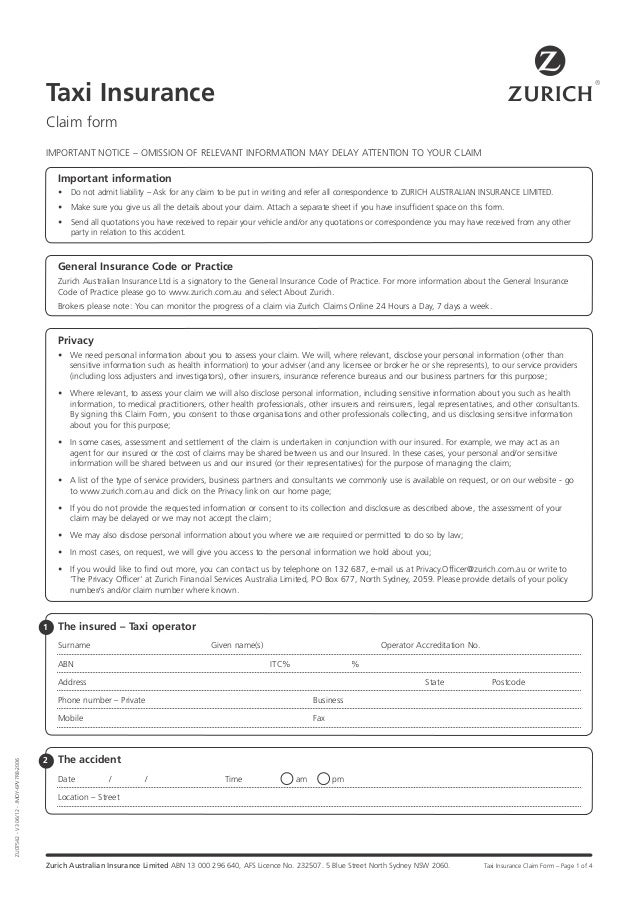

Zurich Taxi Claim Form