End Of Life Care Insurance

End of Life Care Insurance: An Overview

End of life care insurance is an important, yet often overlooked, insurance policy. Although it is not as common as life, health, or car insurance, it is a necessary part of everyone’s overall financial planning. End of life care insurance helps to cover the costs associated with assisted living, hospice care, and other end of life services, such as funerals and burials or cremation. It can also provide financial assistance for family members who are helping to care for the individual during their last days.

What Does End of Life Care Insurance Cover?

End of life care insurance covers a wide range of expenses associated with the final stages of life. This includes costs for long-term care, hospice care, and funeral and burial expenses. It may also cover the costs of medical equipment or medications, as well as other costs associated with end of life care, such as transportation and lodging for family members who come to visit. Additionally, this type of insurance can help to alleviate the financial burden of the family members who are assisting with the individual’s care.

Who Should Consider End of Life Care Insurance?

End of life care insurance is something that everyone should consider, regardless of age or health. It is especially important for those who have a family history of serious health conditions, as well as for anyone who may not have enough savings to cover the costs associated with end of life care. Additionally, those who are at risk for developing a chronic condition, such as Alzheimer’s or dementia, may also want to consider end of life care insurance.

How Much Does End of Life Care Insurance Cost?

The cost of end of life care insurance varies greatly depending on the type of coverage and the amount of coverage purchased. Generally speaking, the more coverage you purchase, the higher the premium will be. Generally, premiums can range from a few hundred dollars to several thousand dollars per year. Additionally, the amount of coverage you choose will also affect the cost of the policy. For example, if you choose a policy with a higher benefit amount, you may pay a higher premium.

How Do I Choose the Right End of Life Care Insurance Policy?

When choosing an end of life care insurance policy, it is important to consider your individual needs and financial situation. You should think about the type and amount of coverage you need, as well as the cost of the policy. Additionally, you may want to speak to an insurance professional who can provide advice and guidance on the best policy for your individual situation.

Final Thoughts

End of life care insurance is an important part of everyone’s financial planning. It can help to cover the costs associated with end of life care, as well as provide financial relief for family members who are assisting with the individual’s care. When selecting a policy, it is important to consider your individual needs and financial situation, as well as the cost of the policy. Additionally, you may want to speak to an insurance professional who can provide advice and guidance on the best policy for your individual situation.

End of Life Care Relative Leaflet | Fab NHS Stuff

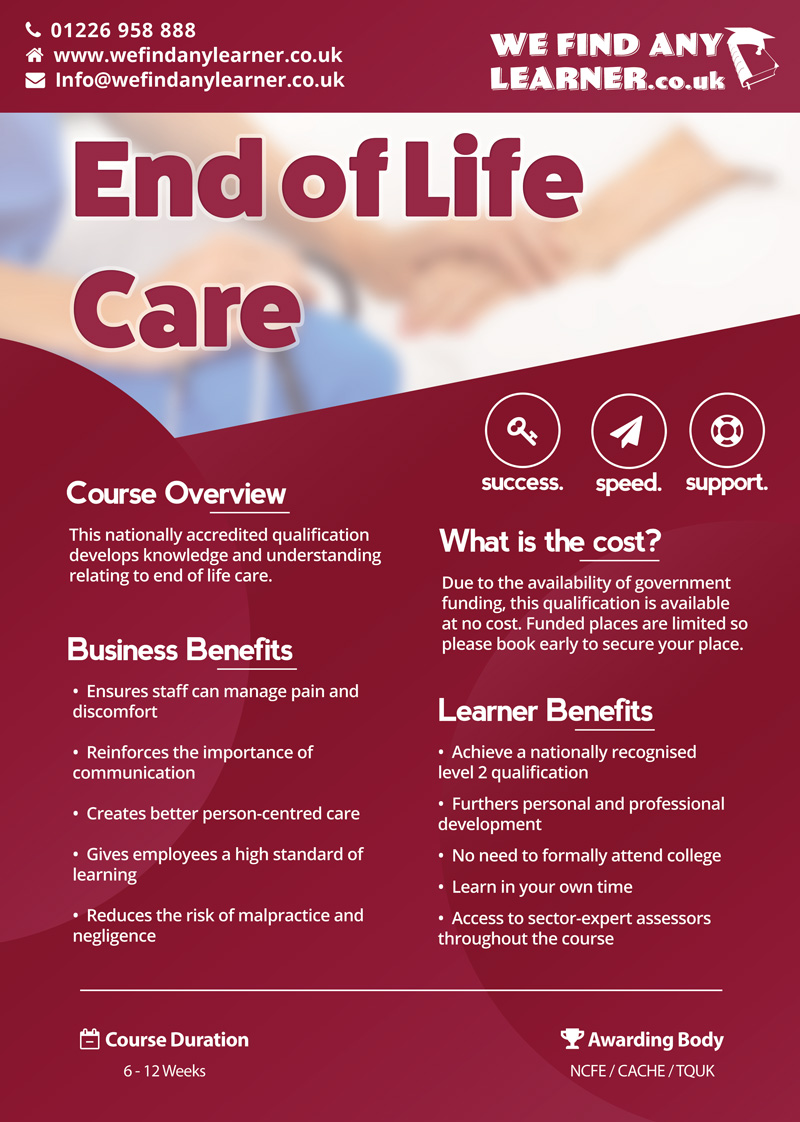

Principles of End of Life Care Level 2 | We Find Any Learner

Barkingside 21 : End of Life Care

End of Life Care – One Education

PPT - End of Life Care PowerPoint Presentation, free download - ID:729856