Credit Insurance On Car Loan Absa

Credit Insurance On Car Loan Absa

What is Credit Insurance?

Credit Insurance is a type of insurance that provides protection against loss due to a borrower's inability to repay a loan. It is also known as loan protection insurance or debt cancellation insurance. This insurance is typically offered by lenders to borrowers when they take out a loan, such as a car loan, mortgage, or other type of loan. Credit insurance can help protect a borrower against the financial burden of loan repayment in the event of death, disability, or unemployment.

What Does Credit Insurance on Car Loan Absa Offer?

Credit Insurance on Car Loan Absa offers protection to borrowers who take out a car loan with the company. This type of insurance covers the borrower in the event of death, disability, or unemployment. If the borrower is unable to make the loan payments due to one of these events, the insurance will cover the remaining balance of the loan. This type of insurance can be invaluable in helping borrowers protect their financial future.

How Does Credit Insurance on Car Loan Absa Work?

When a borrower takes out a car loan with Absa, they have the option to add Credit Insurance to the loan. When the borrower adds the insurance, they will pay a small premium each month, which is added to the loan balance. If the borrower is unable to make the loan payments due to death, disability, or unemployment, the insurance will cover the remaining balance of the loan.

Benefits of Credit Insurance on Car Loan Absa

The main benefit of Credit Insurance on Car Loan Absa is that it provides peace of mind to the borrower. If the borrower is unable to make the loan payments due to death, disability, or unemployment, the insurance will cover the remaining balance of the loan. This can help the borrower protect their financial future and avoid the burden of loan repayment.

Conclusion

Credit Insurance on Car Loan Absa can be a great way for borrowers to protect their financial future. This type of insurance can provide peace of mind to the borrower, knowing that if they are unable to make the loan payments due to death, disability, or unemployment, the insurance will cover the remaining balance of the loan. For those considering a car loan with Absa, adding Credit Insurance can be a wise decision.

absa logo | Money 101

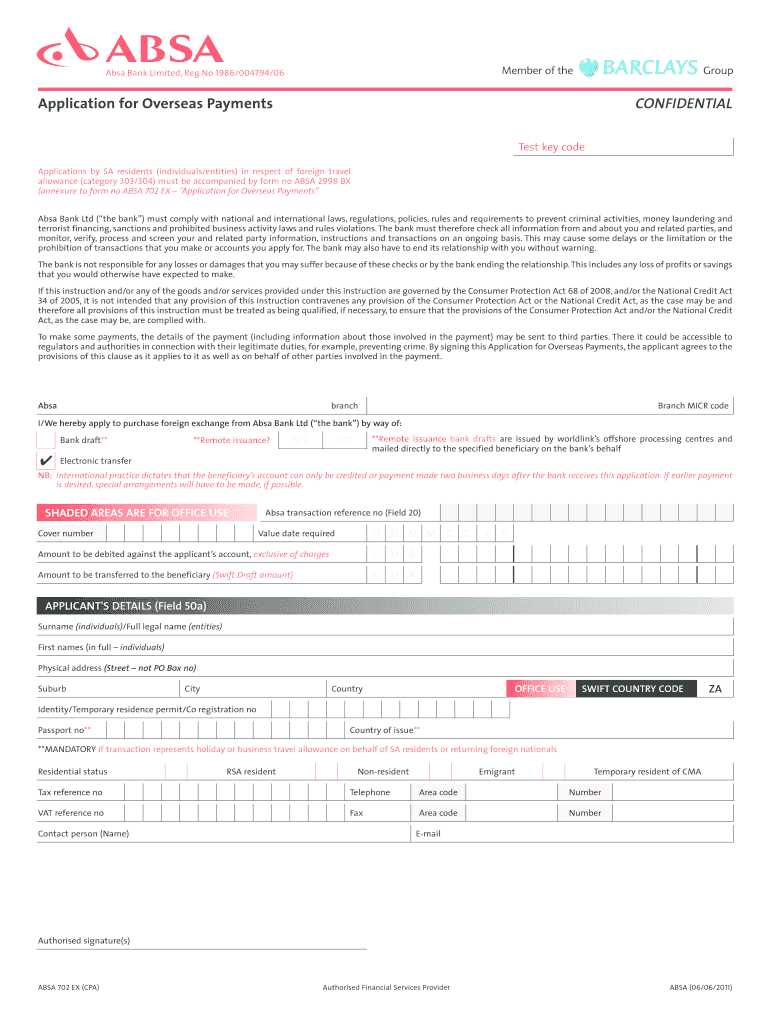

ABSA 702 EX 2011-2022 - Fill and Sign Printable Template Online | US

Absa Bank Car Loan Payment- Guidelines in Detail - Online Banking(UK)

ABSA Flexi Core Credit Card | Feature, Benefit & Reviews – MoneyToday SA

Absa Gold Credit Card – MoneyToday